Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

At variable rates<br />

32<br />

31.12.2008 31.12.2007<br />

Due within one year 13,876,047 35,109,890<br />

Due over one year 0 12,500,000<br />

13,876,047 47,609,890<br />

The credit lines due up <strong>to</strong> one year are au<strong>to</strong>matically renewed on an annual basis.<br />

The amount presented in 2007 due over 1 year referred <strong>to</strong> a Commercial Paper Programme agreed upon at <strong>the</strong> end of <strong>the</strong> year,<br />

whose issues effectively occurred in 2008.<br />

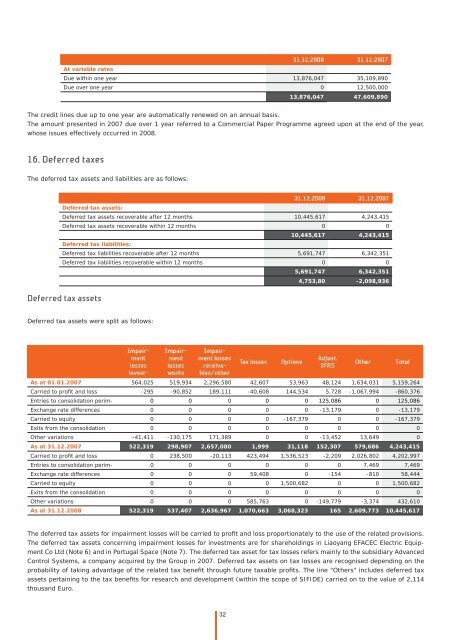

16. Deferred taxes<br />

The deferred tax assets and liabilities are as follows:<br />

31.12.2008 31.12.2007<br />

Deferred tax assets:<br />

Deferred tax assets recoverable after 12 months 10,445,617 4,243,415<br />

Deferred tax assets recoverable within 12 months 0 0<br />

Deferred tax liabilities:<br />

10,445,617 4,243,415<br />

Deferred tax liabilities recoverable after 12 months 5,691,747 6,342,351<br />

Deferred tax liabilities recoverable within 12 months 0 0<br />

5,691,747 6,342,351<br />

4,753,80 -2,098,936<br />

Deferred tax assets<br />

Deferred tax assets were split as follows:<br />

Impairment<br />

losses<br />

invest-<br />

Impairment<br />

losses<br />

works<br />

Impairment<br />

losses<br />

receivables/o<strong>the</strong>r<br />

Tax losses Options<br />

Adjust.<br />

IFRS<br />

O<strong>the</strong>r Total<br />

As at 01.01.2007 564,025 519,934 2,296,580 42,607 53,963 48,124 1,634,031 5,159,264<br />

Carried <strong>to</strong> profi t and loss -295 -90,852 189,111 -40,608 144,534 5,728 -1,067,994 -860,376<br />

Entries <strong>to</strong> consolidation perim- 0 0 0 0 0 125,086 0 125,086<br />

Exchange rate differences 0 0 0 0 0 -13,179 0 -13,179<br />

Carried <strong>to</strong> equity 0 0 0 0 -167,379 0 0 -167,379<br />

Exits from <strong>the</strong> consolidation 0 0 0 0 0 0 0 0<br />

O<strong>the</strong>r variations -41,411 -130,175 171,389 0 0 -13,452 13,649 0<br />

As at 31.12.2007 522,319 298,907 2,657,080 1,999 31,118 152,307 579,686 4,243,415<br />

Carried <strong>to</strong> profi t and loss 0 238,500 -20,113 423,494 1,536,523 -2,209 2,026,802 4,202,997<br />

Entries <strong>to</strong> consolidation perim- 0 0 0 0 0 0 7,469 7,469<br />

Exchange rate differences 0 0 0 59,408 0 -154 -810 58,444<br />

Carried <strong>to</strong> equity 0 0 0 0 1,500,682 0 0 1,500,682<br />

Exits from <strong>the</strong> consolidation 0 0 0 0 0 0 0 0<br />

O<strong>the</strong>r variations 0 0 0 585,763 0 -149,779 -3,374 432,610<br />

As at 31.12.2008 522,319 537,407 2,636,967 1,070,663 3,068,323 165 2,609,773 10,445,617<br />

The deferred tax assets for impairment losses will be carried <strong>to</strong> profi t and loss proportionately <strong>to</strong> <strong>the</strong> use of <strong>the</strong> related provisions.<br />

The deferred tax assets concerning impairment losses for investments are for shareholdings in Liaoyang EFACEC Electric Equipment<br />

Co Ltd (Note 6) and in Portugal Space (Note 7). The deferred tax asset for tax losses refers mainly <strong>to</strong> <strong>the</strong> subsidiary Advanced<br />

Control Systems, a company acquired by <strong>the</strong> Group in 2007. Deferred tax assets on tax losses are recognised depending on <strong>the</strong><br />

probability of taking advantage of <strong>the</strong> related tax benefi t through future taxable profi ts. The line "O<strong>the</strong>rs" includes deferred tax<br />

assets pertaining <strong>to</strong> <strong>the</strong> tax benefi ts for research and development (within <strong>the</strong> scope of SIFIDE) carried on <strong>to</strong> <strong>the</strong> value of 2,114<br />

thousand Euro.