Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

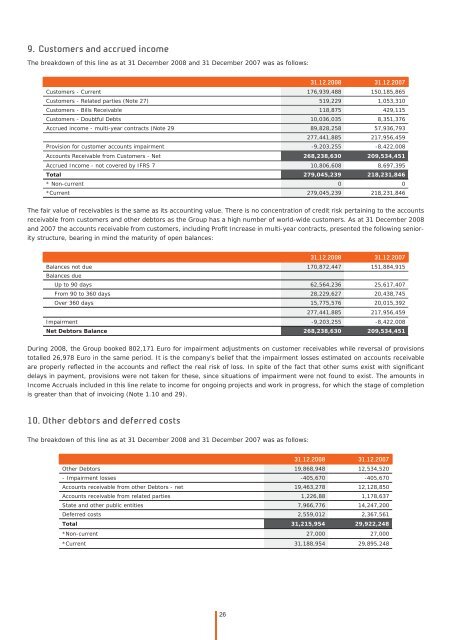

9. Cus<strong>to</strong>mers and accrued income<br />

The breakdown of this line as at 31 December 2008 and 31 December 2007 was as follows:<br />

26<br />

31.12.2008 31.12.2007<br />

Cus<strong>to</strong>mers - Current 176,939,488 150,185,865<br />

Cus<strong>to</strong>mers - Related parties (Note 27) 519,229 1,053,310<br />

Cus<strong>to</strong>mers - Bills Receivable 118,875 429,115<br />

Cus<strong>to</strong>mers - Doubtful Debts 10,036,035 8,351,376<br />

Accrued income - multi-year contracts (Note 29 89,828,258 57,936,793<br />

277,441,885 217,956,459<br />

Provision for cus<strong>to</strong>mer accounts impairment -9,203,255 -8,422,008<br />

Accounts Receivable from Cus<strong>to</strong>mers - Net 268,238,630 209,534,451<br />

Accrued Income - not covered by IFRS 7 10,806,608 8,697,395<br />

Total 279,045,239 218,231,846<br />

* Non-current 0 0<br />

*Current 279,045,239 218,231,846<br />

The fair value of receivables is <strong>the</strong> same as its accounting value. There is no concentration of credit risk pertaining <strong>to</strong> <strong>the</strong> accounts<br />

receivable from cus<strong>to</strong>mers and o<strong>the</strong>r deb<strong>to</strong>rs as <strong>the</strong> Group has a high number of world-wide cus<strong>to</strong>mers. As at 31 December 2008<br />

and 2007 <strong>the</strong> accounts receivable from cus<strong>to</strong>mers, including Profi t Increase in multi-year contracts, presented <strong>the</strong> following seniority<br />

structure, bearing in mind <strong>the</strong> maturity of open balances:<br />

31.12.2008 31.12.2007<br />

Balances not due<br />

Balances due<br />

170,872,447 151,884,915<br />

Up <strong>to</strong> 90 days 62,564,236 25,617,407<br />

From 90 <strong>to</strong> 360 days 28,229,627 20,438,745<br />

Over 360 days 15,775,576 20,015,392<br />

277,441,885 217,956,459<br />

Impairment -9,203,255 -8,422,008<br />

Net Deb<strong>to</strong>rs Balance 268,238,630 209,534,451<br />

During 2008, <strong>the</strong> Group booked 802,171 Euro for impairment adjustments on cus<strong>to</strong>mer receivables while reversal of provisions<br />

<strong>to</strong>talled 26,978 Euro in <strong>the</strong> same period. It is <strong>the</strong> company’s belief that <strong>the</strong> impairment losses estimated on accounts receivable<br />

are properly refl ected in <strong>the</strong> accounts and refl ect <strong>the</strong> real risk of loss. In spite of <strong>the</strong> fact that o<strong>the</strong>r sums exist with signifi cant<br />

delays in payment, provisions were not taken for <strong>the</strong>se, since situations of impairment were not found <strong>to</strong> exist. The amounts in<br />

Income Accruals included in this line relate <strong>to</strong> income for ongoing projects and work in progress, for which <strong>the</strong> stage of completion<br />

is greater than that of invoicing (Note 1.10 and 29).<br />

10. O<strong>the</strong>r deb<strong>to</strong>rs and deferred costs<br />

The breakdown of this line as at 31 December 2008 and 31 December 2007 was as follows:<br />

31.12.2008 31.12.2007<br />

O<strong>the</strong>r Deb<strong>to</strong>rs 19,868,948 12,534,520<br />

- Impairment losses -405,670 -405,670<br />

Accounts receivable from o<strong>the</strong>r Deb<strong>to</strong>rs - net 19,463,278 12,128,850<br />

Accounts receivable from related parties 1,226,88 1,178,637<br />

State and o<strong>the</strong>r public entities 7,966,776 14,247,200<br />

Deferred costs 2,559,012 2,367,561<br />

Total 31,215,954 29,922,248<br />

*Non-current 27,000 27,000<br />

*Current 31,188,954 29,895,248