PEAK OIL

PEAK OIL

PEAK OIL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

#7 What Is the Significance of EROI for the Price of Oil?216<br />

To generate energy, energy is needed. EROI – Energy Return on Investment – specifies<br />

the relation between the energy generated and the energy that is used directly and<br />

indirectly for energy production. Net energy is the energy that remains after the energy<br />

production costs have been deducted. Energy production costs not only include the energy<br />

input necessary for recovering oil (direct) but also the input needed to find new sources or<br />

for the transport of energy (indirect).<br />

The EROI is decreasing, because oil is increasingly found in reservoirs that are difficult to<br />

access, coal with lower energy content is used, and longer oil pipelines have to be built<br />

through difficult terrain. It is difficult to accurately calculate the EROI, but there are<br />

estimates that the EROI of American oil fell from 100:1 in the 1930s to 30:1 in the 1970s<br />

and eventually to between 11:1 and 18:1 today, and that the EROI of global oil and natural<br />

gas production lies at 18:1. These are average values. The value of new production<br />

facilities, however, is even lower. Oil shale, for example, has an EROI of 1.5:1 to 4:1.<br />

With conventional oil decreasing in quantity, unconventional oils from biofuels, tar sands,<br />

etc. are used (no mutual dependences assumed). 100 joules of conventional oil with an<br />

EROI of 11:1 cost 9 joules to manufacture and provide 91 joules of usable energy. If this oil<br />

were replaced with bioethanol, 25 joules would be needed for production with an EROI of<br />

4:1, which only yields 75 joules. The result is an even more rapid decrease in usable energy<br />

and, thus, an increase in energy costs.<br />

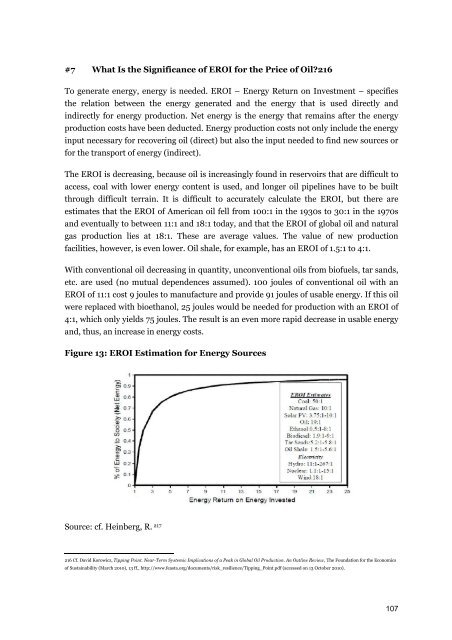

Figure 13: EROI Estimation for Energy Sources<br />

Source: cf. Heinberg, R. 217<br />

216 Cf. David Korowicz, Tipping Point. Near-Term Systemic Implications of a Peak in Global Oil Production. An Outline Review, The Foundation for the Economics<br />

of Sustainability (March 2010), 13 ff., http://www.feasta.org/documents/risk_resilience/Tipping_Point.pdf (accessed on 13 October 2010).<br />

107