2001-2003 Catalog - University of Arkansas at Monticello

2001-2003 Catalog - University of Arkansas at Monticello

2001-2003 Catalog - University of Arkansas at Monticello

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Arkansas</strong>-<strong>Monticello</strong><br />

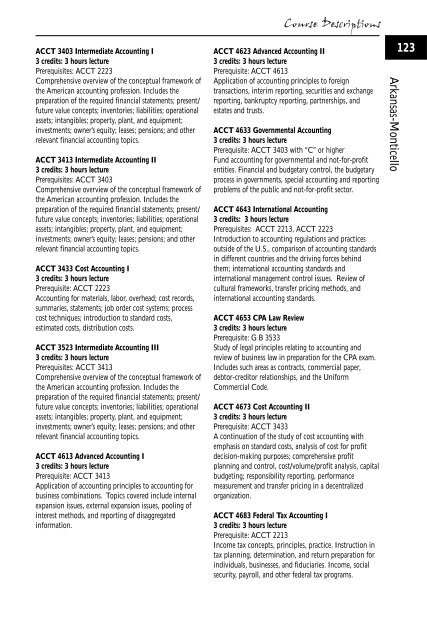

ACCT 3403 Intermedi<strong>at</strong>e Accounting I<br />

3 credits: 3 hours lecture<br />

Prerequisites: ACCT 2223<br />

Comprehensive overview <strong>of</strong> the conceptual framework <strong>of</strong><br />

the American accounting pr<strong>of</strong>ession. Includes the<br />

prepar<strong>at</strong>ion <strong>of</strong> the required financial st<strong>at</strong>ements; present/<br />

future value concepts; inventories; liabilities; oper<strong>at</strong>ional<br />

assets; intangibles; property, plant, and equipment;<br />

investments; owner’s equity; leases; pensions; and other<br />

relevant financial accounting topics.<br />

ACCT 3413 Intermedi<strong>at</strong>e Accounting II<br />

3 credits: 3 hours lecture<br />

Prerequisites: ACCT 3403<br />

Comprehensive overview <strong>of</strong> the conceptual framework <strong>of</strong><br />

the American accounting pr<strong>of</strong>ession. Includes the<br />

prepar<strong>at</strong>ion <strong>of</strong> the required financial st<strong>at</strong>ements; present/<br />

future value concepts; inventories; liabilities; oper<strong>at</strong>ional<br />

assets; intangibles; property, plant, and equipment;<br />

investments; owner’s equity; leases; pensions; and other<br />

relevant financial accounting topics.<br />

ACCT 3433 Cost Accounting I<br />

3 credits: 3 hours lecture<br />

Prerequisite: ACCT 2223<br />

Accounting for m<strong>at</strong>erials, labor, overhead; cost records,<br />

summaries, st<strong>at</strong>ements; job order cost systems; process<br />

cost techniques; introduction to standard costs,<br />

estim<strong>at</strong>ed costs, distribution costs.<br />

ACCT 3523 Intermedi<strong>at</strong>e Accounting III<br />

3 credits: 3 hours lecture<br />

Prerequisites: ACCT 3413<br />

Comprehensive overview <strong>of</strong> the conceptual framework <strong>of</strong><br />

the American accounting pr<strong>of</strong>ession. Includes the<br />

prepar<strong>at</strong>ion <strong>of</strong> the required financial st<strong>at</strong>ements; present/<br />

future value concepts; inventories; liabilities; oper<strong>at</strong>ional<br />

assets; intangibles; property, plant, and equipment;<br />

investments; owner’s equity; leases; pensions; and other<br />

relevant financial accounting topics.<br />

ACCT 4613 Advanced Accounting I<br />

3 credits: 3 hours lecture<br />

Prerequisite: ACCT 3413<br />

Applic<strong>at</strong>ion <strong>of</strong> accounting principles to accounting for<br />

business combin<strong>at</strong>ions. Topics covered include internal<br />

expansion issues, external expansion issues, pooling <strong>of</strong><br />

interest methods, and reporting <strong>of</strong> disaggreg<strong>at</strong>ed<br />

inform<strong>at</strong>ion.<br />

Course Descriptions<br />

ACCT 4623 Advanced Accounting II<br />

3 credits: 3 hours lecture<br />

Prerequisite: ACCT 4613<br />

Applic<strong>at</strong>ion <strong>of</strong> accounting principles to foreign<br />

transactions, interim reporting, securities and exchange<br />

reporting, bankruptcy reporting, partnerships, and<br />

est<strong>at</strong>es and trusts.<br />

ACCT 4633 Governmental Accounting<br />

3 credits: 3 hours lecture<br />

Prerequisite: ACCT 3403 with “C” or higher<br />

Fund accounting for governmental and not-for-pr<strong>of</strong>it<br />

entities. Financial and budgetary control, the budgetary<br />

process in governments, special accounting and reporting<br />

problems <strong>of</strong> the public and not-for-pr<strong>of</strong>it sector.<br />

ACCT 4643 Intern<strong>at</strong>ional Accounting<br />

3 credits: 3 hours lecture<br />

Prerequisites: ACCT 2213, ACCT 2223<br />

Introduction to accounting regul<strong>at</strong>ions and practices<br />

outside <strong>of</strong> the U.S., comparison <strong>of</strong> accounting standards<br />

in different countries and the driving forces behind<br />

them; intern<strong>at</strong>ional accounting standards and<br />

intern<strong>at</strong>ional management control issues. Review <strong>of</strong><br />

cultural frameworks, transfer pricing methods, and<br />

intern<strong>at</strong>ional accounting standards.<br />

ACCT 4653 CPA Law Review<br />

3 credits: 3 hours lecture<br />

Prerequisite: G B 3533<br />

Study <strong>of</strong> legal principles rel<strong>at</strong>ing to accounting and<br />

review <strong>of</strong> business law in prepar<strong>at</strong>ion for the CPA exam.<br />

Includes such areas as contracts, commercial paper,<br />

debtor-creditor rel<strong>at</strong>ionships, and the Uniform<br />

Commercial Code.<br />

ACCT 4673 Cost Accounting II<br />

3 credits: 3 hours lecture<br />

Prerequisite: ACCT 3433<br />

A continu<strong>at</strong>ion <strong>of</strong> the study <strong>of</strong> cost accounting with<br />

emphasis on standard costs, analysis <strong>of</strong> cost for pr<strong>of</strong>it<br />

decision-making purposes; comprehensive pr<strong>of</strong>it<br />

planning and control, cost/volume/pr<strong>of</strong>it analysis, capital<br />

budgeting; responsibility reporting, performance<br />

measurement and transfer pricing in a decentralized<br />

organiz<strong>at</strong>ion.<br />

ACCT 4683 Federal Tax Accounting I<br />

3 credits: 3 hours lecture<br />

Prerequisite: ACCT 2213<br />

Income tax concepts, principles, practice. Instruction in<br />

tax planning, determin<strong>at</strong>ion, and return prepar<strong>at</strong>ion for<br />

individuals, businesses, and fiduciaries. Income, social<br />

security, payroll, and other federal tax programs.<br />

123