Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

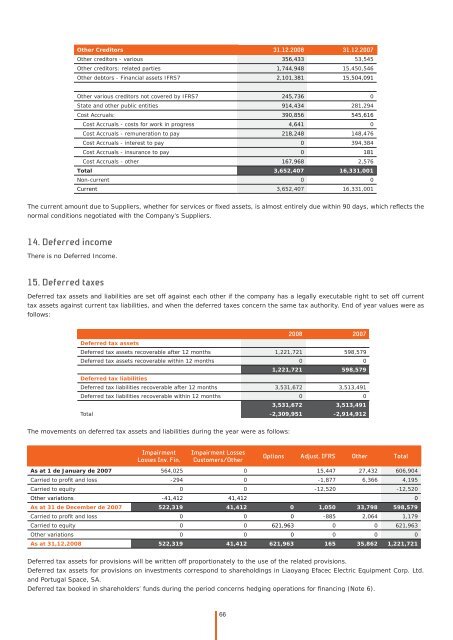

O<strong>the</strong>r Credi<strong>to</strong>rs 31.12.2008 31.12.2007<br />

O<strong>the</strong>r credi<strong>to</strong>rs - various 356,433 53,545<br />

O<strong>the</strong>r credi<strong>to</strong>rs: related parties 1,744,948 15,450,546<br />

O<strong>the</strong>r deb<strong>to</strong>rs - Financial assets IFRS7 2,101,381 15,504,091<br />

O<strong>the</strong>r various credi<strong>to</strong>rs not covered by IFRS7 245,736 0<br />

State and o<strong>the</strong>r public entities 914,434 281,294<br />

Cost Accruals: 390,856 545,616<br />

Cost Accruals - costs for work in progress 4,641 0<br />

Cost Accruals - remuneration <strong>to</strong> pay 218,248 148,476<br />

Cost Accruals - interest <strong>to</strong> pay 0 394,384<br />

Cost Accruals - insurance <strong>to</strong> pay 0 181<br />

Cost Accruals - o<strong>the</strong>r 167,968 2,576<br />

Total 3,652,407 16,331,001<br />

Non-current 0 0<br />

Current 3,652,407 16,331,001<br />

The current amount due <strong>to</strong> Suppliers, whe<strong>the</strong>r for services or fi xed assets, is almost entirely due within 90 days, which refl ects <strong>the</strong><br />

normal conditions negotiated with <strong>the</strong> Company’s Suppliers.<br />

14. Deferred income<br />

There is no Deferred Income.<br />

15. Deferred taxes<br />

Deferred tax assets and liabilities are set off against each o<strong>the</strong>r if <strong>the</strong> company has a legally executable right <strong>to</strong> set off current<br />

tax assets against current tax liabilities, and when <strong>the</strong> deferred taxes concern <strong>the</strong> same tax authority. End of year values were as<br />

follows:<br />

2008 2007<br />

Deferred tax assets<br />

Deferred tax assets recoverable after 12 months 1,221,721 598,579<br />

Deferred tax assets recoverable within 12 months 0 0<br />

Deferred tax liabilities<br />

1,221,721 598,579<br />

Deferred tax liabilities recoverable after 12 months 3,531,672 3,513,491<br />

Deferred tax liabilities recoverable within 12 months 0 0<br />

3,531,672 3,513,491<br />

Total -2,309,951 -2,914,912<br />

The movements on deferred tax assets and liabilities during <strong>the</strong> year were as follows:<br />

Impairment<br />

Losses Inv. Fin.<br />

Impairment Losses<br />

Cus<strong>to</strong>mers/O<strong>the</strong>r<br />

66<br />

Options Adjust. IFRS O<strong>the</strong>r Total<br />

As at 1 de January de 2007 564,025 0 15,447 27,432 606,904<br />

Carried <strong>to</strong> profi t and loss -294 0 -1,877 6,366 4,195<br />

Carried <strong>to</strong> equity 0 0 -12,520 -12,520<br />

O<strong>the</strong>r variations -41,412 41,412 0<br />

As at 31 de December de 2007 522,319 41,412 0 1,050 33,798 598,579<br />

Carried <strong>to</strong> profi t and loss 0 0 0 -885 2,064 1,179<br />

Carried <strong>to</strong> equity 0 0 621,963 0 0 621,963<br />

O<strong>the</strong>r variations 0 0 0 0 0 0<br />

As at 31,12,2008 522,319 41,412 621,963 165 35,862 1,221,721<br />

Deferred tax assets for provisions will be written off proportionately <strong>to</strong> <strong>the</strong> use of <strong>the</strong> related provisions.<br />

Deferred tax assets for provisions on investments correspond <strong>to</strong> shareholdings in Liaoyang <strong>Efacec</strong> Electric Equipment Corp. Ltd.<br />

and Portugal Space, SA.<br />

Deferred tax booked in shareholders’ funds during <strong>the</strong> period concerns hedging operations for fi nancing (Note 6).