English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

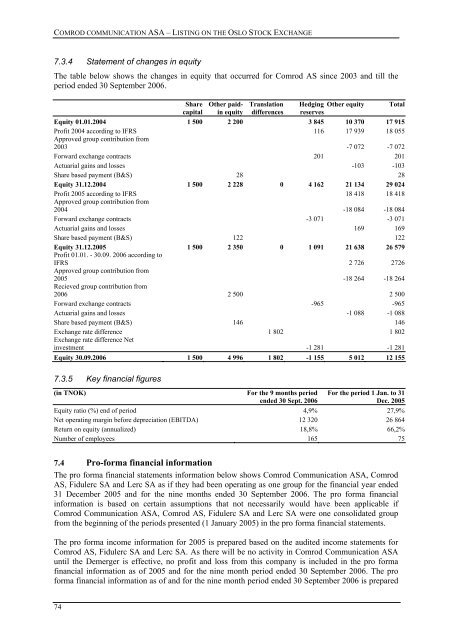

7.3.4 Statement of changes in equity<br />

The table below shows the changes in equity that occurred for Comrod AS since 2003 and till the<br />

period ended 30 September 2006.<br />

Share<br />

capital<br />

Other paidin<br />

equity<br />

Translation<br />

differences<br />

Hedging Other equity<br />

reserves<br />

Equity 01.01.2004 1 500 2 200 3 845 10 370 17 915<br />

Profit 2004 according to IFRS 116 17 939 18 055<br />

Approved group contribution from<br />

2003 -7 072 -7 072<br />

Forward exchange contracts 201 201<br />

Actuarial gains and losses -103 -103<br />

Share based payment (B&S) 28 28<br />

Equity 31.12.2004 1 500 2 228 0 4 162 21 134 29 024<br />

Profit 2005 according to IFRS 18 418 18 418<br />

Approved group contribution from<br />

2004 -18 084 -18 084<br />

Forward exchange contracts -3 071 -3 071<br />

Actuarial gains and losses 169 169<br />

Share based payment (B&S) 122 122<br />

Equity 31.12.2005 1 500 2 350 0 1 091 21 638 26 579<br />

Profit 01.01. - 30.09. 2006 according to<br />

IFRS 2 726 2726<br />

Approved group contribution from<br />

2005 -18 264 -18 264<br />

Recieved group contribution from<br />

2006 2 500 2 500<br />

Forward exchange contracts -965 -965<br />

Actuarial gains and losses -1 088 -1 088<br />

Share based payment (B&S) 146 146<br />

Exchange rate difference 1 802 1 802<br />

Exchange rate difference Net<br />

investment -1 281 -1 281<br />

Equity 30.09.2006 1 500 4 996 1 802 -1 155 5 012 12 155<br />

Total<br />

7.3.5 Key financial figures<br />

(in TNOK)<br />

For the 9 months period<br />

ended 30 Sept. 2006<br />

For the period 1 Jan. to 31<br />

Dec. 2005<br />

Equity ratio (%) end of period 4,9% 27,9%<br />

Net operating margin before depreciation (EBITDA) 12 320 26 864<br />

Return on equity (annualized) 18,8% 66,2%<br />

Number of employees 165 75<br />

7.4 Pro-forma financial information<br />

The pro forma financial statements information below shows Comrod Communication <strong>ASA</strong>, Comrod<br />

AS, Fidulerc SA and Lerc SA as if they had been operating as one group for the financial year ended<br />

31 December 2005 and for the nine months ended 30 September 2006. The pro forma financial<br />

information is based on certain assumptions that not necessarily would have been applicable if<br />

Comrod Communication <strong>ASA</strong>, Comrod AS, Fidulerc SA and Lerc SA were one consolidated group<br />

from the beginning of the periods presented (1 January 2005) in the pro forma financial statements.<br />

The pro forma income information for 2005 is prepared based on the audited income statements for<br />

Comrod AS, Fidulerc SA and Lerc SA. As there will be no activity in Comrod Communication <strong>ASA</strong><br />

until the Demerger is effective, no profit and loss from this company is included in the pro forma<br />

financial information as of 2005 and for the nine month period ended 30 September 2006. The pro<br />

forma financial information as of and for the nine month period ended 30 September 2006 is prepared<br />

74