English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

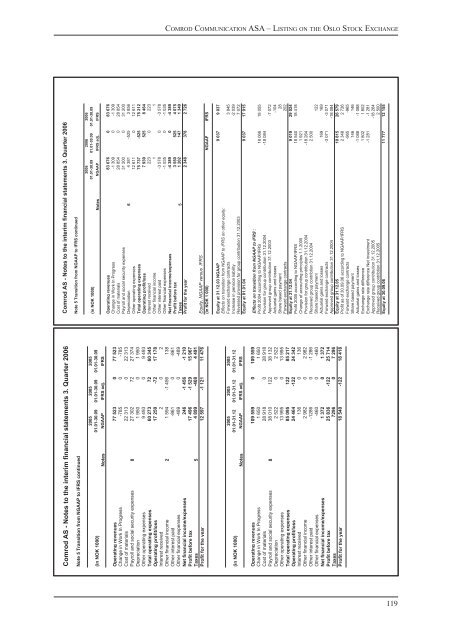

Comrod AS - Notes to the interim financial statements 3. Quarter 2006<br />

Note 5 Transition from NGAAP to IFRS continued<br />

(in NOK 1000)<br />

2005<br />

01.01-30.09<br />

2005<br />

01.01-30.09<br />

2005<br />

01.01-30.09<br />

Notes NGAAP IFRS adj. IFRS<br />

Operating revenues 77 523 0 77 523<br />

Change in Work In Progress -785 0 -785<br />

Cost of materials 22 313 0 22 313<br />

Payroll and social security expenses 8 27 302 72 27 374<br />

Depreciation 1 950 0 1 950<br />

Other operating expenses 9 493 0 9 493<br />

Total operating expenses 60 273 72 60 345<br />

Operating profit/loss 17 250 -72 17 178<br />

Interest received 2 0 2<br />

Other financial income 2 1 594 -1 456 138<br />

Other interest paid -861 0 -861<br />

Other financial expenses -489 0 -489<br />

Net financial income/expenses 246 -1 456 -1 210<br />

Profit before tax 17 496 -1 529 15 967<br />

Taxes 5 4 899 -408 4 491<br />

Profit for the year 12 597 -1 121 11 476<br />

(in NOK 1000)<br />

2005<br />

01.01-31.12<br />

2005<br />

01.01-31.12<br />

2005<br />

01.01-31.12<br />

Notes NGAAP IFRS adj. IFRS<br />

Operating revenues 109 559 0 109 559<br />

Change in Work In Progress 1 650 1 650<br />

Cost of materials 28 918 0 28 918<br />

Payroll and social security expenses 8 38 010 122 38 132<br />

Depreciation 2 522 0 2 522<br />

Other operating expenses 13 995 0 13 995<br />

Total operating expenses 85 095 122 85 217<br />

Operating profit/loss 24 464 -122 24 342<br />

Interest received 136 0 136<br />

Other financial income 2 982 0 2 982<br />

Other interest paid -1286 0 -1 286<br />

Other financial expenses -460 0 -460<br />

Net financial income/expenses 1 372 0 1 372<br />

Profit before tax 25 836 -122 25 714<br />

Taxes 7296 0 7 296<br />

Profit for the year 18 540 -122 18 418<br />

Comrod AS - Notes to the interim financial statements 3. Quarter 2006<br />

Note 5 Transition from NGAAP to IFRS continued<br />

(in NOK 1000)<br />

2006<br />

01.01-30.09<br />

2006<br />

01.01-30.09<br />

2006<br />

01.01-30.09<br />

Notes NGAAP IFRS adj. IFRS<br />

Operating revenues 83 676 0 83 676<br />

Change in Work In Progress -1 309 0 -1 309<br />

Cost of materials 28 854 0 28 854<br />

Payroll and social security expenses 31 200 0 31 200<br />

Depreciation 6 4 381 -525 3 856<br />

Other operating expenses 12 611 0 12 611<br />

Total operating expenses 75 737 -525 75 212<br />

Operating profit/loss 7 939 525 8 464<br />

Interest received 223 0 223<br />

Other financial income 1 1<br />

Other interest paid -3 578 0 -3 578<br />

Other financial expenses -1 035 0 -1 035<br />

Net financial income/expenses -4 389 0 -4 389<br />

Profit before tax 3 550 525 4 075<br />

Taxes 5 1 202 147 1 349<br />

Profit for the year 2 348 378 2 726<br />

Equity, NGAAP versus IFRS<br />

(in NOK 1 000) NGAAP IFRS<br />

Equity at 31.12.03 NGAAP 9 037 9 037<br />

Effects on transition from NGAAP to IFRS on other equity:<br />

Forward exchange contracts 3 845<br />

Increase in pension liability -2 039<br />

Reversed provision for group contribution 31.12.2003 7 072<br />

Equity at 01.01.04 9 037 17 915<br />

Effects on transition from NGAAP to IFRS :<br />

Profit 2004 according to NGAAP/IFRS 18 066 18 055<br />

Provision for group contribution 31.12.2004 -18 084<br />

Approved group contribution 31.12.2003 -7 072<br />

Actuarial gains and losses -104<br />

Share based payment 28<br />

Forward exchange contracts 202<br />

Equity at 31.12.04 9 019 29 024<br />

Profit 2005 according to NGAAP/IFRS 18 540 18 418<br />

Change of accounting principles 1.1.2005 1 921<br />

Provision for group contribution 31.12.2004 -18 264<br />

Received group contribtion 31.12.2004 2 500<br />

Share based payment 122<br />

Actuarial gains and losses 169 169<br />

Forward exchange contracts -3 071 -3 071<br />

Approved group contribution 31.12.2004 -18 084<br />

Equity at 31.12.05 10 815 26 579<br />

Profit as of 30.09.06 according to NGAAP/IFRS 2 348 2 726<br />

Forward exchange contracts -965 -965<br />

Share based payment 146 146<br />

Actuarial gains and losses -1 088 -1 088<br />

Exchange rate difference 1 802 1 802<br />

Exchange rate difference Net investment -1 281 -1 281<br />

Approved group contribution 31.12.2005 -18 264<br />

Received group contribtion 31.12.2005 2 500<br />

Equity at 30.09.06 11 777 12 155<br />

119