Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

Notes to the consolidated financial statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

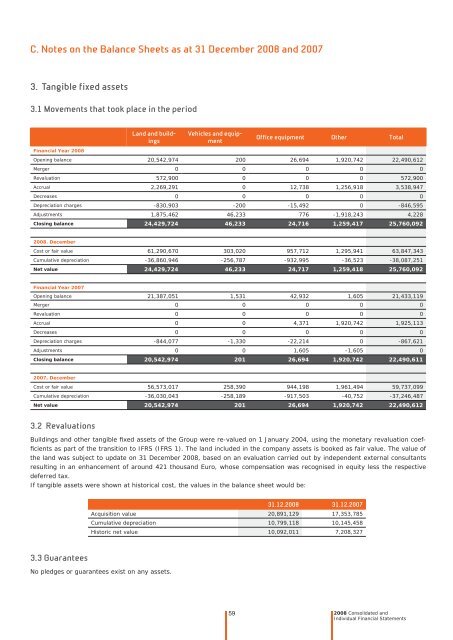

C. <strong>Notes</strong> on <strong>the</strong> Balance Sheets as at 31 December 2008 and 2007<br />

3. Tangible fixed assets<br />

3.1 Movements that <strong>to</strong>ok place in <strong>the</strong> period<br />

Financial Year 2008<br />

Land and buildings<br />

Vehicles and equipment<br />

59<br />

Office equipment O<strong>the</strong>r Total<br />

Opening balance 20,542,974 200 26,694 1,920,742 22,490,612<br />

Merger 0 0 0 0 0<br />

Revaluation 572,900 0 0 0 572,900<br />

Accrual 2,269,291 0 12,738 1,256,918 3,538,947<br />

Decreases 0 0 0 0 0<br />

Depreciation charges -830,903 -200 -15,492 0 -846,595<br />

Adjustments 1,875,462 46,233 776 -1,918,243 4,228<br />

Closing balance 24,429,724 46,233 24,716 1,259,417 25,760,092<br />

2008. December<br />

Cost or fair value 61,290,670 303,020 957,712 1,295,941 63,847,343<br />

Cumulative depreciation -36,860,946 -256,787 -932,995 -36,523 -38,087,251<br />

Net value 24,429,724 46,233 24,717 1,259,418 25,760,092<br />

Financial Year 2007<br />

Opening balance 21,387,051 1,531 42,932 1,605 21,433,119<br />

Merger 0 0 0 0 0<br />

Revaluation 0 0 0 0 0<br />

Accrual 0 0 4,371 1,920,742 1,925,113<br />

Decreases 0 0 0 0 0<br />

Depreciation charges -844,077 -1,330 -22,214 0 -867,621<br />

Adjustments 0 0 1,605 -1,605 0<br />

Closing balance 20,542,974 201 26,694 1,920,742 22,490,611<br />

2007, December<br />

Cost or fair value 56,573,017 258,390 944,198 1,961,494 59,737,099<br />

Cumulative depreciation -36,030,043 -258,189 -917,503 -40,752 -37,246,487<br />

Net value 20,542,974 201 26,694 1,920,742 22,490,612<br />

3.2 Revaluations<br />

Buildings and o<strong>the</strong>r tangible fi xed assets of <strong>the</strong> Group were re-valued on 1 January 2004, using <strong>the</strong> monetary revaluation coeffi<br />

cients as part of <strong>the</strong> transition <strong>to</strong> IFRS (IFRS 1). The land included in <strong>the</strong> company assets is booked as fair value. The value of<br />

<strong>the</strong> land was subject <strong>to</strong> update on 31 December 2008, based on an evaluation carried out by independent external consultants<br />

resulting in an enhancement of around 421 thousand Euro, whose compensation was recognised in equity less <strong>the</strong> respective<br />

deferred tax.<br />

If tangible assets were shown at his<strong>to</strong>rical cost, <strong>the</strong> values in <strong>the</strong> balance sheet would be:<br />

3.3 Guarantees<br />

31.12.2008 31.12.2007<br />

Acquisition value 20,891,129 17,353,785<br />

Cumulative depreciation 10,799,118 10,145,458<br />

His<strong>to</strong>ric net value 10,092,011 7,208,327<br />

No pledges or guarantees exist on any assets.<br />

2008 Consolidated and<br />

Individual Financial Statements