English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

Comrod AS<br />

Annual Accounts 2005<br />

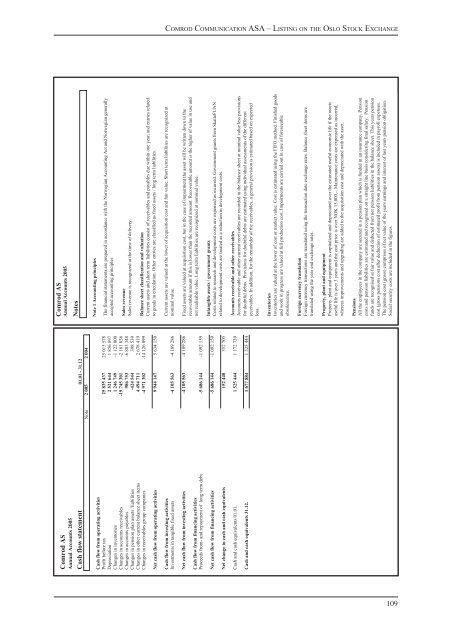

Cash flow statement 01.01 - 31.12<br />

Note 2 005 2 004<br />

Cash flow from operating activities<br />

Profit before tax 25 835 437 25 015 578<br />

Depreciation 2 521 644 1 856 897<br />

Changes in inventories 1 246 749 -1 122 000<br />

Changes in accounts receivables -19 745 301 -2 181 836<br />

Changes in accounts payables 986 753 -6 885 348<br />

Changes in pension plan assets /liabilities -424 544 398 539<br />

Changes in other current balance sheet items 4 494 711 2 678 419<br />

Changes in receivables group companies -4 971 302 -14 126 099<br />

Net cash flow from operating activities 9 944 147 5 634 150<br />

Cash flow from investing activities<br />

Investments in tangible fixed assets -4 105 563 -4 189 286<br />

Net cash flow from investing activities -4 105 563 -4 189 286<br />

Cash flow from financing activities<br />

Proceeds from- and repayment of long term debt -5 686 144 -1 092 159<br />

Net cash flow from financing activities -5 686 144 -1 092 159<br />

Net change in cash and cash equivalents 152 440 352 705<br />

Cash and cash equivalents 01.01. 1 525 444 1 172 739<br />

Cash and cash equivalents 31.12. 1 677 884 1 525 444<br />

Comrod AS<br />

Annual Accounts 2005<br />

Notes<br />

Note 1 Accounting principles<br />

The financial statements are prepared in accordance with the Norwegian Accounting Act and Norwegian generally<br />

accepted accounting principles<br />

Sales revenue<br />

Sales revenue is recognized at the time of delivery.<br />

Balance sheet classification and valuation<br />

Current assets and short term liabilities consist of receivables and payables due within one year, and entries related<br />

to goods in circulation. Other entries are classified as fixed assets / long term liabilities.<br />

Current assets are valued at the lower of acquisition cost and fair value. Short term liabilities are recognized at<br />

nominal value.<br />

Fixed assets are valued at acquisition cost, but in the case of impairment the asset will be written down to the<br />

recoverable amount if this is lower than the recorded amount. Recoverable amount is the higher of value in use and<br />

net realisable value. Long term liabilities are recognized at nominal value.<br />

Intangible assets / government grants<br />

Costs related to research and development costs are expensed as incurred. Government grants from SkatteFUNN<br />

related to development costs are treated as a reduction in development costs.<br />

Accounts receivable and other receivables<br />

Accounts receivable and other current receivables are recorded in the balance sheet at nominal value less provisions<br />

for doubtful debts. Provisions for doubtful debts are estimated using individual assessments of the different<br />

receivables. In addition, for the remainder of the receivables, a general provision is estimated based on expected<br />

loss.<br />

Inventories<br />

Inventories are valued at the lower of cost or market value. Cost is estimated using the FIFO method. Finished goods<br />

and work in progress are valued at full production cost. Impairments are carried out in case of foreseeable<br />

obsolescence.<br />

Foreign currency translation<br />

Foreign currency transactions are translated using the transaction date exchange rates. Balance sheet items are<br />

translated using the year end exchange rates.<br />

Property, plant and equipment<br />

Property, plant and equipment is capitalized and depreciated over the estimated useful economic life if the assets<br />

useful life is over 3 years and the cost price is over NOK 15.000,-. Maintenance costs are expensed as incurred,<br />

whereas improvements and upgrading are added to the acquisition cost and depreciated with the asset.<br />

Pensions<br />

All the employees in the company are secured in a pension plan which is funded in an insurance company. Pension<br />

costs and pension liabilities are estimated and recognised on a straight line basis considering final salary. Pension<br />

funds are recognised at fair value and deducted from net pension liabilities in the balance sheet. This years pension<br />

cost (gross pensions cost after deduction of estimated profit from pension assets) is included in payroll expenses.<br />

The pension cost (gross) comprises of net value of the years earnings and interest of last years pension obligation.<br />

Social security costs are included in the figures.<br />

109