Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1.2 Tangible Fixed Assets<br />

separate, as deemed appropriate, only when it is likely that economic benefi ts fl ow <strong>to</strong> <strong>the</strong> company and <strong>the</strong> cost can be reliably<br />

measured. O<strong>the</strong>r expenditure for repairs and maintenance are recognised as costs within <strong>the</strong> period in which <strong>the</strong>y are incurred.<br />

Increases resulting from revaluations are shown in Reserves in Shareholders’ Funds. Each year, <strong>the</strong> difference between depreciation<br />

based on <strong>the</strong> re-valued amount of <strong>the</strong> asset taken <strong>to</strong> profi t and loss in <strong>the</strong> period, and depreciation based on <strong>the</strong> original cost<br />

of <strong>the</strong> asset, is transferred from fair value Reserves <strong>to</strong> Retained Profi ts.<br />

Land is not depreciated. Depreciation on o<strong>the</strong>r assets is calculated using <strong>the</strong> straight line method using <strong>the</strong> cost value or <strong>the</strong> revalued<br />

amount, in order <strong>to</strong> apportion <strong>the</strong>ir cost or re-valued amount over <strong>the</strong> useful life of <strong>the</strong> asset down <strong>to</strong> <strong>the</strong>ir residual value,<br />

as follows:<br />

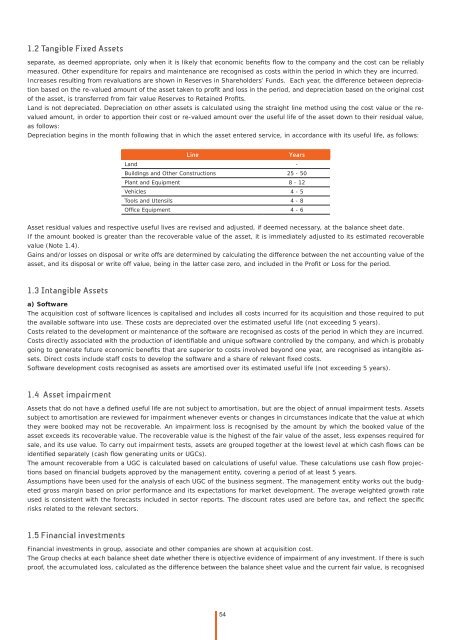

Depreciation begins in <strong>the</strong> month following that in which <strong>the</strong> asset entered service, in accordance with its useful life, as follows:<br />

Line Years<br />

Land -<br />

Buildings and O<strong>the</strong>r Constructions 25 - 50<br />

Plant and Equipment 8 - 12<br />

Vehicles 4 - 5<br />

Tools and Utensils 4 - 8<br />

Offi ce Equipment 4 - 6<br />

Asset residual values and respective useful lives are revised and adjusted, if deemed necessary, at <strong>the</strong> balance sheet date.<br />

If <strong>the</strong> amount booked is greater than <strong>the</strong> recoverable value of <strong>the</strong> asset, it is immediately adjusted <strong>to</strong> its estimated recoverable<br />

value (Note 1.4).<br />

Gains and/or losses on disposal or write offs are determined by calculating <strong>the</strong> difference between <strong>the</strong> net accounting value of <strong>the</strong><br />

asset, and its disposal or write off value, being in <strong>the</strong> latter case zero, and included in <strong>the</strong> Profi t or Loss for <strong>the</strong> period.<br />

1.3 Intangible Assets<br />

a) Software<br />

The acquisition cost of software licences is capitalised and includes all costs incurred for its acquisition and those required <strong>to</strong> put<br />

<strong>the</strong> available software in<strong>to</strong> use. These costs are depreciated over <strong>the</strong> estimated useful life (not exceeding 5 years).<br />

Costs related <strong>to</strong> <strong>the</strong> development or maintenance of <strong>the</strong> software are recognised as costs of <strong>the</strong> period in which <strong>the</strong>y are incurred.<br />

Costs directly associated with <strong>the</strong> production of identifi able and unique software controlled by <strong>the</strong> company, and which is probably<br />

going <strong>to</strong> generate future economic benefi ts that are superior <strong>to</strong> costs involved beyond one year, are recognised as intangible assets.<br />

Direct costs include staff costs <strong>to</strong> develop <strong>the</strong> software and a share of relevant fi xed costs.<br />

Software development costs recognised as assets are amortised over its estimated useful life (not exceeding 5 years).<br />

1.4 Asset impairment<br />

Assets that do not have a defi ned useful life are not subject <strong>to</strong> amortisation, but are <strong>the</strong> object of annual impairment tests. Assets<br />

subject <strong>to</strong> amortisation are reviewed for impairment whenever events or changes in circumstances indicate that <strong>the</strong> value at which<br />

<strong>the</strong>y were booked may not be recoverable. An impairment loss is recognised by <strong>the</strong> amount by which <strong>the</strong> booked value of <strong>the</strong><br />

asset exceeds its recoverable value. The recoverable value is <strong>the</strong> highest of <strong>the</strong> fair value of <strong>the</strong> asset, less expenses required for<br />

sale, and its use value. To carry out impairment tests, assets are grouped <strong>to</strong>ge<strong>the</strong>r at <strong>the</strong> lowest level at which cash fl ows can be<br />

identifi ed separately (cash fl ow generating units or UGCs).<br />

The amount recoverable from a UGC is calculated based on calculations of useful value. These calculations use cash fl ow projections<br />

based on fi nancial budgets approved by <strong>the</strong> management entity, covering a period of at least 5 years.<br />

Assumptions have been used for <strong>the</strong> analysis of each UGC of <strong>the</strong> business segment. The management entity works out <strong>the</strong> budgeted<br />

gross margin based on prior performance and its expectations for market development. The average weighted growth rate<br />

used is consistent with <strong>the</strong> forecasts included in sec<strong>to</strong>r reports. The discount rates used are before tax, and refl ect <strong>the</strong> specifi c<br />

risks related <strong>to</strong> <strong>the</strong> relevant sec<strong>to</strong>rs.<br />

1.5 Financial investments<br />

Financial investments in group, associate and o<strong>the</strong>r companies are shown at acquisition cost.<br />

The Group checks at each balance sheet date whe<strong>the</strong>r <strong>the</strong>re is objective evidence of impairment of any investment. If <strong>the</strong>re is such<br />

proof, <strong>the</strong> accumulated loss, calculated as <strong>the</strong> difference between <strong>the</strong> balance sheet value and <strong>the</strong> current fair value, is recognised<br />

54