annual report 2011â12 - Parliament of New South Wales - NSW ...

annual report 2011â12 - Parliament of New South Wales - NSW ...

annual report 2011â12 - Parliament of New South Wales - NSW ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Transport for <strong>NSW</strong><br />

Notes to the financial statements<br />

For the period from 1 November 2011 to 30 June 2012<br />

9. Financial assets (cont’d)<br />

Interest free advances to taxi operators:<br />

Transport for <strong>NSW</strong> provides repayable interest-free advances to assist taxi operators (in rural<br />

and regional <strong>NSW</strong>) to make their taxi wheel-chair accessible. Transport for <strong>NSW</strong> holds bills <strong>of</strong><br />

sale as security for these advances and has recorded its financial interests in the vehicles in<br />

the Register <strong>of</strong> Encumbered vehicles.<br />

Investment in and loans to A.C.N. 156 211 906 Pty Ltd:<br />

A.C.N. 156 211 906 Pty Ltd is a for-pr<strong>of</strong>it proprietary company limited by shares and domiciled<br />

in Australia. The company was incorporated on 12 March 2012 and is fully owned subsidiary<br />

<strong>of</strong> Transport for <strong>NSW</strong>.<br />

On 23 March 2012 Transport for <strong>NSW</strong>, acting on behalf <strong>of</strong> A.C.N. 156 211 906 Pty Ltd, paid<br />

$19.738m for the 100% acquisition <strong>of</strong> Metro Transport Sydney Pty Ltd and its Group, the<br />

owners <strong>of</strong> the Light Rail and Monorail Systems in Sydney (Note 9). A.C.N. 156 211 906 Pty<br />

Ltd issued 20m shares <strong>of</strong> $1 each fully paid to Transport for <strong>NSW</strong> to fund this<br />

acquisition($19.738m) and related stamp duty costs ($0.266m).<br />

On 1 June 2012, Transport for <strong>NSW</strong> provided a short term interest bearing loan to A.C.N. 156<br />

211 906 Pty Ltd. The loan is due for repayment on 31 July 2012.<br />

Refer to Note 22 for further information regarding credit risk, liquidity risk, and market risk<br />

arising from financial instruments.<br />

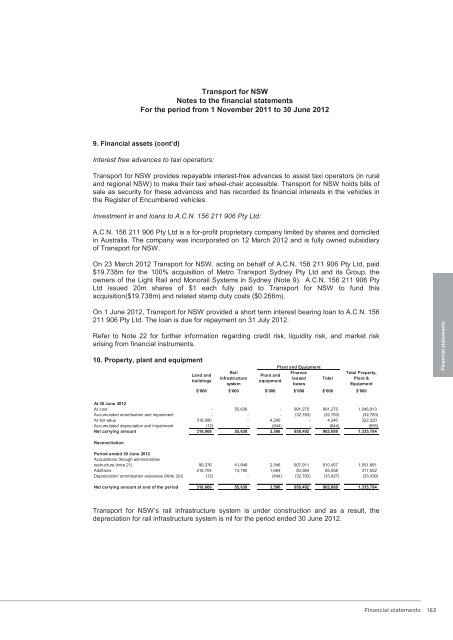

10. Property, plant and equipment<br />

Land and<br />

buildings<br />

Rail<br />

infrastructure<br />

system<br />

Plant and Equipment<br />

Finance<br />

Plant and<br />

leased<br />

equipment<br />

buses<br />

Total<br />

Total Property,<br />

Plant &<br />

Equipment<br />

$’000 $’000 $’000 $’000 $’000 $’000<br />

Financial statements<br />

At 30 June 2012<br />

At cost - 55,638 - 991,275 991,275 1,046,913<br />

Accumulated amortisation and impairment - - - (32,783) (32,783) (32,783)<br />

At fair value 318,080 - 4,240 - 4,240 322,320<br />

Accumulated depreciation and impairment (12) - (644) - (644) (656)<br />

Net carrying amount 318,068 55,638 3,596 958,492 962,088 1,335,794<br />

Reconciliation<br />

Period ended 30 June 2012<br />

Acquisitions through administrative<br />

restructure (note 21) 99,376 41,848 2,546 907,911 910,457 1,051,681<br />

Additions 218,704 13,790 1,694 83,364 85,058 317,552<br />

Depreciation/ amortisation expenses (Note 2(d) (12) - (644) (32,783) (33,427) (33,439)<br />

Net carrying amount at end <strong>of</strong> the period 318,068 55,638 3,596 958,492 962,088 1,335,794<br />

Transport for <strong>NSW</strong>’s rail infrastructure system is under construction and as a result, the<br />

depreciation for rail infrastructure system is nil for the period ended 30 June 2012.<br />

Financial statements<br />

163