English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

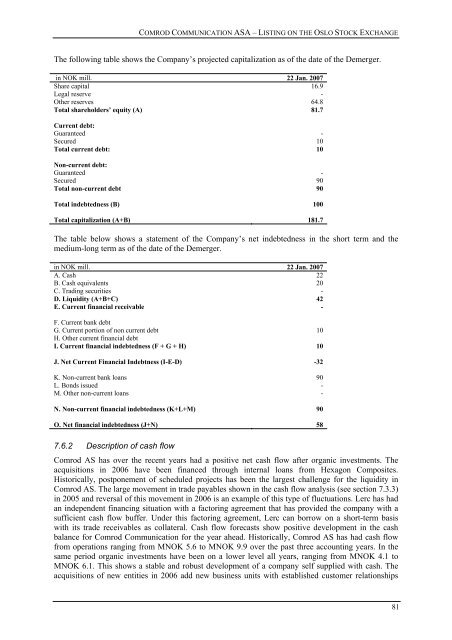

The following table shows the Company’s projected capitalization as of the date of the Demerger.<br />

in NOK mill. 22 Jan. 2007<br />

Share capital 16.9<br />

Legal reserve -<br />

Other reserves 64.8<br />

Total shareholders’ equity (A) 81.7<br />

Current debt:<br />

Guaranteed -<br />

Secured 10<br />

Total current debt: 10<br />

Non-current debt:<br />

Guaranteed -<br />

Secured 90<br />

Total non-current debt 90<br />

Total indebtedness (B) 100<br />

Total capitalization (A+B) 181.7<br />

The table below shows a statement of the Company’s net indebtedness in the short term and the<br />

medium-long term as of the date of the Demerger.<br />

in NOK mill. 22 Jan. 2007<br />

A. Cash 22<br />

B. Cash equivalents 20<br />

C. Trading securities -<br />

D. Liquidity (A+B+C) 42<br />

E. Current financial receivable -<br />

F. Current bank debt<br />

G. Current portion of non current debt 10<br />

H. Other current financial debt<br />

I. Current financial indebtedness (F + G + H) 10<br />

J. Net Current Financial Indebtness (I-E-D) -32<br />

K. Non-current bank loans 90<br />

L. Bonds issued -<br />

M. Other non-current loans -<br />

N. Non-current financial indebtedness (K+L+M) 90<br />

O. Net financial indebtedness (J+N) 58<br />

7.6.2 Description of cash flow<br />

Comrod AS has over the recent years had a positive net cash flow after organic investments. The<br />

acquisitions in 2006 have been financed through internal loans from <strong>Hexagon</strong> <strong>Composites</strong>.<br />

Historically, postponement of scheduled projects has been the largest challenge for the liquidity in<br />

Comrod AS. The large movement in trade payables shown in the cash flow analysis (see section 7.3.3)<br />

in 2005 and reversal of this movement in 2006 is an example of this type of fluctuations. Lerc has had<br />

an independent financing situation with a factoring agreement that has provided the company with a<br />

sufficient cash flow buffer. Under this factoring agreement, Lerc can borrow on a short-term basis<br />

with its trade receivables as collateral. Cash flow forecasts show positive development in the cash<br />

balance for Comrod Communication for the year ahead. Historically, Comrod AS has had cash flow<br />

from operations ranging from MNOK 5.6 to MNOK 9.9 over the past three accounting years. In the<br />

same period organic investments have been on a lower level all years, ranging from MNOK 4.1 to<br />

MNOK 6.1. This shows a stable and robust development of a company self supplied with cash. The<br />

acquisitions of new entities in 2006 add new business units with established customer relationships<br />

81