Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Companies and has period of 5 years with yearly renewals. <strong>Efacec</strong> Capital SGPS, SA carried out an issue for <strong>the</strong> <strong>to</strong>tal Programme<br />

that falls due on 8 April 2009. In Oc<strong>to</strong>ber 2008 a Commercial Paper Programme was agreed upon with <strong>the</strong> Espíri<strong>to</strong> San<strong>to</strong> Bank <strong>to</strong><br />

a maximum value of 30,000,000 Euro. This programme comprises <strong>Efacec</strong> Group Companies and has period of 5 years with yearly<br />

renewals. <strong>Efacec</strong> Capital SGPS, SA carried out an issue for <strong>the</strong> <strong>to</strong>tal Programme that falls due on 5 May 2009.<br />

Reimbursable subsidies<br />

These arise from contracts for investment projects fi nanced by European Union and Portuguese funds under <strong>the</strong> POE scheme. As at<br />

31 December 2008, this line included 4,069,163 Euro received from AICEP – Agência para o Investimen<strong>to</strong> e Comércio Externo de<br />

Portugal, by <strong>the</strong> subsidiary <strong>Efacec</strong> Energia between 2005 and 2008, pertaining <strong>to</strong> <strong>the</strong> three investment contracts. The reimbursement<br />

plans are half-yearly and go until 2015. The due part is less than a year away <strong>to</strong> <strong>the</strong> value of 659,622 Euro.<br />

Bank overdrafts<br />

Bank overdrafts involve <strong>the</strong> use of current credit accounts according <strong>to</strong> limits and conditions previously negotiated with fi nancial<br />

institutions and without defi ned reimbursement periods, although <strong>the</strong>y are assumed <strong>to</strong> be of short duration. The average rate of<br />

<strong>the</strong>se credits is indexed <strong>to</strong> Euribor plus an average spread of 0.96%.<br />

O<strong>the</strong>r loans<br />

The line O<strong>the</strong>r Non-Current Loans refers <strong>to</strong> a fi nancing operation celebrated with <strong>the</strong> Santander Totta Bank within <strong>the</strong> scope of <strong>the</strong><br />

MAIS Programme, for investment projects carried out by <strong>the</strong> company which can be assigned community funds.<br />

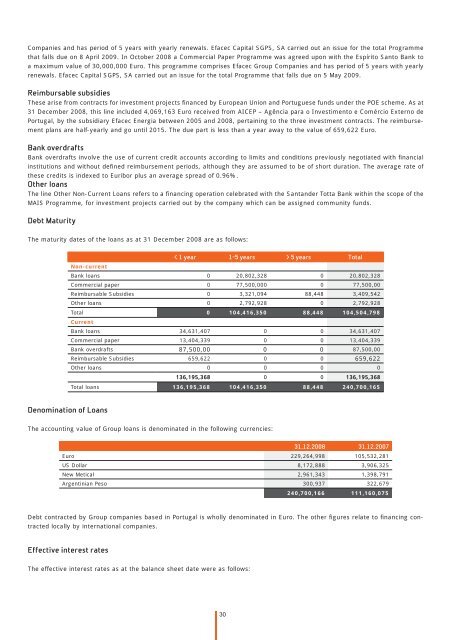

Debt Maturity<br />

The maturity dates of <strong>the</strong> loans as at 31 December 2008 are as follows:<br />

Non-current5<br />

Denomination of Loans<br />

< 1 year 1-5 years > 5 years Total<br />

Bank loans 0 20,802,328 0 20,802,328<br />

Commercial paper 0 77,500,000 0 77,500,00<br />

Reimbursable Subsidies 0 3,321,094 88,448 3,409,542<br />

O<strong>the</strong>r loans 0 2,792,928 0 2,792,928<br />

Total<br />

Current<br />

0 104,416,350 88,448 104,504,798<br />

Bank loans 34,631,407 0 0 34,631,407<br />

Commercial paper 13,404,339 0 0 13,404,339<br />

Bank overdrafts 87,500,00 0 0 87,500,00<br />

Reimbursable Subsidies 659,622 0 0 659,622<br />

O<strong>the</strong>r loans 0 0 0 0<br />

136,195,368 0 0 136,195,368<br />

Total loans 136,195,368 104,416,350 88,448 240,700,165<br />

The accounting value of Group loans is denominated in <strong>the</strong> following currencies:<br />

31.12.2008 31.12.2007<br />

Euro 229,264,998 105,532,281<br />

US Dollar 8,172,888 3,906,325<br />

New Metical 2,961,343 1,398,791<br />

Argentinian Peso 300,937 322,679<br />

30<br />

240,700,166 111,160,075<br />

Debt contracted by Group companies based in Portugal is wholly denominated in Euro. The o<strong>the</strong>r fi gures relate <strong>to</strong> fi nancing contracted<br />

locally by international companies.<br />

Effective interest rates<br />

The effective interest rates as at <strong>the</strong> balance sheet date were as follows: