The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

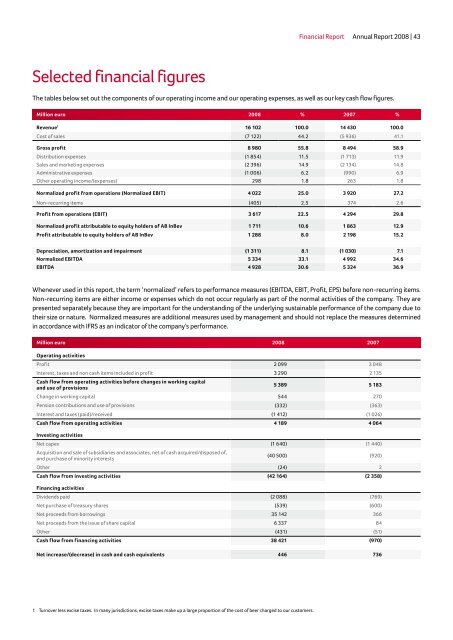

Selected f<strong>in</strong>ancial figures<br />

F<strong>in</strong>ancial Report Annual Report 2008 | 43<br />

<strong>The</strong> tables below set out the components of our operat<strong>in</strong>g <strong>in</strong>come and our operat<strong>in</strong>g expenses, as well as our key cash flow figures.<br />

Million euro 2008 % 2007 %<br />

Revenue 1 16 102 100.0 14 430 100.0<br />

Cost of sales (7 122) 44.2 (5 936) 41.1<br />

Gross profit 8 980 55.8 8 494 58.9<br />

Distribution expenses (1 854) 11.5 (1 713) 11.9<br />

Sales and market<strong>in</strong>g expenses (2 396) 14.9 (2 134) 14.8<br />

Adm<strong>in</strong>istrative expenses (1 006) 6.2 (990) 6.9<br />

Other operat<strong>in</strong>g <strong>in</strong>come/(expenses) 298 1.8 263 1.8<br />

Normalized profit from operations (Normalized EBIT) 4 022 25.0 3 920 27.2<br />

Non-recurr<strong>in</strong>g items (405) 2.5 374 2.6<br />

Profit from operations (EBIT) 3 617 22.5 4 294 29.8<br />

Normalized profit attributable to equity holders of AB <strong>InBev</strong> 1 711 10.6 1 863 12.9<br />

Profit attributable to equity holders of AB <strong>InBev</strong> 1 288 8.0 2 198 15.2<br />

Depreciation, amortization and impairment (1 311) 8.1 (1 030) 7.1<br />

Normalized EBITDA 5 334 33.1 4 992 34.6<br />

EBITDA 4 928 30.6 5 324 36.9<br />

Whenever used <strong>in</strong> this report, the term ‘normalized’ refers to performance measures (EBITDA, EBIT, Profit, EPS) before non-recurr<strong>in</strong>g items.<br />

Non-recurr<strong>in</strong>g items are either <strong>in</strong>come or expenses which do not occur regularly as part of the normal activities of the company. <strong>The</strong>y are<br />

presented separately because they are important for the understand<strong>in</strong>g of the underly<strong>in</strong>g susta<strong>in</strong>able performance of the company due to<br />

their size or nature. Normalized measures are additional measures used by management and should not replace the measures determ<strong>in</strong>ed<br />

<strong>in</strong> accordance with IFRS as an <strong>in</strong>dicator of the company’s performance.<br />

Million euro 2008 2007<br />

Operat<strong>in</strong>g activities<br />

Profit 2 099 3 048<br />

Interest, taxes and non cash items <strong>in</strong>cluded <strong>in</strong> profit 3 290 2 135<br />

Cash flow from operat<strong>in</strong>g activities before changes <strong>in</strong> work<strong>in</strong>g capital<br />

and use of provisions<br />

5 389 5 183<br />

Change <strong>in</strong> work<strong>in</strong>g capital 544 270<br />

Pension contributions and use of provisions (332) (363)<br />

Interest and taxes (paid)/received (1 412) (1 026)<br />

Cash flow from operat<strong>in</strong>g activities 4 189 4 064<br />

Invest<strong>in</strong>g activities<br />

Net capex (1 640) (1 440)<br />

Acquisition and sale of subsidiaries and associates, net of cash acquired/disposed of,<br />

and purchase of m<strong>in</strong>ority <strong>in</strong>terests<br />

(40 500) (920)<br />

Other (24) 2<br />

Cash flow from <strong>in</strong>vest<strong>in</strong>g activities (42 164) (2 358)<br />

F<strong>in</strong>anc<strong>in</strong>g activities<br />

Dividends paid (2 088) (769)<br />

Net purchase of treasury shares (539) (600)<br />

Net proceeds from borrow<strong>in</strong>gs 35 142 366<br />

Net proceeds from the issue of share capital 6 337 84<br />

Other (431) (51)<br />

Cash flow from f<strong>in</strong>anc<strong>in</strong>g activities 38 421 (970)<br />

Net <strong>in</strong>crease/(decrease) <strong>in</strong> cash and cash equivalents 446 736<br />

1 Turnover less excise taxes. In many jurisdictions, excise taxes make up a large proportion of the cost of beer charged to our customers.