Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

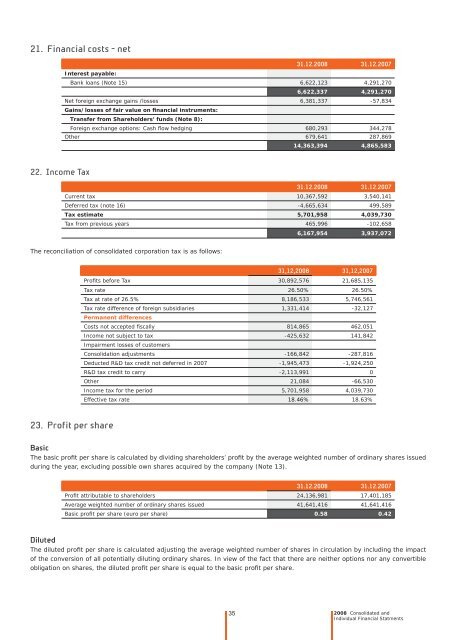

21. Financial costs - net<br />

22. Income Tax<br />

31.12.2008 31.12.2007<br />

Interest payable:<br />

Bank loans (Note 15) 6,622,123 4,291,270<br />

35<br />

6,622,337 4,291,270<br />

Net foreign exchange gains /losses<br />

Gains/losses of fair value on fi nancial instruments:<br />

Transfer from Shareholders’ funds (Note 8):<br />

6,381,337 -57,834<br />

Foreign exchange options: Cash fl ow hedging 680,293 344,278<br />

O<strong>the</strong>r 679,641 287,869<br />

14,363,394 4,865,583<br />

31.12.2008 31.12.2007<br />

Current tax 10,367,592 3,540,141<br />

Deferred tax (note 16) -4,665,634 499,589<br />

Tax estimate 5,701,958 4,039,730<br />

Tax from previous years 465,996 -102,658<br />

The reconciliation of <strong>consolidated</strong> corporation tax is as follows:<br />

23. Profit per share<br />

6,167,954 3,937,072<br />

31,12,2008 31,12,2007<br />

Profi ts before Tax 30,892,576 21,685,135<br />

Tax rate 26.50% 26.50%<br />

Tax at rate of 26.5% 8,186,533 5,746,561<br />

Tax rate difference of foreign subsidiaries<br />

Permanent differences<br />

1,331,414 -32,127<br />

Costs not accepted fi scally 814,865 462,051<br />

Income not subject <strong>to</strong> tax<br />

Impairment losses of cus<strong>to</strong>mers<br />

-425,632 141,842<br />

Consolidation adjustments -166,842 -287,816<br />

Deducted R&D tax credit not deferred in 2007 -1,945,473 -1,924,250<br />

R&D tax credit <strong>to</strong> carry -2,113,991 0<br />

O<strong>the</strong>r 21,084 -66,530<br />

Income tax for <strong>the</strong> period 5,701,958 4,039,730<br />

Effective tax rate 18.46% 18.63%<br />

Basic<br />

The basic profi t per share is calculated by dividing shareholders’ profi t by <strong>the</strong> average weighted number of ordinary shares issued<br />

during <strong>the</strong> year, excluding possible own shares acquired by <strong>the</strong> company (Note 13).<br />

31.12.2008 31.12.2007<br />

Profi t attributable <strong>to</strong> shareholders 24,136,981 17,401,185<br />

Average weighted number of ordinary shares issued 41,641,416 41,641,416<br />

Basic profi t per share (euro per share) 0.58 0.42<br />

Diluted<br />

The diluted profi t per share is calculated adjusting <strong>the</strong> average weighted number of shares in circulation by including <strong>the</strong> impact<br />

of <strong>the</strong> conversion of all potentially diluting ordinary shares. In view of <strong>the</strong> fact that <strong>the</strong>re are nei<strong>the</strong>r options nor any convertible<br />

obligation on shares, <strong>the</strong> diluted profi t per share is equal <strong>to</strong> <strong>the</strong> basic profi t per share.<br />

2008 Consolidated and<br />

Individual Financial Statments