Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

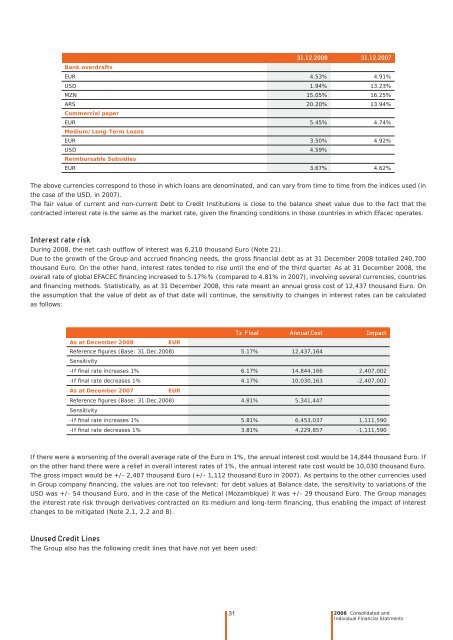

31.12.2008 31.12.2007<br />

Bank overdrafts<br />

EUR 4.53% 4.91%<br />

USD 1.94% 13.23%<br />

MZN 15.05% 16.25%<br />

ARS 20.20% 13.94%<br />

Commercial paper<br />

EUR 5.45% 4.74%<br />

Medium/Long-Term Loans<br />

EUR 3.50% 4.92%<br />

USD 4.59%<br />

Reimbursable Subsidies<br />

EUR 3.67% 4.62%<br />

The above currencies correspond <strong>to</strong> those in which loans are denominated, and can vary from time <strong>to</strong> time from <strong>the</strong> indices used (in<br />

<strong>the</strong> case of <strong>the</strong> USD, in 2007).<br />

The fair value of current and non-current Debt <strong>to</strong> Credit Institutions is close <strong>to</strong> <strong>the</strong> balance sheet value due <strong>to</strong> <strong>the</strong> fact that <strong>the</strong><br />

contracted interest rate is <strong>the</strong> same as <strong>the</strong> market rate, given <strong>the</strong> fi nancing conditions in those countries in which <strong>Efacec</strong> operates.<br />

Interest rate risk<br />

During 2008, <strong>the</strong> net cash outfl ow of interest was 6,210 thousand Euro (Note 21).<br />

Due <strong>to</strong> <strong>the</strong> growth of <strong>the</strong> Group and accrued fi nancing needs, <strong>the</strong> gross fi nancial debt as at 31 December 2008 <strong>to</strong>talled 240,700<br />

thousand Euro. On <strong>the</strong> o<strong>the</strong>r hand, interest rates tended <strong>to</strong> rise until <strong>the</strong> end of <strong>the</strong> third quarter. As at 31 December 2008, <strong>the</strong><br />

overall rate of global EFACEC fi nancing increased <strong>to</strong> 5.17%% (compared <strong>to</strong> 4.81% in 2007), involving several currencies, countries<br />

and fi nancing methods. Statistically, as at 31 December 2008, this rate meant an annual gross cost of 12,437 thousand Euro. On<br />

<strong>the</strong> assumption that <strong>the</strong> value of debt as of that date will continue, <strong>the</strong> sensitivity <strong>to</strong> changes in interest rates can be calculated<br />

as follows:<br />

Tx Final Annual Cost Impact<br />

As at December 2008 EUR<br />

Reference fi gures (Base: 31.Dec.2008)<br />

Sensitivity<br />

5.17% 12,437,164<br />

-If fi nal rate increases 1% 6.17% 14,844,166 2,407,002<br />

-If fi nal rate decreases 1% 4.17% 10,030,163 -2,407,002<br />

As at December 2007 EUR<br />

Reference fi gures (Base: 31.Dec.2008)<br />

Sensitivity<br />

4.81% 5,341,447<br />

-If fi nal rate increases 1% 5.81% 6,453,037 1,111,590<br />

-If fi nal rate decreases 1% 3.81% 4,229,857 -1,111,590<br />

If <strong>the</strong>re were a worsening of <strong>the</strong> overall average rate of <strong>the</strong> Euro in 1%, <strong>the</strong> annual interest cost would be 14,844 thousand Euro. If<br />

on <strong>the</strong> o<strong>the</strong>r hand <strong>the</strong>re were a relief in overall interest rates of 1%, <strong>the</strong> annual interest rate cost would be 10,030 thousand Euro.<br />

The gross impact would be +/- 2,407 thousand Euro (+/- 1,112 thousand Euro in 2007). As pertains <strong>to</strong> <strong>the</strong> o<strong>the</strong>r currencies used<br />

in Group company fi nancing, <strong>the</strong> values are not <strong>to</strong>o relevant: for debt values at Balance date, <strong>the</strong> sensitivity <strong>to</strong> variations of <strong>the</strong><br />

USD was +/- 54 thousand Euro, and in <strong>the</strong> case of <strong>the</strong> Metical (Mozambique) it was +/- 29 thousand Euro. The Group manages<br />

<strong>the</strong> interest rate risk through derivatives contracted on its medium and long-term fi nancing, thus enabling <strong>the</strong> impact of interest<br />

changes <strong>to</strong> be mitigated (Note 2.1, 2.2 and 8).<br />

Unused Credit Lines<br />

The Group also has <strong>the</strong> following credit lines that have not yet been used:<br />

31<br />

2008 Consolidated and<br />

Individual Financial Statments