Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

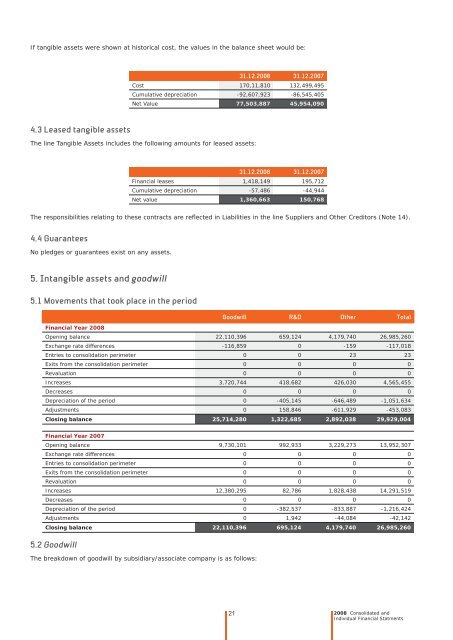

If tangible assets were shown at his<strong>to</strong>rical cost, <strong>the</strong> values in <strong>the</strong> balance sheet would be:<br />

4.3 Leased tangible assets<br />

31.12.2008 31.12.2007<br />

Cost 170,11,810 132,499,495<br />

Cumulative depreciation -92,607,923 -86,545,405<br />

Net Value 77,503,887 45,954,090<br />

The line Tangible Assets includes <strong>the</strong> following amounts for leased assets:<br />

31.12.2008 31.12.2007<br />

Financial leases 1,418,149 195,712<br />

Cumulative depreciation -57,486 -44,944<br />

Net value 1,360,663 150,768<br />

The responsibilities relating <strong>to</strong> <strong>the</strong>se contracts are refl ected in Liabilities in <strong>the</strong> line Suppliers and O<strong>the</strong>r Credi<strong>to</strong>rs (Note 14).<br />

4.4 Guarantees<br />

No pledges or guarantees exist on any assets.<br />

5. Intangible assets and goodwill<br />

5.1 Movements that <strong>to</strong>ok place in <strong>the</strong> period<br />

Financial Year 2008<br />

Goodwill R&D O<strong>the</strong>r Total<br />

Opening balance 22,110,396 659,124 4,179,740 26,985,260<br />

Exchange rate differences -116,859 0 -159 -117,018<br />

Entries <strong>to</strong> consolidation perimeter 0 0 23 23<br />

Exits from <strong>the</strong> consolidation perimeter 0 0 0 0<br />

Revaluation 0 0 0 0<br />

Increases 3,720,744 418,682 426,030 4,565,455<br />

Decreases 0 0 0 0<br />

Depreciation of <strong>the</strong> period 0 -405,145 -646,489 -1,051,634<br />

Adjustments 0 158,846 -611,929 -453,083<br />

Closing balance 25,714,280 1,322,685 2,892,038 29,929,004<br />

Financial Year 2007<br />

Opening balance 9,730,101 992,933 3,229,273 13,952,307<br />

Exchange rate differences 0 0 0 0<br />

Entries <strong>to</strong> consolidation perimeter 0 0 0 0<br />

Exits from <strong>the</strong> consolidation perimeter 0 0 0 0<br />

Revaluation 0 0 0 0<br />

Increases 12,380,295 82,786 1,828,438 14,291,519<br />

Decreases 0 0 0 0<br />

Depreciation of <strong>the</strong> period 0 -382,537 -833,887 -1,216,424<br />

Adjustments 0 1,942 -44,084 -42,142<br />

Closing balance 22,110,396 695,124 4,179,740 26,985,260<br />

5.2 Goodwill<br />

The breakdown of goodwill by subsidiary/associate company is as follows:<br />

21<br />

2008 Consolidated and<br />

Individual Financial Statments