English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

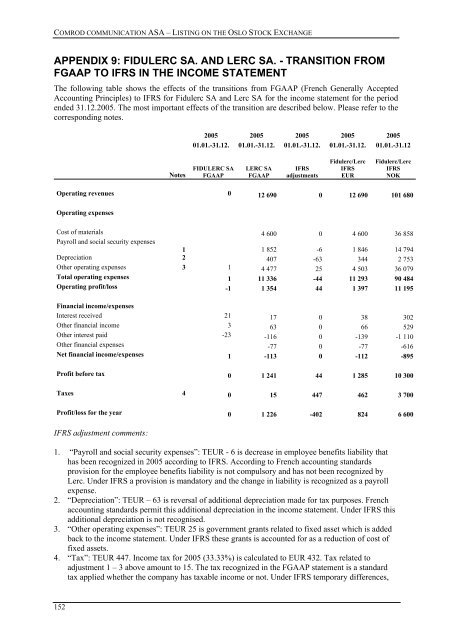

APPENDIX 9: FIDULERC SA. AND LERC SA. - TRANSITION FROM<br />

FGAAP TO IFRS IN THE INCOME STATEMENT<br />

The following table shows the effects of the transitions from FGAAP (French Generally Accepted<br />

Accounting Principles) to IFRS for Fidulerc SA and Lerc SA for the income statement for the period<br />

ended 31.12.2005. The most important effects of the transition are described below. Please refer to the<br />

corresponding notes.<br />

2005 2005 2005 2005 2005<br />

01.01.-31.12. 01.01.-31.12. 01.01.-31.12. 01.01.-31.12. 01.01.-31.12<br />

Notes<br />

FIDULERC SA<br />

FGAAP<br />

LERC SA<br />

FGAAP<br />

IFRS<br />

adjustments<br />

Fidulerc/Lerc<br />

IFRS<br />

EUR<br />

Fidulerc/Lerc<br />

IFRS<br />

NOK<br />

Operating revenues 0 12 690 0 12 690 101 680<br />

Operating expenses<br />

Cost of materials 4 600 0 4 600 36 858<br />

Payroll and social security expenses<br />

1 1 852 -6 1 846 14 794<br />

Depreciation 2 407 -63 344 2 753<br />

Other operating expenses 3 1 4 477 25 4 503 36 079<br />

Total operating expenses 1 11 336 -44 11 293 90 484<br />

Operating profit/loss -1 1 354 44 1 397 11 195<br />

Financial income/expenses<br />

Interest received 21 17 0 38 302<br />

Other financial income 3 63 0 66 529<br />

Other interest paid -23 -116 0 -139 -1 110<br />

Other financial expenses -77 0 -77 -616<br />

Net financial income/expenses 1 -113 0 -112 -895<br />

Profit before tax 0 1 241 44 1 285 10 300<br />

Taxes 4 0 15 447 462 3 700<br />

Profit/loss for the year 0 1 226 -402 824 6 600<br />

IFRS adjustment comments:<br />

1. “Payroll and social security expenses”: TEUR - 6 is decrease in employee benefits liability that<br />

has been recognized in 2005 according to IFRS. According to French accounting standards<br />

provision for the employee benefits liability is not compulsory and has not been recognized by<br />

Lerc. Under IFRS a provision is mandatory and the change in liability is recognized as a payroll<br />

expense.<br />

2. “Depreciation”: TEUR – 63 is reversal of additional depreciation made for tax purposes. French<br />

accounting standards permit this additional depreciation in the income statement. Under IFRS this<br />

additional depreciation is not recognised.<br />

3. “Other operating expenses”: TEUR 25 is government grants related to fixed asset which is added<br />

back to the income statement. Under IFRS these grants is accounted for as a reduction of cost of<br />

fixed assets.<br />

4. “Tax”: TEUR 447. Income tax for 2005 (33.33%) is calculated to EUR 432. Tax related to<br />

adjustment 1 – 3 above amount to 15. The tax recognized in the FGAAP statement is a standard<br />

tax applied whether the company has taxable income or not. Under IFRS temporary differences,<br />

152