English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

Comrod AS<br />

Annual Accounts 2005<br />

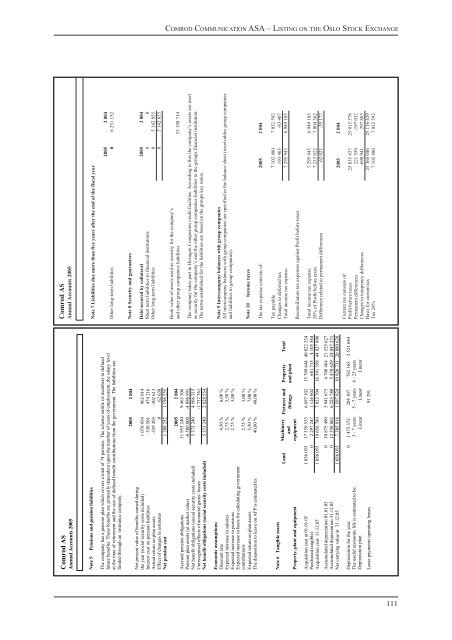

Note 5 Pensions and pension liabilities<br />

The company has a pension plan which covers a total of 74 persons. The scheme entitle its members to defined<br />

future benefits. These benefits are primarily dependent upon the number of years of employment, the salary level<br />

at the time of retirement and the size of defined benefit contributions from the government. The liabilities are<br />

funded through an insurance company.<br />

2005 2 004<br />

Net present value of benefits earned during<br />

the year (social security costs included) 1 078 954 962 014<br />

Interest cost on pension liabilities 530 501 474 216<br />

Actual return on plan assets -329 203 -302 613<br />

Effect of changes in estimates 0 62 638<br />

Net pension cost 1 280 252 1 196 255<br />

2005 2 004<br />

Accrued pension obligations 11 953 240 9 463 306<br />

Pension plan assets (at market value) -6 580 000 -4 896 991<br />

Net benefit obligations (social security costs included) 5 373 240 4 566 315<br />

Unrecognised effects of actuarial gains/ losses -1 737 761<br />

Net benefit obligations (social security costs included) 5 373 240 2 828 554<br />

Economic assumptions:<br />

Discount rate 4,50 % 6,00 %<br />

Expected increase in salaries 2,75 % 3,50 %<br />

Expected increase in pensions 2,75 % 3,00 %<br />

Expected increase in basis for calculating government<br />

contributions 2,75 % 3,00 %<br />

Expected return on plan assets 5,50 % 7,00 %<br />

The disposition to leave on AFP is estimated to: 40,00 % 40,00 %<br />

Note 6 Tangible assets<br />

Property, plant and equipment<br />

Land Machinery<br />

and<br />

equipment<br />

Fixtures and<br />

fittings<br />

Property<br />

and plant<br />

Total<br />

Acquisition cost at 01.01.05 1 056 055 17 359 533 6 697 102 15 709 644 40 822 334<br />

Purchased tangibles 0 2 297 247 1 126 602 681 715 4 105 564<br />

Acquisition cost 31.12.05 1 056 055 19 656 780 7 823 704 16 391 359 44 927 898<br />

Accumulated depreciation 01.01.05 0 10 875 490 5 941 673 4 708 464 21 525 627<br />

Accumulated depreciation 31.12.05 0 12 350 862 6 225 780 5 470 629 24 047 271<br />

Net carrying value at 31.12.05 1 056 055 7 305 918 1 597 924 10 920 731 20 880 628<br />

Depreciation for the year 0 1 475 372 284 107 762 165 2 521 644<br />

The useful economic life is estimated to be: 3 - 7 years 5 - 7 years 6 - 25 years<br />

Depreciation plan Linear Linear Linear<br />

Lease payments operating leases 91 291<br />

Comrod AS<br />

Annual Accounts 2005<br />

Note 7 Liabilities due more than five years after the end of the fiscal year<br />

2005 2 004<br />

Other long-term liabilities 0 6 231 152<br />

Note 8 Security and guarantees<br />

Debt secured by collateral 2005 2 004<br />

Short term liabilities to financial institutions 0 0<br />

Other long-term liabilities 0 5 142 855<br />

0 5 142 855<br />

Book value of assets used as security for the company’s<br />

and other group companies liabilities 53 198 714<br />

The company takes part in <strong>Hexagon</strong> <strong>Composites</strong> credit facilities. According to this the company’s assets are used<br />

as security for the company’s and the other group companies liabilities to the groups financial institution.<br />

The terms established for the liabilities are based on the groups key ratios.<br />

Note 9 Intercompany balances with group companies<br />

All intercompany balances with group companies are specified in the balance sheet (receivables group companies<br />

and liabilities to group companies).<br />

Note 10 Income taxes<br />

The tax expense consists of: 2005 2 004<br />

Tax payable 7 102 480 7 032 592<br />

Changes in deferred tax 193 463 -83 407<br />

Total income tax expense 7 295 943 6 949 185<br />

Reconciliation tax expenses against Profit before taxes<br />

Total income tax expense 7 295 943 6 949 185<br />

28% of Profit before taxes 7 233 922 7 004 362<br />

Difference related to permanent differences 62 021 -55 177<br />

2005 2 004<br />

Current tax consists of:<br />

Profit before taxes 25 835 437 25 015 578<br />

Permanent differences 221 550 -197 032<br />

Changes in temporary differences -690 941 297 883<br />

Basis for current tax 25 366 046 25 116 429<br />

Tax 28% 7 102 480 7 032 592<br />

111