English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

Comrod AS<br />

Annual Accounts 2005<br />

Notes<br />

Note 1 Accounting principles continued<br />

Financial instruments<br />

In addition to traditional financial instruments as trade receivables, accounts payable and interest-bearing liabilities,<br />

the company has entered into forward exchange contracts. Gains or losses from the forward exchange contracts<br />

classified as hedging is accrued for and offset against the item which is hedged. Forward exchange contracts which<br />

not meet the hedging criteria are measured at fair value and recognised in the balance sheet. Gains or losses is<br />

recognised as financial income or financial expenses.<br />

Income tax<br />

The tax expense in the profit and loss account consists of both tax payable for the accounting period and changes in<br />

deferred tax. Deferred tax is calculated as 28 percent of temporary differences between accounting profit and<br />

taxable profit considering the tax effect of former operating losses. Temporary differences, both positive and<br />

negative, are offset within the same period. Deferred tax assets are recorded in the balance sheet when it is more<br />

likely than not that the tax assets will be utilized.<br />

Change of accounting principles<br />

a) Pensions<br />

Until 2004 actuarial gains and losses (if they exceeded 10% of the highest of total pension assets or liabilities<br />

(corridor)) were amortized over the remaining average period for accumulated actuarial gains or losses. From 2005<br />

actuarial gains or losses is recognised directly in equity (net of tax). Accumulated actuarial gains from former<br />

periods (net of tax) at a total of NOK 143 850 has reduced the equity in 2005.<br />

Effective from 2005 pension obligations is treated in accordance with NRS 6 (correspond with IAS 19 "Employee<br />

Benefits"). The effect of the transition NOK 2.241 418 (net of tax) is set of against equity.<br />

b) Financial derivatives<br />

Forward exchange contracts which did meet the hedging criteria were until 2004 not recognised until the transaction<br />

was realised, while only unrealized losses on other foreign currency transactions were recognised. From 2005 also<br />

unrealised gains on other exchange contracts is recognised. In 2005 gains (net of tax) of<br />

NOK 946 080 were recognised in the income statement.<br />

Forward exchange contracts which met the hedging criteria were until 2004 not recognised. From 2005 these<br />

forward exchange contracts are measured at fair value and recognised in the balance sheet. Revaluations relating to<br />

foreign currency transactions which meet the hedging criteria are recognised directly in equity until the object of the<br />

hedge transaction is realised, or the hedging is evaluated not to be effective. The value of unrealised gains was NOK<br />

5 781 265 (net of tax) at 31.12.2004<br />

The figures from former years are not restated and are not directly comparable.<br />

Comrod AS<br />

Annual Accounts 2005<br />

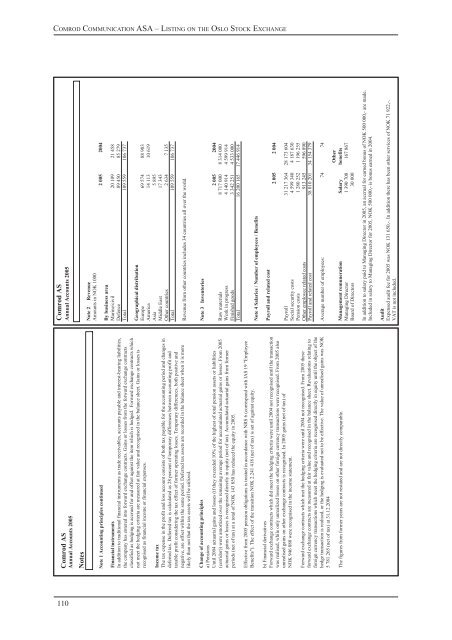

Note 2 Revenue<br />

Amounts in NOK 1000<br />

2 005 2004<br />

By business area<br />

Marine/civil 20 109 21 458<br />

Defence 89 450 85 279<br />

Total 109 559 106 737<br />

Geographical distribution<br />

Europe 69 574 88 983<br />

America 14 113 10 619<br />

Asia 5 895<br />

Middle East 17 343<br />

Other countries 2 634 7 135<br />

Total 109 559 106 737<br />

Revenue from other countries includes 34 countries all over the world.<br />

Note 3 Inventories<br />

2 005 2004<br />

Raw materials 8 717 000 8 314 000<br />

Work in progress 4 140 914 4 599 914<br />

Finished goods 3 342 251 4 533 000<br />

Total 16 200 165 17 446 914<br />

Note 4 Salaries / Number of employees / Benefits<br />

Payroll and related cost<br />

2 005 2 004<br />

Payroll 31 217 364 28 173 604<br />

Social security costs 4 599 340 4 187 630<br />

Pension costs 1 280 252 1 196 255<br />

Other employee related costs 913 245 596 890<br />

Payroll and related cost 38 010 201 34 154 379<br />

Average number of employees: 74 74<br />

Management remuneration Salary<br />

Other<br />

benefits<br />

Managing Director 1 390 708 167 867<br />

Board of Directors 30 000<br />

In addition to salary paid to Managing Director in 2005, an accrual for earned bonus of NOK 500 000,- are made.<br />

Included in salary to Managing Director for 2005, NOK 500 000,- is bonus earned in 2004.<br />

Audit<br />

Expensed audit fee for 2005 was NOK 131 650,-. In addition there has been other services of NOK 71 922,-.<br />

VAT is not included.<br />

110