English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

and for Lerc a stable cash flow. The cash flow from the acquired Power operations is more volatile as<br />

it depends on few projects and customers, however it constitutes only about 10% of the total activity,<br />

and as activity and customer base increases the volatility is likely to be reduced.<br />

7.6.3 Debt structure<br />

Following the Demerger, the Company has obtained a long-term loan through DnB Nor Bank to<br />

refinance inter company loans to <strong>Hexagon</strong>, mainly related to the acquisition of Lerc SA, and to secure<br />

a sound working capital and financing of the Company’s operations.<br />

Long-term debt<br />

A secured long-term loan (5 years) of NOK 100 million or the equivalent in Euro is committed from<br />

DnB NOR. As a reserve NOK 10 mill will be available to the Company in the offer, but is not<br />

included in the cash flow projections above. Of the NOK 100 million a total of 10 million in<br />

installments are due for payment within the first year. Consequently these NOK 10 mill. are defined as<br />

a short-term part of long-term debt under IFRS.<br />

The total loan will be split in two and granted 50/50 between Comrod AS and Comrod<br />

Communication <strong>ASA</strong>.<br />

Short-term debt<br />

The Company will have free cash and cash equivalents of MNOK 22. This figure is dependent on cash<br />

movements from mid December to the time of listing. In this period the cash balance is expected to<br />

remain stable or increase. In addition, an overdraft facility of MNOK 20 from DnB NOR is committed<br />

to Comrod Communication <strong>ASA</strong>. This credit is secured in the same manner and with the same<br />

financial covenants as the long-term loan.<br />

7.6.4 Restrictions on use of capital resources<br />

Financial covenants on the sum of long-term and short-term debt to DnB NOR are as follows:<br />

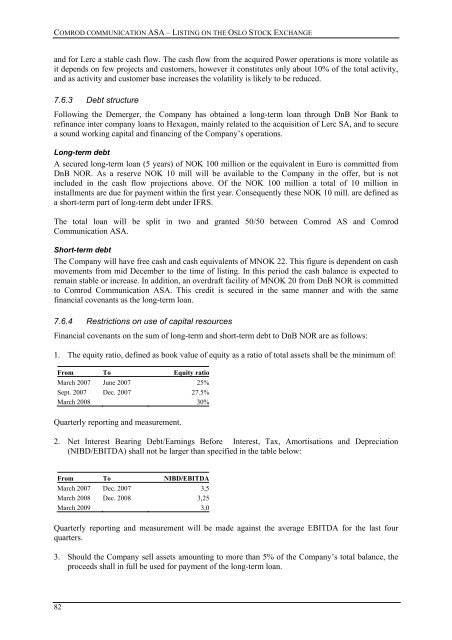

1. The equity ratio, defined as book value of equity as a ratio of total assets shall be the minimum of:<br />

From To Equity ratio<br />

March 2007 June 2007 25%<br />

Sept. 2007 Dec. 2007 27.5%<br />

March 2008 30%<br />

Quarterly reporting and measurement.<br />

2. Net Interest Bearing Debt/Earnings Before Interest, Tax, Amortisations and Depreciation<br />

(NIBD/EBITDA) shall not be larger than specified in the table below:<br />

From To NIBD/EBITDA<br />

March 2007 Dec. 2007 3,5<br />

March 2008 Dec. 2008 3,25<br />

March 2009 3,0<br />

Quarterly reporting and measurement will be made against the average EBITDA for the last four<br />

quarters.<br />

3. Should the Company sell assets amounting to more than 5% of the Company’s total balance, the<br />

proceeds shall in full be used for payment of the long-term loan.<br />

82