Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

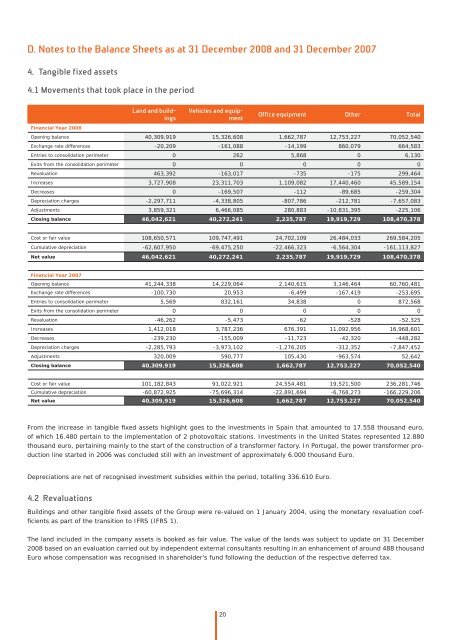

D. <strong>Notes</strong> <strong>to</strong> <strong>the</strong> Balance Sheets as at 31 December 2008 and 31 December 2007<br />

4. Tangible fixed assets<br />

4.1 Movements that <strong>to</strong>ok place in <strong>the</strong> period<br />

Financial Year 2008<br />

Land and buildings<br />

Vehicles and equipment<br />

20<br />

Office equipment O<strong>the</strong>r Total<br />

Opening balance 40,309,919 15,326,608 1,662,787 12,753,227 70,052,540<br />

Exchange rate differences -20,209 -161,088 -14,199 860,079 664,583<br />

Entries <strong>to</strong> consolidation perimeter 0 262 5,868 0 6,130<br />

Exits from <strong>the</strong> consolidation perimeter 0 0 0 0 0<br />

Revaluation 463,392 -163,017 -735 -175 299,464<br />

Increases 3,727,908 23,311,703 1,109,082 17,440,460 45,589,154<br />

Decreases 0 -169,507 -112 -89,685 -259,304<br />

Depreciation charges -2,297,711 -4,338,805 -807,786 -212,781 -7,657,083<br />

Adjustments 3,859,321 6,466,085 280,883 -10,831,395 -225,106<br />

Closing balance 46,042,621 40,272,241 2,235,787 19,919,729 108,470,378<br />

Cost or fair value 108,650,571 109,747,491 24,702,109 26,484,033 269,584,205<br />

Cumulative depreciation -62,607,950 -69,475,250 -22,466,323 -6,564,304 -161,113,827<br />

Net value 46,042,621 40,272,241 2,235,787 19,919,729 108,470,378<br />

Financial Year 2007<br />

Opening balance 41,244,338 14,229,064 2,140,615 3,146,464 60,760,481<br />

Exchange rate differences -100,730 20,953 -6,499 -167,419 -253,695<br />

Entries <strong>to</strong> consolidation perimeter 5,569 832,161 34,838 0 872,568<br />

Exits from <strong>the</strong> consolidation perimeter 0 0 0 0 0<br />

Revaluation -46,262 -5,473 -62 -528 -52,325<br />

Increases 1,412,018 3,787,236 676,391 11,092,956 16,968,601<br />

Decreases -239,230 -155,009 -11,723 -42,320 -448,282<br />

Depreciation charges -2,285,793 -3,973,102 -1,276,205 -312,352 -7,847,452<br />

Adjustments 320,009 590,777 105,430 -963,574 52,642<br />

Closing balance 40,309,919 15,326,608 1,662,787 12,753,227 70,052,540<br />

Cost or fair value 101,182,843 91,022,921 24,554,481 19,521,500 236,281,746<br />

Cumulative depreciation -60,872,925 -75,696,314 -22,891,694 -6,768,273 -166,229,206<br />

Net value 40,309,919 15,326,608 1,662,787 12,753,227 70,052,540<br />

From <strong>the</strong> increase in tangible fi xed assets highlight goes <strong>to</strong> <strong>the</strong> investments in Spain that amounted <strong>to</strong> 17.558 thousand euro,<br />

of which 16.480 pertain <strong>to</strong> <strong>the</strong> implementation of 2 pho<strong>to</strong>voltaic stations. Investments in <strong>the</strong> United States represented 12.880<br />

thousand euro, pertaining mainly <strong>to</strong> <strong>the</strong> start of <strong>the</strong> construction of a transformer fac<strong>to</strong>ry. In Portugal, <strong>the</strong> power transformer production<br />

line started in 2006 was concluded still with an investment of approximately 6.000 thousand Euro.<br />

Depreciations are net of recognised investment subsidies within <strong>the</strong> period, <strong>to</strong>talling 336.610 Euro.<br />

4.2 Revaluations<br />

Buildings and o<strong>the</strong>r tangible fi xed assets of <strong>the</strong> Group were re-valued on 1 January 2004, using <strong>the</strong> monetary revaluation coeffi<br />

cients as part of <strong>the</strong> transition <strong>to</strong> IFRS (IFRS 1).<br />

The land included in <strong>the</strong> company assets is booked as fair value. The value of <strong>the</strong> lands was subject <strong>to</strong> update on 31 December<br />

2008 based on an evaluation carried out by independent external consultants resulting in an enhancement of around 488 thousand<br />

Euro whose compensation was recognised in shareholder's fund following <strong>the</strong> deduction of <strong>the</strong> respective deferred tax.