English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

2. “Other interest paid”: The purchase of Fidulerc SA on 11.4 MEUR was 100 % financed by an<br />

inter company loan from <strong>Hexagon</strong> <strong>Composites</strong> <strong>ASA</strong>. Interest is 6,32% according to long term<br />

bond loan in <strong>Hexagon</strong> <strong>Composites</strong> <strong>ASA</strong> related to the acquisition.<br />

3. “Taxes”: All the adjustments have a calculated 28% tax expense for adjustments subject to<br />

Norwegian tax rules and 33,3% for adjustments subject to French tax rules.<br />

All of the adjustments listed above will also apply for and impact the financial statements going<br />

forward. See Appendix 9 for information about the IFRS adjustments for Lerc and Fidulerc.<br />

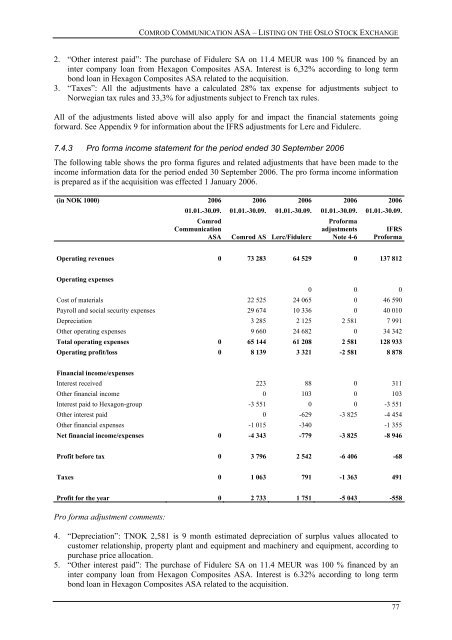

7.4.3 Pro forma income statement for the period ended 30 September 2006<br />

The following table shows the pro forma figures and related adjustments that have been made to the<br />

income information data for the period ended 30 September 2006. The pro forma income information<br />

is prepared as if the acquisition was effected 1 January 2006.<br />

(in NOK 1000)<br />

2006 2006 2006 2006 2006<br />

01.01.-30.09. 01.01.-30.09. 01.01.-30.09. 01.01.-30.09. 01.01.-30.09.<br />

Comrod<br />

Communication<br />

<strong>ASA</strong> Comrod AS Lerc/Fidulerc<br />

Proforma<br />

adjustments<br />

Note 4-6<br />

IFRS<br />

Proforma<br />

Operating revenues 0 73 283 64 529 0 137 812<br />

Operating expenses<br />

0 0 0<br />

Cost of materials 22 525 24 065 0 46 590<br />

Payroll and social security expenses 29 674 10 336 0 40 010<br />

Depreciation 3 285 2 125 2 581 7 991<br />

Other operating expenses 9 660 24 682 0 34 342<br />

Total operating expenses 0 65 144 61 208 2 581 128 933<br />

Operating profit/loss 0 8 139 3 321 -2 581 8 878<br />

Financial income/expenses<br />

Interest received 223 88 0 311<br />

Other financial income 0 103 0 103<br />

Interest paid to <strong>Hexagon</strong>-group -3 551 0 0 -3 551<br />

Other interest paid 0 -629 -3 825 -4 454<br />

Other financial expenses -1 015 -340 -1 355<br />

Net financial income/expenses 0 -4 343 -779 -3 825 -8 946<br />

Profit before tax 0 3 796 2 542 -6 406 -68<br />

Taxes 0 1 063 791 -1 363 491<br />

Profit for the year 0 2 733 1 751 -5 043 -558<br />

Pro forma adjustment comments:<br />

4. “Depreciation”: TNOK 2,581 is 9 month estimated depreciation of surplus values allocated to<br />

customer relationship, property plant and equipment and machinery and equipment, according to<br />

purchase price allocation.<br />

5. “Other interest paid”: The purchase of Fidulerc SA on 11.4 MEUR was 100 % financed by an<br />

inter company loan from <strong>Hexagon</strong> <strong>Composites</strong> <strong>ASA</strong>. Interest is 6.32% according to long term<br />

bond loan in <strong>Hexagon</strong> <strong>Composites</strong> <strong>ASA</strong> related to the acquisition.<br />

77