annual report 2011â12 - Parliament of New South Wales - NSW ...

annual report 2011â12 - Parliament of New South Wales - NSW ...

annual report 2011â12 - Parliament of New South Wales - NSW ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

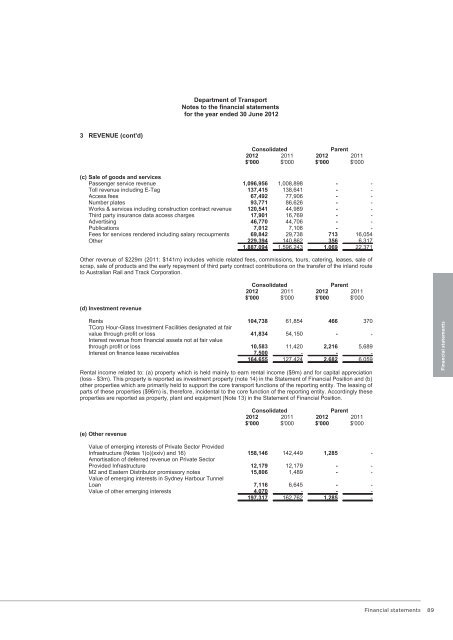

Department <strong>of</strong> Transport<br />

Notes to the financial statements<br />

for the year ended 30 June 2012<br />

3 REVENUE (cont'd)<br />

Consolidated<br />

Parent<br />

2012 2011 2012 2011<br />

$'000 $'000 $'000 $'000<br />

(c) Sale <strong>of</strong> goods and services<br />

Passenger service revenue 1,096,956 1,008,898 - -<br />

Toll revenue including E-Tag 137,415 138,641 - -<br />

Access fees 67,492 77,906 - -<br />

Number plates 93,771 86,626 - -<br />

Works & services including construction contract revenue 120,541 44,989 - -<br />

Third party insurance data access charges 17,901 16,769 - -<br />

Advertising 46,770 44,706 - -<br />

Publications 7,012 7,108 - -<br />

Fees for services rendered including salary recoupments 69,842 29,738 713 16,054<br />

Other 229,394 140,862 356 6,317<br />

1,887,094 1,596,243 1,069 22,371<br />

Other revenue <strong>of</strong> $229m (2011: $141m) includes vehicle related fees, commissions, tours, catering, leases, sale <strong>of</strong><br />

scrap, sale <strong>of</strong> products and the early repayment <strong>of</strong> third party contract contributions on the transfer <strong>of</strong> the inland route<br />

to Australian Rail and Track Corporation.<br />

(d) Investment revenue<br />

Consolidated<br />

Parent<br />

2012 2011 2012 2011<br />

$'000 $'000 $'000 $'000<br />

Rents 104,738 61,854 466 370<br />

TCorp Hour-Glass Investment Facilities designated at fair<br />

value through pr<strong>of</strong>it or loss 41,834 54,150 - -<br />

Interest revenue from financial assets not at fair value<br />

through pr<strong>of</strong>it or loss 10,583 11,420 2,216 5,689<br />

Interest on finance lease receivables 7,500 - - -<br />

164,655 127,424 2,682 6,059<br />

Rental income related to: (a) property which is held mainly to earn rental income ($9m) and for capital appreciation<br />

(loss - $3m). This property is <strong>report</strong>ed as investment property (note 14) in the Statement <strong>of</strong> Financial Position and (b)<br />

other properties which are primarily held to support the core transport functions <strong>of</strong> the <strong>report</strong>ing entity. The leasing <strong>of</strong><br />

parts <strong>of</strong> these properties ($96m) is, therefore, incidental to the core function <strong>of</strong> the <strong>report</strong>ing entity. Accordingly these<br />

properties are <strong>report</strong>ed as property, plant and equipment (Note 13) in the Statement <strong>of</strong> Financial Position.<br />

Financial statements<br />

(e) Other revenue<br />

Consolidated<br />

Parent<br />

2012 2011 2012 2011<br />

$'000 $'000 $'000 $'000<br />

Value <strong>of</strong> emerging interests <strong>of</strong> Private Sector Provided<br />

Infrastructure (Notes 1(o)(xxiv) and 16) 158,146 142,449 1,285 -<br />

Amortisation <strong>of</strong> deferred revenue on Private Sector<br />

Provided Infrastructure 12,179 12,179 - -<br />

M2 and Eastern Distributor promissory notes 15,806 1,489 - -<br />

Value <strong>of</strong> emerging interests in Sydney Harbour Tunnel<br />

Loan 7,116 6,645 - -<br />

Value <strong>of</strong> other emerging interests 4,070 - - -<br />

197,317 162,762 1,285 -<br />

Financial statements<br />

89