English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

Comrod Communication <strong>ASA</strong><br />

Financial Statements 2006<br />

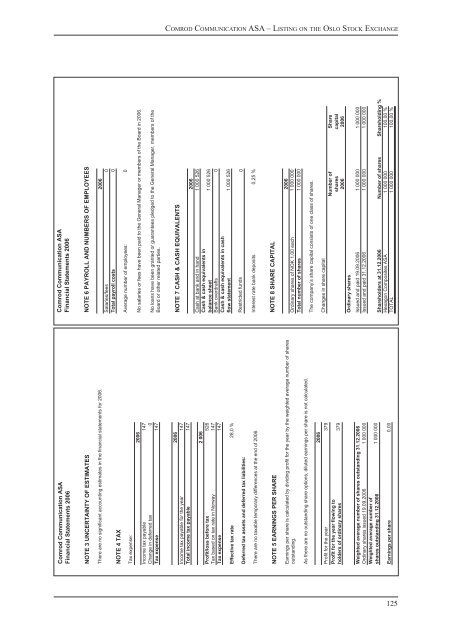

NOTE 3 UNCERTAINTY OF ESTIMATES<br />

There are no significant accounting estimates in the financial statements for 2006.<br />

NOTE 4 TAX<br />

Tax expense:<br />

2006<br />

Income tax payable 147<br />

Change in deferred tax 0<br />

Tax expense 147<br />

2006<br />

Income tax payable for the year 147<br />

Total income tax payable 147<br />

2 006<br />

Profit/loss before tax 526<br />

Tax based on tax rate in Norway 147<br />

Tax expense 147<br />

Effective tax rate 28,0 %<br />

Deferred tax assets and deferred tax liabilities:<br />

There are no taxable temporary differences at the end of 2006.<br />

NOTE 5 EARNINGS PER SHARE<br />

Earnings per share is calculated by dividing profit for the year by the weighted average number of shares<br />

outstanding.<br />

As there are no outstanding share options, diluted earnings per share is not calculated.<br />

2006<br />

Profit for the year 379<br />

Profit for the year flowing to<br />

holders of ordinary shares 379<br />

Weighted average number of shares outstanding 31.12.2006<br />

Ordinary shares issued 19.09.2006 1 000 000<br />

Weighted average number of<br />

shares outstanding 31.12.2006 1 000 000<br />

Earnings per share 0,00<br />

Comrod Communication <strong>ASA</strong><br />

Financial Statements 2006<br />

NOTE 6 PAYROLL AND NUMBERS OF EMPLOYEES<br />

2006<br />

Salaries/fees 0<br />

Total payroll costs 0<br />

Average number of employees: 0<br />

No salaries or fees have been paid to the General Manager or members of the Board in 2006.<br />

No loans have been granted or guarantees pledged to the General Manager, members of the<br />

Board or other related parties.<br />

NOTE 7 CASH & CASH EQUIVALENTS<br />

2006<br />

Cash at bank and in hand 1 000 526<br />

Cash & cash equivalents in<br />

balance sheet 1 000 526<br />

Bank overdrafts 0<br />

Cash & cash equivalents in cash<br />

flow statement<br />

1 000 526<br />

Restricted funds 0<br />

Interest rate bank deposits 0,25 %<br />

NOTE 8 SHARE CAPITAL<br />

2006<br />

Ordinary shares of NOK 1,00 each 1 000 000<br />

Total number of shares 1 000 000<br />

The company’s share capital consists of one class of shares.<br />

Changes in share capital<br />

Ordinary shares<br />

Number of<br />

Share<br />

shares<br />

capital<br />

2006 2006<br />

Issued and paid 19.09.2006 1 000 000 1 000 000<br />

Issued and paid 31.12.2006 1 000 000 1 000 000<br />

Shareholders at 31.12.2006 Number of shares Shareholding %<br />

<strong>Hexagon</strong> <strong>Composites</strong> <strong>ASA</strong> 1 000 000 100,00 %<br />

TOTAL 1 000 000 100,00 %<br />

125