LDK Solar Co., Ltd. - Asia Europe Clean Energy (Solar) Advisory Co ...

LDK Solar Co., Ltd. - Asia Europe Clean Energy (Solar) Advisory Co ...

LDK Solar Co., Ltd. - Asia Europe Clean Energy (Solar) Advisory Co ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

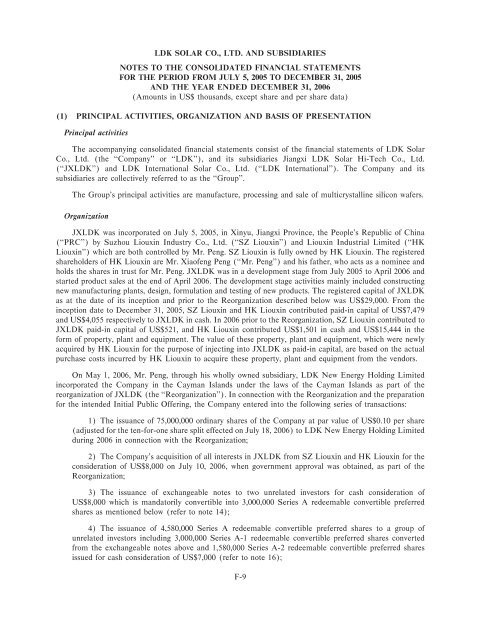

<strong>LDK</strong> SOLAR CO., LTD. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE PERIOD FROM JULY 5, 2005 TO DECEMBER 31, 2005<br />

AND THE YEAR ENDED DECEMBER 31, 2006<br />

(Amounts in US$ thousands, except share and per share data)<br />

(1) PRINCIPAL ACTIVITIES, ORGANIZATION AND BASIS OF PRESENTATION<br />

Principal activities<br />

The accompanying consolidated financial statements consist of the financial statements of <strong>LDK</strong> <strong>Solar</strong><br />

<strong>Co</strong>., <strong>Ltd</strong>. (the ""<strong>Co</strong>mpany'' or ""<strong>LDK</strong>''), and its subsidiaries Jiangxi <strong>LDK</strong> <strong>Solar</strong> Hi-Tech <strong>Co</strong>., <strong>Ltd</strong>.<br />

(""JX<strong>LDK</strong>'') and <strong>LDK</strong> International <strong>Solar</strong> <strong>Co</strong>., <strong>Ltd</strong>. (""<strong>LDK</strong> International''). The <strong>Co</strong>mpany and its<br />

subsidiaries are collectively referred to as the ""Group''.<br />

The Group's principal activities are manufacture, processing and sale of multicrystalline silicon wafers.<br />

Organization<br />

JX<strong>LDK</strong> was incorporated on July 5, 2005, in Xinyu, Jiangxi Province, the People's Republic of China<br />

(""PRC'') by Suzhou Liouxin Industry <strong>Co</strong>., <strong>Ltd</strong>. (""SZ Liouxin'') and Liouxin Industrial Limited (""HK<br />

Liouxin'') which are both controlled by Mr. Peng. SZ Liouxin is fully owned by HK Liouxin. The registered<br />

shareholders of HK Liouxin are Mr. Xiaofeng Peng (""Mr. Peng'') and his father, who acts as a nominee and<br />

holds the shares in trust for Mr. Peng. JX<strong>LDK</strong> was in a development stage from July 2005 to April 2006 and<br />

started product sales at the end of April 2006. The development stage activities mainly included constructing<br />

new manufacturing plants, design, formulation and testing of new products. The registered capital of JX<strong>LDK</strong><br />

as at the date of its inception and prior to the Reorganization described below was US$29,000. From the<br />

inception date to December 31, 2005, SZ Liouxin and HK Liouxin contributed paid-in capital of US$7,479<br />

and US$4,055 respectively to JX<strong>LDK</strong> in cash. In 2006 prior to the Reorganization, SZ Liouxin contributed to<br />

JX<strong>LDK</strong> paid-in capital of US$521, and HK Liouxin contributed US$1,501 in cash and US$15,444 in the<br />

form of property, plant and equipment. The value of these property, plant and equipment, which were newly<br />

acquired by HK Liouxin for the purpose of injecting into JX<strong>LDK</strong> as paid-in capital, are based on the actual<br />

purchase costs incurred by HK Liouxin to acquire these property, plant and equipment from the vendors.<br />

On May 1, 2006, Mr. Peng, through his wholly owned subsidiary, <strong>LDK</strong> New <strong>Energy</strong> Holding Limited<br />

incorporated the <strong>Co</strong>mpany in the Cayman Islands under the laws of the Cayman Islands as part of the<br />

reorganization of JX<strong>LDK</strong> (the ""Reorganization''). In connection with the Reorganization and the preparation<br />

for the intended Initial Public Offering, the <strong>Co</strong>mpany entered into the following series of transactions:<br />

1) The issuance of 75,000,000 ordinary shares of the <strong>Co</strong>mpany at par value of US$0.10 per share<br />

(adjusted for the ten-for-one share split effected on July 18, 2006) to <strong>LDK</strong> New <strong>Energy</strong> Holding Limited<br />

during 2006 in connection with the Reorganization;<br />

2) The <strong>Co</strong>mpany's acquisition of all interests in JX<strong>LDK</strong> from SZ Liouxin and HK Liouxin for the<br />

consideration of US$8,000 on July 10, 2006, when government approval was obtained, as part of the<br />

Reorganization;<br />

3) The issuance of exchangeable notes to two unrelated investors for cash consideration of<br />

US$8,000 which is mandatorily convertible into 3,000,000 Series A redeemable convertible preferred<br />

shares as mentioned below (refer to note 14);<br />

4) The issuance of 4,580,000 Series A redeemable convertible preferred shares to a group of<br />

unrelated investors including 3,000,000 Series A-1 redeemable convertible preferred shares converted<br />

from the exchangeable notes above and 1,580,000 Series A-2 redeemable convertible preferred shares<br />

issued for cash consideration of US$7,000 (refer to note 16);<br />

F-9