Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

24<br />

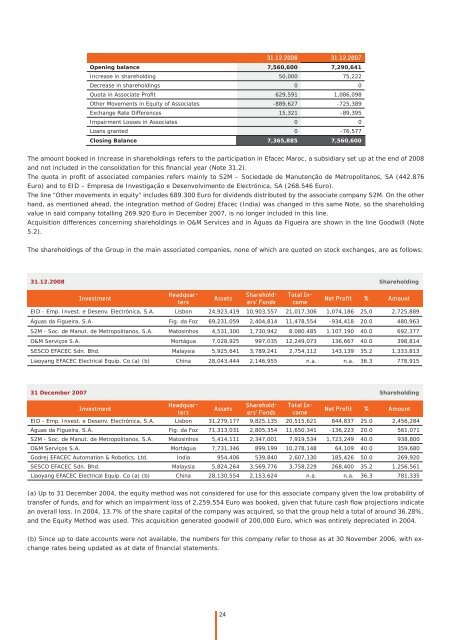

31.12.2008 31.12.2007<br />

Opening balance 7,560,600 7,290,641<br />

Increase in shareholding 50,000 75,222<br />

Decrease in shareholdings 0 0<br />

Quota in Associate Profi t 629,591 1,086,098<br />

O<strong>the</strong>r Movements in Equity of Associates -889,627 -725,389<br />

Exchange Rate Differences 15,321 -89,395<br />

Impairment Losses in Associates 0 0<br />

Loans granted 0 -76,577<br />

Closing Balance 7,365,885 7,560,600<br />

The amount booked in Increase in shareholdings refers <strong>to</strong> <strong>the</strong> participation in <strong>Efacec</strong> Maroc, a subsidiary set up at <strong>the</strong> end of 2008<br />

and not included in <strong>the</strong> consolidation for this fi nancial year (Note 31.2).<br />

The quota in profi t of associated companies refers mainly <strong>to</strong> S2M – Sociedade de Manutenção de Metropolitanos, SA (442.876<br />

Euro) and <strong>to</strong> EID – Empresa de Investigação e Desenvolvimen<strong>to</strong> de Electrónica, SA (268.546 Euro).<br />

The line “O<strong>the</strong>r movements in equity” includes 689.300 Euro for dividends distributed by <strong>the</strong> associate company S2M. On <strong>the</strong> o<strong>the</strong>r<br />

hand, as mentioned ahead, <strong>the</strong> integration method of Godrej <strong>Efacec</strong> (India) was changed in this same Note, so <strong>the</strong> shareholding<br />

value in said company <strong>to</strong>talling 269.920 Euro in December 2007, is no longer included in this line.<br />

Acquisition differences concerning shareholdings in O&M Services and in Águas da Figueira are shown in <strong>the</strong> line Goodwill (Note<br />

5.2).<br />

The shareholdings of <strong>the</strong> Group in <strong>the</strong> main associated companies, none of which are quoted on s<strong>to</strong>ck exchanges, are as follows:<br />

31.12.2008 Shareholding<br />

Investment<br />

Headquarters<br />

Assets<br />

Shareholders’<br />

Funds<br />

Total Income<br />

Net Profit % Amount<br />

EID - Emp. Invest. e Desenv. Electrónica, S.A. Lisbon 24,923,419 10,903,557 21,017,306 1,074,186 25,0 2,725,889<br />

Águas da Figueira, S.A. Fig. da Foz 69,231,059 2,404,814 11,478,554 -934,418 20.0 480,963<br />

S2M - Soc. de Manut. de Metropolitanos, S.A. Ma<strong>to</strong>sinhos 4,531,300 1,730,942 8.080.485 1.107.190 40.0 692,377<br />

O&M Serviços S.A. Mortágua 7,028,925 997,035 12,249,073 136,667 40.0 398,814<br />

SESCO EFACEC Sdn. Bhd. Malaysia 5,925,641 3,789,241 2,754,112 143,139 35.2 1,333,813<br />

Liaoyang EFACEC Electrical Equip. Co (a) (b) China 28,043,444 2,146,955 n.a. n.a. 36.3 778,915<br />

31 December 2007 Shareholding<br />

Investment<br />

Headquarters<br />

Assets<br />

Shareholders’<br />

Funds<br />

Total Income<br />

Net Profit % Amount<br />

EID - Emp. Invest. e Desenv. Electrónica, S.A. Lisbon 31,279,177 9,825,135 20,515,621 844,837 25.0 2,456,284<br />

Águas da Figueira, S.A. Fig. da Foz 71,313,031 2,805,354 11,650,341 -136,223 20.0 561,071<br />

S2M - Soc. de Manut. de Metropolitanos, S.A. Ma<strong>to</strong>sinhos 5,414,111 2,347,001 7,919,534 1,723,249 40.0 938,800<br />

O&M Serviços S.A. Mortágua 7,731,346 899,199 10,278,148 64,109 40.0 359,680<br />

Godrej EFACEC Au<strong>to</strong>mation & Robotics, Ltd. India 954,406 539,840 2,607,130 185,426 50.0 269,920<br />

SESCO EFACEC Sdn. Bhd. Malaysia 5,824,264 3,569,776 3,758,229 268,400 35.2 1,256,561<br />

Liaoyang EFACEC Electrical Equip. Co (a) (b) China 28,130,554 2,153,624 n.a. n.a. 36.3 781,335<br />

(a) Up <strong>to</strong> 31 December 2004, <strong>the</strong> equity method was not considered for use for this associate company given <strong>the</strong> low probability of<br />

transfer of funds, and for which an impairment loss of 2,259,554 Euro was booked, given that future cash fl ow projections indicate<br />

an overall loss. In 2004, 13.7% of <strong>the</strong> share capital of <strong>the</strong> company was acquired, so that <strong>the</strong> group held a <strong>to</strong>tal of around 36.28%,<br />

and <strong>the</strong> Equity Method was used. This acquisition generated goodwill of 200,000 Euro, which was entirely depreciated in 2004.<br />

(b) Since up <strong>to</strong> date accounts were not available, <strong>the</strong> numbers for this company refer <strong>to</strong> those as at 30 November 2006, with exchange<br />

rates being updated as at date of fi nancial <strong>statements</strong>.