Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22<br />

31.12.2008 31.12.2007<br />

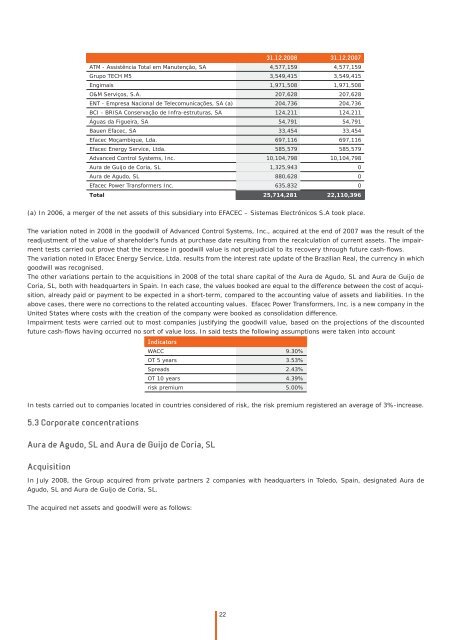

ATM - Assistência Total em Manutenção, SA 4,577,159 4,577,159<br />

Grupo TECH M5 3,549,415 3,549,415<br />

Engimais 1,971,508 1,971,508<br />

O&M Serviços, S.A. 207,628 207,628<br />

ENT - Empresa Nacional de Telecomunicações, SA (a) 204,736 204,736<br />

BCI - BRISA Conservação de Infra-estruturas, SA 124,211 124,211<br />

Águas da Figueira, SA 54,791 54,791<br />

Bauen <strong>Efacec</strong>, SA 33,454 33,454<br />

<strong>Efacec</strong> Moçambique, Lda. 697,116 697,116<br />

<strong>Efacec</strong> Energy Service, Ltda. 585,579 585,579<br />

Advanced Control Systems, Inc. 10,104,798 10,104,798<br />

Aura de Guijo de Coria, SL 1,325,943 0<br />

Aura de Agudo, SL 880,628 0<br />

<strong>Efacec</strong> Power Transformers Inc. 635,832 0<br />

Total 25,714,281 22,110,396<br />

(a) In 2006, a merger of <strong>the</strong> net assets of this subsidiary in<strong>to</strong> EFACEC – Sistemas Electrónicos S.A <strong>to</strong>ok place.<br />

The variation noted in 2008 in <strong>the</strong> goodwill of Advanced Control Systems, Inc., acquired at <strong>the</strong> end of 2007 was <strong>the</strong> result of <strong>the</strong><br />

readjustment of <strong>the</strong> value of shareholder's funds at purchase date resulting from <strong>the</strong> recalculation of current assets. The impairment<br />

tests carried out prove that <strong>the</strong> increase in goodwill value is not prejudicial <strong>to</strong> its recovery through future cash-fl ows.<br />

The variation noted in <strong>Efacec</strong> Energy Service, Ltda. results from <strong>the</strong> interest rate update of <strong>the</strong> Brazilian Real, <strong>the</strong> currency in which<br />

goodwill was recognised.<br />

The o<strong>the</strong>r variations pertain <strong>to</strong> <strong>the</strong> acquisitions in 2008 of <strong>the</strong> <strong>to</strong>tal share capital of <strong>the</strong> Aura de Agudo, SL and Aura de Guijo de<br />

Coria, SL, both with headquarters in Spain. In each case, <strong>the</strong> values booked are equal <strong>to</strong> <strong>the</strong> difference between <strong>the</strong> cost of acquisition,<br />

already paid or payment <strong>to</strong> be expected in a short-term, compared <strong>to</strong> <strong>the</strong> accounting value of assets and liabilities. In <strong>the</strong><br />

above cases, <strong>the</strong>re were no corrections <strong>to</strong> <strong>the</strong> related accounting values. <strong>Efacec</strong> Power Transformers, Inc. is a new company in <strong>the</strong><br />

United States where costs with <strong>the</strong> creation of <strong>the</strong> company were booked as consolidation difference.<br />

Impairment tests were carried out <strong>to</strong> most companies justifying <strong>the</strong> goodwill value, based on <strong>the</strong> projections of <strong>the</strong> discounted<br />

future cash-fl ows having occurred no sort of value loss. In said tests <strong>the</strong> following assumptions were taken in<strong>to</strong> account<br />

Indica<strong>to</strong>rs<br />

WACC 9.30%<br />

OT 5 years 3.53%<br />

Spreads 2.43%<br />

OT 10 years 4.39%<br />

risk premium 5.00%<br />

In tests carried out <strong>to</strong> companies located in countries considered of risk, <strong>the</strong> risk premium registered an average of 3%-increase.<br />

5.3 Corporate concentrations<br />

Aura de Agudo, SL and Aura de Guijo de Coria, SL<br />

Acquisition<br />

In July 2008, <strong>the</strong> Group acquired from private partners 2 companies with headquarters in Toledo, Spain, designated Aura de<br />

Agudo, SL and Aura de Guijo de Coria, SL.<br />

The acquired net assets and goodwill were as follows: