Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

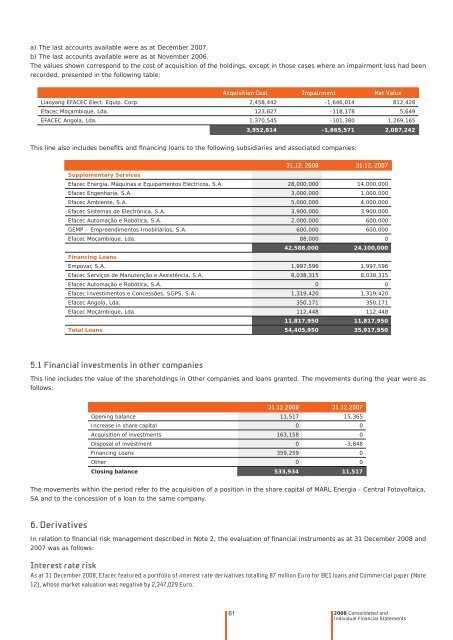

a) The last accounts available were as at December 2007.<br />

b) The last accounts available were as at November 2006.<br />

The values shown correspond <strong>to</strong> <strong>the</strong> cost of acquisition of <strong>the</strong> holdings, except in those cases where an impairment loss had been<br />

recorded, presented in <strong>the</strong> following table:<br />

Acquisition Cost Impairment Net Value<br />

Liaoyang EFACEC Elect. Equip. Corp. 2,458,442 -1,646,014 812,428<br />

<strong>Efacec</strong> Moçambique, Lda. 123,827 -118,178 5,649<br />

EFACEC Angola, Lda. 1,370,545 -101,380 1,269,165<br />

3,952,814 -1,865,571 2,087,242<br />

This line also includes benefi ts and fi nancing loans <strong>to</strong> <strong>the</strong> following subsidiaries and associated companies:<br />

Supplementary Services<br />

61<br />

31.12. 2008 31.12. 2007<br />

<strong>Efacec</strong> Energia, Máquinas e Equipamen<strong>to</strong>s Eléctricos, S.A. 28,000,000 14,000,000<br />

<strong>Efacec</strong> Engenharia, S.A. 3,000,000 1,000,000<br />

<strong>Efacec</strong> Ambiente, S.A. 5,000,000 4,000,000<br />

<strong>Efacec</strong> Sistemas de Electrónica, S.A. 3,900,000 3,900,000<br />

<strong>Efacec</strong> Au<strong>to</strong>mação e Robótica, S.A. 2,000,000 600,000<br />

GEMP – Empreendimen<strong>to</strong>s Imobiliários, S.A. 600,000 600,000<br />

<strong>Efacec</strong> Moçambique, Lda. 88,000 0<br />

Financing Loans<br />

42,588,000 24,100,000<br />

Empovar, S.A. 1,997,596 1,997,596<br />

<strong>Efacec</strong> Serviços de Manutenção e Assistência, S.A. 8,038,315 8,038,315<br />

<strong>Efacec</strong> Au<strong>to</strong>mação e Robótica, S.A. 0 0<br />

<strong>Efacec</strong> Investimen<strong>to</strong>s e Concessões, SGPS, S.A. 1,319,420 1,319,420<br />

<strong>Efacec</strong> Angola, Lda. 350,171 350,171<br />

<strong>Efacec</strong> Moçambique, Lda. 112,448 112,448<br />

11,817,950 11,817,950<br />

Total Loans 54,405,950 35,917,950<br />

5.1 Financial investments in o<strong>the</strong>r companies<br />

This line includes <strong>the</strong> value of <strong>the</strong> shareholdings in O<strong>the</strong>r companies and loans granted. The movements during <strong>the</strong> year were as<br />

follows:<br />

31.12.2008 31.12.2007<br />

Opening balance 11,517 15,365<br />

Increase in share capital 0 0<br />

Acquisition of investments 163,158 0<br />

Disposal of investment 0 -3,848<br />

Financing Loans 359,259 0<br />

O<strong>the</strong>r 0 0<br />

Closing balance 533,934 11,517<br />

The movements within <strong>the</strong> period refer <strong>to</strong> <strong>the</strong> acquisition of a position in <strong>the</strong> share capital of MARL Energia - Central Fo<strong>to</strong>voltaica,<br />

SA and <strong>to</strong> <strong>the</strong> concession of a loan <strong>to</strong> <strong>the</strong> same company.<br />

6. Derivatives<br />

In relation <strong>to</strong> fi nancial risk management described in Note 2, <strong>the</strong> evaluation of fi nancial instruments as at 31 December 2008 and<br />

2007 was as follows:<br />

Interest rate risk<br />

As at 31 December 2008, <strong>Efacec</strong> featured a portfolio of interest rate derivatives <strong>to</strong>talling 87 million Euro for BEI loans and Commercial paper (Note<br />

12), whose market valuation was negative by 2,347,029 Euro.<br />

2008 Consolidated and<br />

Individual Financial Statements