The North Seas Countries' Offshore Grid Initiative - Initial ... - Benelux

The North Seas Countries' Offshore Grid Initiative - Initial ... - Benelux

The North Seas Countries' Offshore Grid Initiative - Initial ... - Benelux

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4 Market Based Potential for Further Interconnection<br />

4.1 System Evolution between 2020 and 2030<br />

As part of the process described in Chapters 2and 3, an assessment was made of the<br />

potential for further interconnection capacities between the 10 countries of NSCOGI over<br />

and above the planned links in the TYNDP. <strong>The</strong> assessment uses market modelling tools<br />

to evaluate the changes up to 2030 in the fuel mix of energy production, import and<br />

export positions, CO emissions and production costs. <strong>The</strong> market models calculate the<br />

2<br />

energy produced by every generator during the study year. By amalgamating the<br />

generation output by fuel-type, a view of the total amount of generation produced by each<br />

fuel can be obtained for each market node and for the NSCOGI region as a whole.<br />

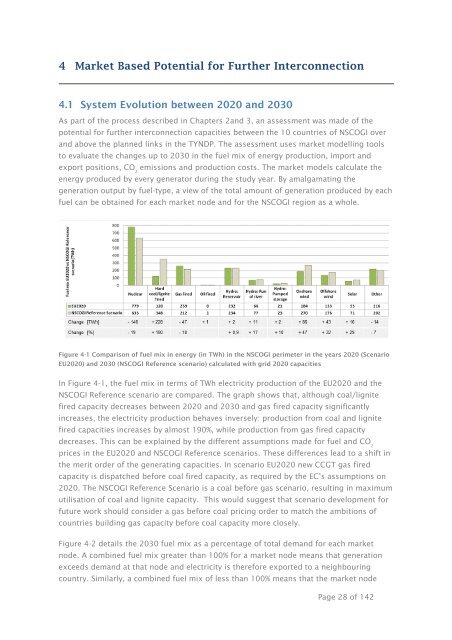

Figure 4-1 Comparison of fuel mix in energy (in TWh) in the NSCOGI perimeter in the years 2020 (Scenario<br />

EU2020) and 2030 (NSCOGI Reference scenario) calculated with grid 2020 capacities<br />

In Figure 4-1, the fuel mix in terms of TWh electricity production of the EU2020 and the<br />

NSCOGI Reference scenario are compared. <strong>The</strong> graph shows that, although coal/lignite<br />

fired capacity decreases between 2020 and 2030 and gas fired capacity significantly<br />

increases, the electricity production behaves inversely: production from coal and lignite<br />

fired capacities increases by almost 190%, while production from gas fired capacity<br />

decreases. This can be explained by the different assumptions made for fuel and CO<br />

2<br />

prices in the EU2020 and NSCOGI Reference scenarios. <strong>The</strong>se differences lead to a shift in<br />

the merit order of the generating capacities. In scenario EU2020 new CCGT gas fired<br />

capacity is dispatched before coal fired capacity, as required by the EC’s assumptions on<br />

2020. <strong>The</strong> NSCOGI Reference Scenario is a coal before gas scenario, resulting in maximum<br />

utilisation of coal and lignite capacity. This would suggest that scenario development for<br />

future work should consider a gas before coal pricing order to match the ambitions of<br />

countries building gas capacity before coal capacity more closely.<br />

Figure 4-2 details the 2030 fuel mix as a percentage of total demand for each market<br />

node. A combined fuel mix greater than 100% for a market node means that generation<br />

exceeds demand at that node and electricity is therefore exported to a neighbouring<br />

country. Similarly, a combined fuel mix of less than 100% means that the market node<br />

Page 28 of 142