Gasoline Price Changes - Federal Trade Commission

Gasoline Price Changes - Federal Trade Commission

Gasoline Price Changes - Federal Trade Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Million Barrels per Day<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0.0<br />

-0.1<br />

Source: IEA<br />

THE DYNAMIC OF SUPPLY, DEMAND, AND COMPETITION<br />

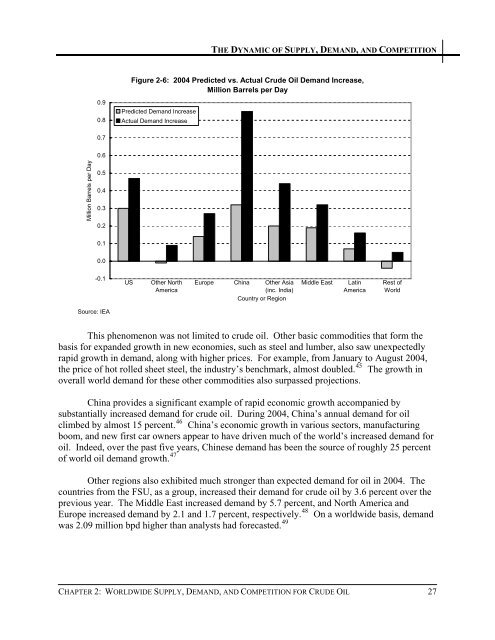

Figure 2-6: 2004 Predicted vs. Actual Crude Oil Demand Increase,<br />

Million Barrels per Day<br />

Predicted Demand Increase<br />

Actual Demand Increase<br />

US Other North<br />

America<br />

Europe China Other Asia<br />

(inc. India)<br />

Country or Region<br />

Middle East Latin<br />

America<br />

Rest of<br />

World<br />

This phenomenon was not limited to crude oil. Other basic commodities that form the<br />

basis for expanded growth in new economies, such as steel and lumber, also saw unexpectedly<br />

rapid growth in demand, along with higher prices. For example, from January to August 2004,<br />

the price of hot rolled sheet steel, the industry’s benchmark, almost doubled. 45 The growth in<br />

overall world demand for these other commodities also surpassed projections.<br />

China provides a significant example of rapid economic growth accompanied by<br />

substantially increased demand for crude oil. During 2004, China’s annual demand for oil<br />

climbed by almost 15 percent. 46 China’s economic growth in various sectors, manufacturing<br />

boom, and new first car owners appear to have driven much of the world’s increased demand for<br />

oil. Indeed, over the past five years, Chinese demand has been the source of roughly 25 percent<br />

of world oil demand growth. 47<br />

Other regions also exhibited much stronger than expected demand for oil in 2004. The<br />

countries from the FSU, as a group, increased their demand for crude oil by 3.6 percent over the<br />

previous year. The Middle East increased demand by 5.7 percent, and North America and<br />

Europe increased demand by 2.1 and 1.7 percent, respectively. 48 On a worldwide basis, demand<br />

was 2.09 million bpd higher than analysts had forecasted. 49<br />

CHAPTER 2: WORLDWIDE SUPPLY, DEMAND, AND COMPETITION FOR CRUDE OIL 27