annual report 2011â12 - Parliament of New South Wales - NSW ...

annual report 2011â12 - Parliament of New South Wales - NSW ...

annual report 2011â12 - Parliament of New South Wales - NSW ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Transport for <strong>NSW</strong><br />

Notes to the financial statements<br />

For the period from 1 November 2011 to 30 June 2012<br />

22. Financial instruments (cont’d)<br />

(d) Market risk (cont’d)<br />

(i) Interest rate risk<br />

Exposure to interest rate risk arises primarily through Transport for <strong>NSW</strong>’s interest bearing<br />

liabilities. This risk is minimised by undertaking mainly fixed rate borrowings, primarily with <strong>NSW</strong><br />

Treasury Corporation (<strong>NSW</strong> TCorp).<br />

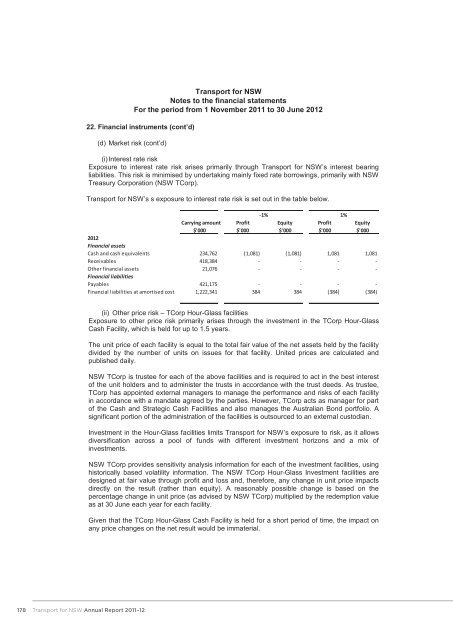

Transport for <strong>NSW</strong>’s s exposure to interest rate risk is set out in the table below.<br />

-1% 1%<br />

Carrying amount Pr<strong>of</strong>it Equity Pr<strong>of</strong>it Equity<br />

$'000 $'000 $'000 $'000 $'000<br />

2012<br />

Financial assets<br />

Cash and cash equivalents 234,762 (1,081) (1,081) 1,081 1,081<br />

Receivables 418,384 - - - -<br />

Other financial assets 21,076 - - - -<br />

Financial liabilities<br />

Payables 421,175 - - - -<br />

Financial liabilities at amortised cost 1,222,341 384 384 (384) (384)<br />

(ii) Other price risk – TCorp Hour-Glass facilities<br />

Exposure to other price risk primarily arises through the investment in the TCorp Hour-Glass<br />

Cash Facility, which is held for up to 1.5 years.<br />

The unit price <strong>of</strong> each facility is equal to the total fair value <strong>of</strong> the net assets held by the facility<br />

divided by the number <strong>of</strong> units on issues for that facility. United prices are calculated and<br />

published daily.<br />

<strong>NSW</strong> TCorp is trustee for each <strong>of</strong> the above facilities and is required to act in the best interest<br />

<strong>of</strong> the unit holders and to administer the trusts in accordance with the trust deeds. As trustee,<br />

TCorp has appointed external managers to manage the performance and risks <strong>of</strong> each facility<br />

in accordance with a mandate agreed by the parties. However, TCorp acts as manager for part<br />

<strong>of</strong> the Cash and Strategic Cash Facilities and also manages the Australian Bond portfolio. A<br />

significant portion <strong>of</strong> the administration <strong>of</strong> the facilities is outsourced to an external custodian.<br />

Investment in the Hour-Glass facilities limits Transport for <strong>NSW</strong>’s exposure to risk, as it allows<br />

diversification across a pool <strong>of</strong> funds with different investment horizons and a mix <strong>of</strong><br />

investments.<br />

<strong>NSW</strong> TCorp provides sensitivity analysis information for each <strong>of</strong> the investment facilities, using<br />

historically based volatility information. The <strong>NSW</strong> TCorp Hour-Glass Investment facilities are<br />

designed at fair value through pr<strong>of</strong>it and loss and, therefore, any change in unit price impacts<br />

directly on the result (rather than equity). A reasonably possible change is based on the<br />

percentage change in unit price (as advised by <strong>NSW</strong> TCorp) multiplied by the redemption value<br />

as at 30 June each year for each facility.<br />

Given that the TCorp Hour-Glass Cash Facility is held for a short period <strong>of</strong> time, the impact on<br />

any price changes on the net result would be immaterial.<br />

178<br />

Transport for <strong>NSW</strong> Annual Report 2011–12