English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

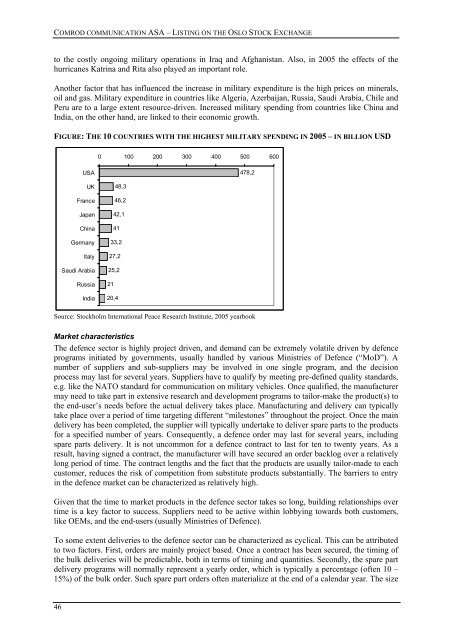

to the costly ongoing military operations in Iraq and Afghanistan. Also, in 2005 the effects of the<br />

hurricanes Katrina and Rita also played an important role.<br />

Another factor that has influenced the increase in military expenditure is the high prices on minerals,<br />

oil and gas. Military expenditure in countries like Algeria, Azerbaijan, Russia, Saudi Arabia, Chile and<br />

Peru are to a large extent resource-driven. Increased military spending from countries like China and<br />

India, on the other hand, are linked to their economic growth.<br />

FIGURE:THE 10 COUNTRIES WITH THE HIGHEST MILITARY SPENDING IN 2005 – IN BILLION USD<br />

0 100 200 300 400 500 600<br />

USA<br />

478,2<br />

UK<br />

France<br />

Japan<br />

China<br />

Germany<br />

Italy<br />

Saudi Arabia<br />

Russia<br />

India<br />

48,3<br />

46,2<br />

42,1<br />

41<br />

33,2<br />

27,2<br />

25,2<br />

21<br />

20,4<br />

Source: Stockholm International Peace Research Institute, 2005 yearbook<br />

Market characteristics<br />

The defence sector is highly project driven, and demand can be extremely volatile driven by defence<br />

programs initiated by governments, usually handled by various Ministries of Defence (“MoD”). A<br />

number of suppliers and sub-suppliers may be involved in one single program, and the decision<br />

process may last for several years. Suppliers have to qualify by meeting pre-defined quality standards,<br />

e.g. like the NATO standard for communication on military vehicles. Once qualified, the manufacturer<br />

may need to take part in extensive research and development programs to tailor-make the product(s) to<br />

the end-user’s needs before the actual delivery takes place. Manufacturing and delivery can typically<br />

take place over a period of time targeting different “milestones” throughout the project. Once the main<br />

delivery has been completed, the supplier will typically undertake to deliver spare parts to the products<br />

for a specified number of years. Consequently, a defence order may last for several years, including<br />

spare parts delivery. It is not uncommon for a defence contract to last for ten to twenty years. As a<br />

result, having signed a contract, the manufacturer will have secured an order backlog over a relatively<br />

long period of time. The contract lengths and the fact that the products are usually tailor-made to each<br />

customer, reduces the risk of competition from substitute products substantially. The barriers to entry<br />

in the defence market can be characterized as relatively high.<br />

Given that the time to market products in the defence sector takes so long, building relationships over<br />

time is a key factor to success. Suppliers need to be active within lobbying towards both customers,<br />

like OEMs, and the end-users (usually Ministries of Defence).<br />

To some extent deliveries to the defence sector can be characterized as cyclical. This can be attributed<br />

to two factors. First, orders are mainly project based. Once a contract has been secured, the timing of<br />

the bulk deliveries will be predictable, both in terms of timing and quantities. Secondly, the spare part<br />

delivery programs will normally represent a yearly order, which is typically a percentage (often 10 –<br />

15%) of the bulk order. Such spare part orders often materialize at the end of a calendar year. The size<br />

46