The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

82 | Annual Report 2008 F<strong>in</strong>ancial Report<br />

14. Goodwill<br />

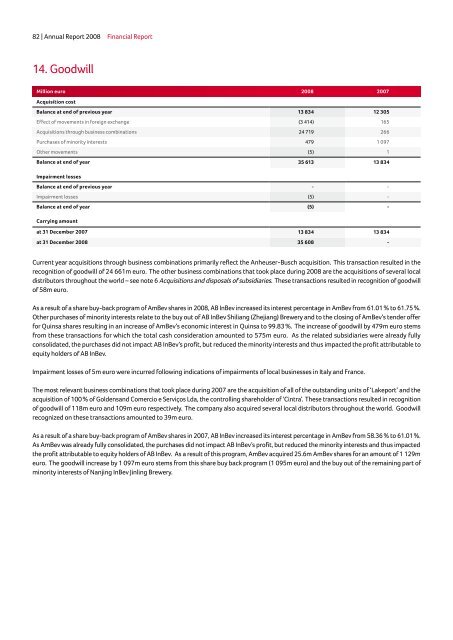

Million euro 2008 2007<br />

Acquisition cost<br />

Balance at end of previous year 13 834 12 305<br />

Effect of movements <strong>in</strong> foreign exchange (3 414) 165<br />

Acquisitions through bus<strong>in</strong>ess comb<strong>in</strong>ations 24 719 266<br />

Purchases of m<strong>in</strong>ority <strong>in</strong>terests 479 1 097<br />

Other movements (5) 1<br />

Balance at end of year 35 613 13 834<br />

Impairment losses<br />

Balance at end of previous year - -<br />

Impairment losses (5) -<br />

Balance at end of year (5) -<br />

Carry<strong>in</strong>g amount<br />

at 31 December 2007 13 834 13 834<br />

at 31 December 2008 35 608 -<br />

Current year acquisitions through bus<strong>in</strong>ess comb<strong>in</strong>ations primarily reflect the <strong>Anheuser</strong>-<strong>Busch</strong> acquisition. This transaction resulted <strong>in</strong> the<br />

recognition of goodwill of 24 661m euro. <strong>The</strong> other bus<strong>in</strong>ess comb<strong>in</strong>ations that took place dur<strong>in</strong>g 2008 are the acquisitions of several local<br />

distributors throughout the world – see note 6 Acquisitions and disposals of subsidiaries. <strong>The</strong>se transactions resulted <strong>in</strong> recognition of goodwill<br />

of 58m euro.<br />

As a result of a share buy-back program of AmBev shares <strong>in</strong> 2008, AB <strong>InBev</strong> <strong>in</strong>creased its <strong>in</strong>terest percentage <strong>in</strong> AmBev from 61.01 % to 61.75 %.<br />

Other purchases of m<strong>in</strong>ority <strong>in</strong>terests relate to the buy out of AB <strong>InBev</strong> Shiliang (Zhejiang) Brewery and to the clos<strong>in</strong>g of AmBev’s tender offer<br />

for Qu<strong>in</strong>sa shares result<strong>in</strong>g <strong>in</strong> an <strong>in</strong>crease of AmBev’s economic <strong>in</strong>terest <strong>in</strong> Qu<strong>in</strong>sa to 99.83 %. <strong>The</strong> <strong>in</strong>crease of goodwill by 479m euro stems<br />

from these transactions for which the total cash consideration amounted to 575m euro. As the related subsidiaries were already fully<br />

consolidated, the purchases did not impact AB <strong>InBev</strong>’s profit, but reduced the m<strong>in</strong>ority <strong>in</strong>terests and thus impacted the profit attributable to<br />

equity holders of AB <strong>InBev</strong>.<br />

Impairment losses of 5m euro were <strong>in</strong>curred follow<strong>in</strong>g <strong>in</strong>dications of impairments of local bus<strong>in</strong>esses <strong>in</strong> Italy and France.<br />

<strong>The</strong> most relevant bus<strong>in</strong>ess comb<strong>in</strong>ations that took place dur<strong>in</strong>g 2007 are the acquisition of all of the outstand<strong>in</strong>g units of ‘Lakeport’ and the<br />

acquisition of 100 % of Goldensand Comercio e Serviços Lda, the controll<strong>in</strong>g shareholder of ‘C<strong>in</strong>tra’. <strong>The</strong>se transactions resulted <strong>in</strong> recognition<br />

of goodwill of 118m euro and 109m euro respectively. <strong>The</strong> company also acquired several local distributors throughout the world. Goodwill<br />

recognized on these transactions amounted to 39m euro.<br />

As a result of a share buy-back program of AmBev shares <strong>in</strong> 2007, AB <strong>InBev</strong> <strong>in</strong>creased its <strong>in</strong>terest percentage <strong>in</strong> AmBev from 58.36 % to 61.01 %.<br />

As AmBev was already fully consolidated, the purchases did not impact AB <strong>InBev</strong>’s profit, but reduced the m<strong>in</strong>ority <strong>in</strong>terests and thus impacted<br />

the profit attributable to equity holders of AB <strong>InBev</strong>. As a result of this program, AmBev acquired 25.6m AmBev shares for an amount of 1 129m<br />

euro. <strong>The</strong> goodwill <strong>in</strong>crease by 1 097m euro stems from this share buy back program (1 095m euro) and the buy out of the rema<strong>in</strong><strong>in</strong>g part of<br />

m<strong>in</strong>ority <strong>in</strong>terests of Nanj<strong>in</strong>g <strong>InBev</strong> J<strong>in</strong>l<strong>in</strong>g Brewery.