English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

English version - Hexagon Composites ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMROD COMMUNICATION <strong>ASA</strong> – LISTING ON THE OSLO STOCK EXCHANGE<br />

Comrod AS Group - Notes to the interim financial statements 3. Quarter 2006<br />

Note 4 continued<br />

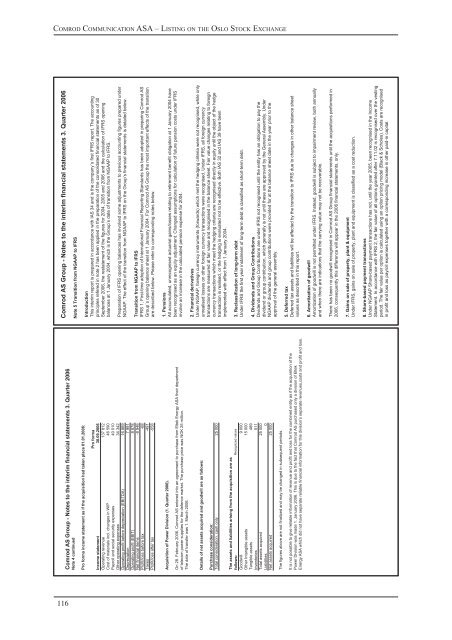

Pro forma income statement as if the acquisition had taken place 01.01.2006:<br />

Pro forma<br />

Income statement 30.09.2006<br />

Operating revenue 137 812<br />

Cost of materials incl. changes in WIP 46 590<br />

Payroll and social security expenses 40 010<br />

Other operating expenses 34 342<br />

Operating profit before depreciation (EBITDA) 16 869<br />

Depreciation 7 991<br />

Operating profit (EBIT) 8 878<br />

Net financial items -8 946<br />

Profit/loss before tax -68<br />

Taxes -491<br />

Profit/loss after tax -558<br />

Acquisition of Power Division (1. Quarter 2006).<br />

On 28. February 2006, Comrod AS entered into an agreement to purchase from Eltek Energy <strong>ASA</strong> their department<br />

of telecom power supplies for the defence market. The purchase price was NOK 25 million.<br />

The date of transfer was 1. March 2006.<br />

Details of net assets acquired and goodwill are as follows:<br />

Purchase consideration:<br />

Total consideration, cash only 25 000<br />

The assets and liabilities arising from the acquisition are as<br />

follows:<br />

Recognized values<br />

Goodwill 9 000<br />

Other Intangible assets 15 000<br />

Tangible assets 489<br />

Inventories 511<br />

Total assets acquired 25 000<br />

Liabilities 0<br />

Net assets acquired 25 000<br />

The figures above are not finalized and may be changed in subsequent periods.<br />

It is not possible to give reliable information of revenue and profit and loss for the combined entity as if the acquisition of the<br />

Power Division was made 1. January 2006. This is due to the fact that Comrod AS purchased only a division of Eltek<br />

Energy <strong>ASA</strong> which did not have separate reliable financial information for this division’s separate revenues,costs and profit and loss.<br />

Comrod AS Group - Notes to the interim financial statements 3. Quarter 2006<br />

Note 5 Transition from NGAAP to IFRS<br />

Introduction<br />

This interim report is prepared in accordance with IAS 34 and is the company´s first IFRS report. The accounting<br />

principles refered in note 2 has been applied in the preparation of the consolidated financial statements as of 30<br />

September 2006, the restatement of the figures for 2004, 2005 and 2006 and the calculation of IFRS opening<br />

balances at 1 January 2004, which is the Group’s date of transition from NGAAP to IFRS.<br />

Preparation of IFRS opening balances has involved some adjustments to previous accounting figures prepared under<br />

NGAAP. The effect of the transition from NGAAP to IFRS on the Group’s financial statements is detailed below.<br />

Transition from NGAAP to IFRS<br />

IFRS 1, First-time adoption of International Financial Reporting Standards has been adopted in preparing Comrod AS<br />

Group´s opening balance sheet at 1 January 2004. For Comrod AS Group the most important effects of the transition<br />

are described below. Please refer to corresponding notes below.<br />

1. Pensions<br />

All accumulated, unrecognised actuarial gains/losses relating to retirement benefit obligation at 1 January 2004 have<br />

been recognised as an equity adjustment. Changed assumptions for calculation of future pension costs under IFRS<br />

involve an increase in the calculated pension expense for 2004.<br />

2. Financial derivatives<br />

Under NGAAP, foreign currency instruments (forwards) which met the hedging criteria were not recognised, while only<br />

unrealised losses on other foreign currency transactions were recognised. Under IFRS, all foreign currency<br />

transactions are measured at fair value and recognised in the balance sheet. Fair value changes relating to foreign<br />

currency transactions which meet the hedging criteria are recognised directly in equity until the object of the hedge<br />

transaction is realised, or the hedging is evaluated not to be effective. Both IAS 32 and IAS 39 have been<br />

implemented with effect from 1 January 2004.<br />

3. Reclassification of long-term debt<br />

Under IFRS the first year instalment of long-term debt is classified as short-term debt.<br />

4. Dividends and Group Contributions<br />

Dividends and Group Contributions are under IFRS not recognised until the entity has an obligation to pay the<br />

dividend or group contribution, which generally is not until these are approved by the General Assembly. Under<br />

NGAAP dividends and group contributions were provided for at the balance sheet date in the year prior to the<br />

approval of the general assembly.<br />

5. Deferred tax<br />

Deferred tax assets and liabilities will be affected by the transition to IFRS due to changes in other balance sheet<br />

values as described in this report.<br />

6. Amortization of goodwill<br />

Amortization of goodwill is not permitted under IFRS. Instead, goodwill is subject to impairment review, both annually<br />

and when there are indications that the carrying value may not be recoverable.<br />

There has been no goodwill recognised in Comrod AS Group financial statements until the acquisitions performed in<br />

2006, consequently this difference will appear in the 2006 financial statements, only.<br />

7. Gains on sale of property, plant & equipment<br />

Under IFRS, gains on sale of property, plant and equipment is classified as a cost reduction.<br />

8. Share-based payment transactions<br />

Under NGAAP Share-based payment transactions has not, until the year 2005, been recognised in the Income<br />

Statement. In accordance with IFRS 2, the fair value of all options granted after 7.11.02 is recognised over the vesting<br />

period. The fair value per option is calculated using an option pricing model (Black & Scholes). Costs are recognised<br />

in profit and loss as payroll expenses together with a corresponding increase in other paid-in capital.<br />

116