Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In April 2008, a Commercial Paper programme was agreed with <strong>the</strong> Santander Totta Bank <strong>to</strong> a maximum value of 20,000,000<br />

Euro. This programme has a contract period of 3 years, and its reimbursement is made through half-yearly and consecutive amortisations<br />

<strong>to</strong> <strong>the</strong> value of 5,000,000 Euro, as of <strong>the</strong> 2nd year of <strong>the</strong> Programme. The current issues fall due on 15 de Oc<strong>to</strong>ber de<br />

2009.<br />

In June 2008, a Commercial Paper programme was agreed with Caixa Geral de Depósi<strong>to</strong>s <strong>to</strong> a maximum value of 30,000,000 Euro.<br />

This programme has a contract period of 3 years with one year exemption period and <strong>the</strong> reimbursement is carried out through<br />

half-yearly amortisations <strong>to</strong> <strong>the</strong> value of 7,500,000 €. There are two simultaneous issues, one <strong>to</strong> <strong>the</strong> value of 10,000,000 € which<br />

falls due on 21 April 2009 and <strong>the</strong> o<strong>the</strong>r <strong>to</strong> <strong>the</strong> value of 20,000,000 € which falls due on 2 February 2009.<br />

In August 2008, a Commercial Paper programme was agreed with <strong>the</strong> BPI Bank <strong>to</strong> a maximum value of 15,000,000 Euro. The<br />

programme has a contract period of 6 months without renewal. The current issues fall due on 30 January 2009.<br />

In September 2008, a Commercial Paper programme was agreed with BARCLAYS <strong>to</strong> a maximum value of 10,000,000 Euro. This<br />

programme comprises <strong>Efacec</strong> Group Companies and has period of 5 years with yearly renewals. <strong>Efacec</strong> Capital carried out an issue<br />

for <strong>the</strong> <strong>to</strong>tal Programme that falls due on 8 de April de 2009.<br />

In Oc<strong>to</strong>ber 2008, a Commercial Paper programme was agreed with <strong>the</strong> Banco Espíri<strong>to</strong> San<strong>to</strong> <strong>to</strong> a maximum value of 30,000,000<br />

Euro. This programme comprises <strong>Efacec</strong> Group Companies and has period of 5 years with yearly renewals. <strong>Efacec</strong> Capital carried<br />

out an issue for <strong>the</strong> <strong>to</strong>tal Programme that falls due on 05 May 2009.<br />

Bank overdrafts<br />

Bank overdrafts involve <strong>the</strong> use of current credit accounts according <strong>to</strong> limits and conditions previously negotiated with fi nancial<br />

institutions and without defi ned reimbursement periods, although <strong>the</strong>y are assumed <strong>to</strong> be of short duration. The average rate of<br />

<strong>the</strong>se credits is indexed <strong>to</strong> Euribor plus an average spread of 0.96%.<br />

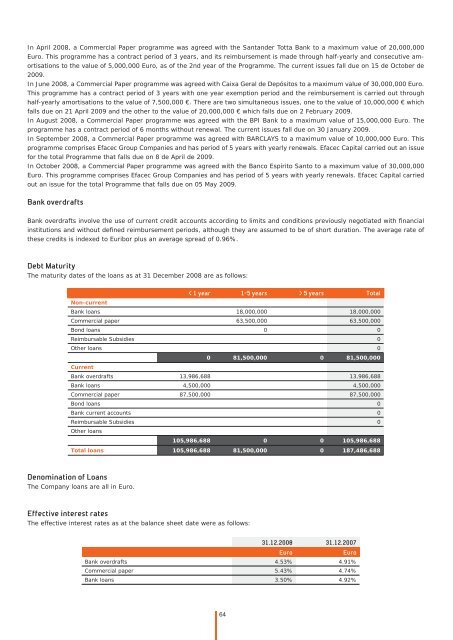

Debt Maturity<br />

The maturity dates of <strong>the</strong> loans as at 31 December 2008 are as follows:<br />

< 1 year 1-5 years > 5 years Total<br />

Non-current<br />

Bank loans 18,000,000 18,000,000<br />

Commercial paper 63,500,000 63,500,000<br />

Bond loans 0 0<br />

Reimbursable Subsidies 0<br />

O<strong>the</strong>r loans 0<br />

0 81,500,000 0 81,500,000<br />

Current<br />

Bank overdrafts 13,986,688 13,986,688<br />

Bank loans 4,500,000 4,500,000<br />

Commercial paper 87,500,000 87,500,000<br />

Bond loans 0<br />

Bank current accounts 0<br />

Reimbursable Subsidies<br />

O<strong>the</strong>r loans<br />

0<br />

105,986,688 0 0 105,986,688<br />

Total loans 105,986,688 81,500,000 0 187,486,688<br />

Denomination of Loans<br />

The Company loans are all in Euro.<br />

Effective interest rates<br />

The effective interest rates as at <strong>the</strong> balance sheet date were as follows:<br />

64<br />

31.12.2008 31.12.2007<br />

Euro Euro<br />

Bank overdrafts 4.53% 4.91%<br />

Commercial paper 5.43% 4.74%<br />

Bank loans 3.50% 4.92%