Conference Sessions - Jesse H. Jones Graduate School of ...

Conference Sessions - Jesse H. Jones Graduate School of ...

Conference Sessions - Jesse H. Jones Graduate School of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

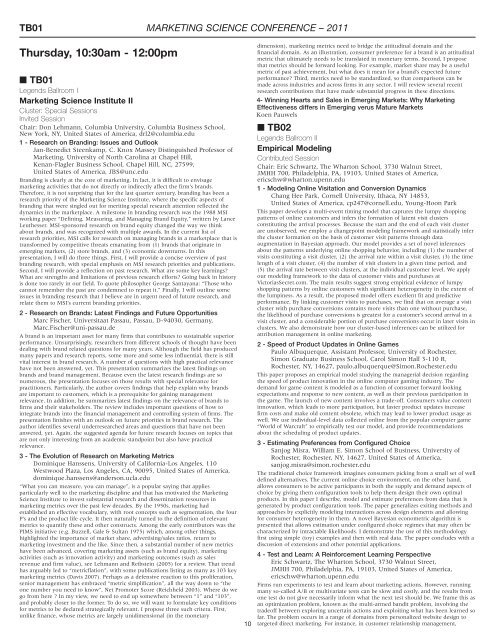

TB01 MARKETING SCIENCE CONFERENCE – 2011<br />

Thursday, 10:30am - 12:00pm<br />

■ TB01<br />

Legends Ballroom I<br />

Marketing Science Institute II<br />

Cluster: Special <strong>Sessions</strong><br />

Invited Session<br />

Chair: Don Lehmann, Columbia University, Columbia Business <strong>School</strong>,<br />

New York, NY, United States <strong>of</strong> America, drl2@columbia.edu<br />

1 - Research on Branding: Issues and Outlook<br />

Jan-Benedict Steenkamp, C. Knox Massey Distinguished Pr<strong>of</strong>essor <strong>of</strong><br />

Marketing, University <strong>of</strong> North Carolina at Chapel Hill,<br />

Kenan-Flagler Business <strong>School</strong>, Chapel Hill, NC, 27599,<br />

United States <strong>of</strong> America, JBS@unc.edu<br />

Branding is clearly at the core <strong>of</strong> marketing. In fact, it is difficult to envisage<br />

marketing activities that do not directly or indirectly affect the firm’s brands.<br />

Therefore, it is not surprising that for the last quarter century, branding has been a<br />

research priority <strong>of</strong> the Marketing Science Institute, where the specific aspects <strong>of</strong><br />

branding that were singled out for meriting special research attention reflected the<br />

dynamics in the marketplace. A milestone in branding research was the 1988 MSI<br />

working paper “Defining, Measuring, and Managing Brand Equity,” written by Lance<br />

Leuthesser. MSI-sponsored research on brand equity changed the way we think<br />

about brands, and was recognized with multiple awards. In the current list <strong>of</strong><br />

research priorities, MSI calls for research on managing brands in a marketplace that is<br />

transformed by competitive threats emanating from (1) brands that originate in<br />

emerging markets, (2) store brands, and (3) economic downturns. In this<br />

presentation, I will do three things. First, I will provide a concise overview <strong>of</strong> past<br />

branding research, with special emphasis on MSI research priorities and publications.<br />

Second, I will provide a reflection on past research. What are some key learnings?<br />

What are strengths and limitations <strong>of</strong> previous research efforts? Going back in history<br />

is done too rarely in our field. To quote philosopher George Santayana: “Those who<br />

cannot remember the past are condemned to repeat it.” Finally, I will outline some<br />

issues in branding research that I believe are in urgent need <strong>of</strong> future research, and<br />

relate them to MSI’s current branding priorities.<br />

2 - Research on Brands: Latest Findings and Future Opportunities<br />

Marc Fischer, Universitaat Passau, Passau, D-94030, Germany,<br />

Marc.Fischer@uni-passau.de<br />

A brand is an important asset for many firms that contributes to sustainable superior<br />

performance. Unsurprisingly, researchers from different schools <strong>of</strong> thought have been<br />

dealing with brand related questions for many years. Although the field has produced<br />

many papers and research reports, some more and some less influential, there is still<br />

vital interest in brand research. A number <strong>of</strong> questions with high practical relevance<br />

have not been answered, yet. This presentation summarizes the latest findings on<br />

brands and brand management. Because even the latest research findings are so<br />

numerous, the presentation focuses on those results with special relevance for<br />

practitioners. Particularly, the author covers findings that help explain why brands<br />

are important to customers, which is a prerequisite for gaining management<br />

relevance. In addition, he summarizes latest findings on the relevance <strong>of</strong> brands to<br />

firms and their stakeholders. The review includes important questions <strong>of</strong> how to<br />

integrate brands into the financial management and controlling system <strong>of</strong> firms. The<br />

presentation finishes with an outlook on future priorities in brand research. The<br />

author identifies several underresearched areas and questions that have not been<br />

anwered, yet. Again, the suggested agenda for future research focuses on topics that<br />

are not only interesting from an academic standpoint but also have practical<br />

relevance.<br />

3 - The Evolution <strong>of</strong> Research on Marketing Metrics<br />

Dominique Hanssens, University <strong>of</strong> California-Los Angeles, 110<br />

Westwood Plaza, Los Angeles, CA, 90095, United States <strong>of</strong> America,<br />

dominique.hanssens@anderson.ucla.edu<br />

“What you can measure, you can manage”, is a popular saying that applies<br />

particularly well to the marketing discipline and that has motivated the Marketing<br />

Science Institute to invest substantial research and dissemination resources in<br />

marketing metrics over the past few decades. By the 1950s, marketing had<br />

established an effective vocabulary, with root concepts such as segmentation, the four<br />

P’s and the product life cycle. It then naturally turned to the definition <strong>of</strong> relevant<br />

metrics to quantify these and other constructs. Among the early contributors was the<br />

PIMS initiative (e.g. Buzzell, Gale & Sultan 1975) which, among other things,<br />

highlighted the importance <strong>of</strong> market share, advertising/sales ratios, return to<br />

marketing investment and the like. Since then, a substantial number <strong>of</strong> new metrics<br />

have been advanced, covering marketing assets (such as brand equity), marketing<br />

activities (such as innovation activity) and marketing outcomes (such as sales<br />

revenue and firm value), see Lehmann and Reibstein (2005) for a review. That trend<br />

has arguably led to “metricflation”, with some publications listing as many as 103 key<br />

marketing metrics (Davis 2007). Perhaps as a defensive reaction to this proliferation,<br />

senior management has embraced “metric simplification”, all the way down to “the<br />

one number you need to know”, Net Promoter Score (Reichheld 2003). Where do we<br />

go from here ? In my view, we need to end up somewhere between “1” and “103”,<br />

and probably closer to the former. To do so, we will want to formulate key conditions<br />

for metrics to be declared strategically relevant. I propose three such critera. First,<br />

unlike finance, whose metrics are largely unidimensional (in the monetary<br />

10<br />

dimension), marketing metrics need to bridge the attitudinal domain and the<br />

financial domain. As an illustration, consumer preference for a brand is an attitudinal<br />

metric that ultimately needs to be translated in monetary terms. Second, I propose<br />

that metrics should be forward looking. For example, market share may be a useful<br />

metric <strong>of</strong> past achievement, but what does it mean for a brand’s expected future<br />

performance? Third, metrics need to be standardized, so that comparisons can be<br />

made across industries and across firms in any sector. I will review several recent<br />

research contributions that have made substantial progress in these directions.<br />

4- Winning Hearts and Sales in Emerging Markets: Why Marketing<br />

Effectiveness differs in Emerging verus Mature Markets<br />

Koen Pauwels<br />

■ TB02<br />

Legends Ballroom II<br />

Empirical Modeling<br />

Contributed Session<br />

Chair: Eric Schwartz, The Wharton <strong>School</strong>, 3730 Walnut Street,<br />

JMHH 700, Philadelphia, PA, 19103, United States <strong>of</strong> America,<br />

ericschw@wharton.upenn.edu<br />

1 - Modeling Online Visitation and Conversion Dynamics<br />

Chang Hee Park, Cornell University, Ithaca, NY 14853,<br />

United States <strong>of</strong> America, cp247@cornell.edu, Young-Hoon Park<br />

This paper develops a multi-event timing model that captures the lumpy shopping<br />

patterns <strong>of</strong> online customers and infers the formation <strong>of</strong> latent visit clusters<br />

constituting the arrival processes. Because the start and the end <strong>of</strong> each visit cluster<br />

are unobserved, we employ a changepoint modeling framework and statistically infer<br />

the cluster formation on the basis <strong>of</strong> customer visit patterns through data<br />

augmentation in Bayesian approach. Our model provides a set <strong>of</strong> novel inferences<br />

about the patterns underlying online shopping behavior, including (1) the number <strong>of</strong><br />

visits constituting a visit cluster, (2) the arrival rate within a visit cluster, (3) the time<br />

length <strong>of</strong> a visit cluster, (4) the number <strong>of</strong> visit clusters in a given time period, and<br />

(5) the arrival rate between visit clusters, at the individual customer level. We apply<br />

our modeling framework to the data <strong>of</strong> customer visits and purchases at<br />

VictoriasSecret.com. The main results suggest strong empirical evidence <strong>of</strong> lumpy<br />

shopping patterns by online customers with significant heterogeneity in the extent <strong>of</strong><br />

the lumpiness. As a result, the proposed model <strong>of</strong>fers excellent fit and predictive<br />

performance. By linking customer visits to purchases, we find that on average a visit<br />

cluster with purchase conversions contains more visits than one without purchase,<br />

the likelihood <strong>of</strong> purchase conversions is greatest for a customer’s second arrival in a<br />

visit cluster, and a considerable portion <strong>of</strong> purchase conversions occur in later visits in<br />

clusters. We also demonstrate how our cluster-based inferences can be utilized for<br />

attribution management in online marketing.<br />

2 - Speed <strong>of</strong> Product Updates in Online Games<br />

Paulo Albuquerque, Assistant Pr<strong>of</strong>essor, University <strong>of</strong> Rochester,<br />

Simon <strong>Graduate</strong> Business <strong>School</strong>, Carol Simon Hall 3-110 R,<br />

Rochester, NY, 14627, paulo.albuquerque@Simon.Rochester.edu<br />

This paper proposes an empirical model studying the managerial decision regarding<br />

the speed <strong>of</strong> product innovation in the online computer gaming industry. The<br />

demand for game content is modeled as a function <strong>of</strong> consumer forward looking<br />

expectations and response to new content, as well as their previous participation in<br />

the game. The launch <strong>of</strong> new content involves a trade-<strong>of</strong>f. Consumers value content<br />

innovation, which leads to more participation, but faster product updates increase<br />

firm costs and make old content obsolete, which may lead to lower product usage as<br />

well. We use individual-level data collected online from the popular computer game<br />

“World <strong>of</strong> Warcraft” to empirically test our model, and provide recommendations<br />

about the scheduling <strong>of</strong> product updates.<br />

3 - Estimating Preferences from Configured Choice<br />

Sanjog Misra, William E. Simon <strong>School</strong> <strong>of</strong> Business, University <strong>of</strong><br />

Rochester, Rochester, NY, 14627, United States <strong>of</strong> America,<br />

sanjog.misra@simon.rochester.edu<br />

The traditional choice framework imagines consumers picking from a small set <strong>of</strong> well<br />

defined alternatives. The current online choice environment, on the other hand,<br />

allows consumers to be active participants in both the supply and demand aspects <strong>of</strong><br />

choice by giving them configuration tools to help them design their own optimal<br />

products. In this paper I describe, model and estimate preferences from data that is<br />

generated by product configuration tools. The paper generalizes exiting methods and<br />

approaches by explicitly modeling interactions across design elements and allowing<br />

for consumer heterogeneity in them. A novel Bayesian econometric algorithm is<br />

presented that allows estimation under configured choice regimes that may <strong>of</strong>ten be<br />

characterized by intractable likelihoods. I demonstrate the use <strong>of</strong> this methodology<br />

first using simple (toy) examples and then with real data. The paper concludes with a<br />

discussion <strong>of</strong> extensions and other potential applications.<br />

4 - Test and Learn: A Reinforcement Learning Perspective<br />

Eric Schwartz, The Wharton <strong>School</strong>, 3730 Walnut Street,<br />

JMHH 700, Philadelphia, PA, 19103, United States <strong>of</strong> America,<br />

ericschw@wharton.upenn.edu<br />

Firms run experiments to test and learn about marketing actions. However, running<br />

many so-called A/B or multivariate tests can be slow and costly, and the results from<br />

one test do not give necessarily inform what the next test should be. We frame this as<br />

an optimization problem, known as the multi-armed bandit problem, involving the<br />

trade<strong>of</strong>f between exploring uncertain actions and exploiting what has been learned so<br />

far. The problem occurs in a range <strong>of</strong> domains from personalized website design to<br />

targeted direct marketing. For instance, in customer relationship management,