English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

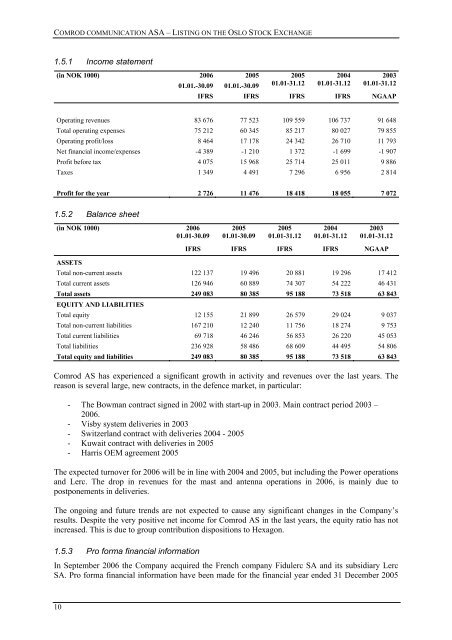

1.5.1 Income statement<br />

(in NOK 1000)<br />

2006 2005 2005 2004 2003<br />

01.01.-30.09 01.01.-30.09 01.01-31.12 01.01-31.12 01.01-31.12<br />

IFRS IFRS IFRS IFRS NGAAP<br />

Operating revenues 83 676 77 523 109 559 106 737 91 648<br />

Total operating expenses 75 212 60 345 85 217 80 027 79 855<br />

Operating profit/loss 8 464 17 178 24 342 26 710 11 793<br />

Net financial income/expenses -4 389 -1 210 1 372 -1 699 -1 907<br />

Profit before tax 4 075 15 968 25 714 25 011 9 886<br />

Taxes 1 349 4 491 7 296 6 956 2 814<br />

Profit for the year 2 726 11 476 18 418 18 055 7 072<br />

1.5.2 Balance sheet<br />

(in NOK 1000) 2006<br />

01.01-30.09<br />

2005<br />

01.01-30.09<br />

2005<br />

01.01-31.12<br />

2004<br />

01.01-31.12<br />

2003<br />

01.01-31.12<br />

IFRS IFRS IFRS IFRS NGAAP<br />

ASSETS<br />

Total non-current assets 122 137 19 496 20 881 19 296 17 412<br />

Total current assets 126 946 60 889 74 307 54 222 46 431<br />

Total assets 249 083 80 385 95 188 73 518 63 843<br />

EQUITY AND LIABILITIES<br />

Total equity 12 155 21 899 26 579 29 024 9 037<br />

Total non-current liabilities 167 210 12 240 11 756 18 274 9 753<br />

Total current liabilities 69 718 46 246 56 853 26 220 45 053<br />

Total liabilities 236 928 58 486 68 609 44 495 54 806<br />

Total equity and liabilities 249 083 80 385 95 188 73 518 63 843<br />

Comrod AS has experienced a significant growth in activity and revenues over the last years. The<br />

reason is several large, new contracts, in the defence market, in particular:<br />

- The Bowman contract signed in 2002 with start-up in 2003. Main contract period 2003 –<br />

2006.<br />

- Visby system deliveries in 2003<br />

- Switzerland contract with deliveries 2004 - 2005<br />

- Kuwait contract with deliveries in 2005<br />

- Harris OEM agreement 2005<br />

The expected turnover for 2006 will be in line with 2004 and 2005, but including the Power operations<br />

and Lerc. The drop in revenues for the mast and antenna operations in 2006, is mainly due to<br />

postponements in deliveries.<br />

The ongoing and future trends are not expected to cause any significant changes in the Company’s<br />

results. Despite the very positive net income for Comrod AS in the last years, the equity ratio has not<br />

increased. This is due to group contribution dispositions to <strong>Hexagon</strong>.<br />

1.5.3 Pro forma financial information<br />

In September 2006 the Company acquired the French company Fidulerc SA and its subsidiary Lerc<br />

SA. Pro forma financial information have been made for the financial year ended 31 December 2005<br />

10