Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2009<br />

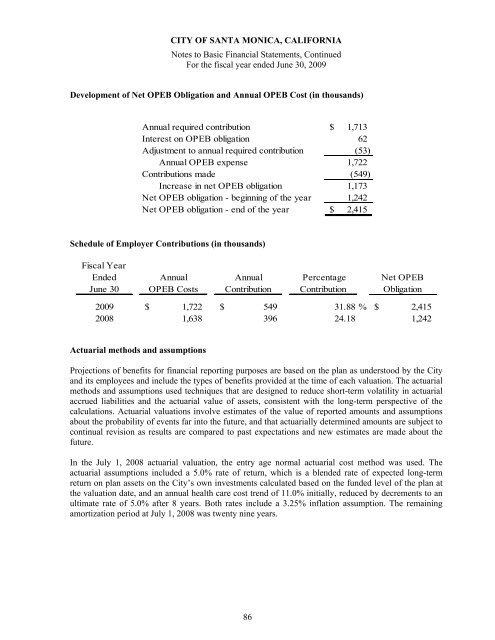

Development <strong>of</strong> Net OPEB Obligation and <strong>Annual</strong> OPEB Cost (in thousands)<br />

<strong>Annual</strong> required contribution $ 1,713<br />

Interest on OPEB obligation 62<br />

Adjustment to annual required contribution (53)<br />

<strong>Annual</strong> OPEB expense 1,722<br />

Contributions made (549)<br />

Increase in net OPEB obligation 1,173<br />

Net OPEB obligation - beginning <strong>of</strong> the year 1,242<br />

Net OPEB obligation - end <strong>of</strong> the year $ 2,415<br />

Schedule <strong>of</strong> Employer Contributions (in thousands)<br />

Fiscal Year<br />

Ended<br />

June 30<br />

<strong>Annual</strong><br />

OPEB Costs<br />

<strong>Annual</strong><br />

Contribution<br />

Percentage<br />

Contribution<br />

Net OPEB<br />

Obligation<br />

2009 $ 1,722 $ 549<br />

31.88 % $ 2,415<br />

2008 1,638 396 24.18 1,242<br />

Actuarial methods and assumptions<br />

Projections <strong>of</strong> benefits for financial reporting purposes are based on the plan as understood by the <strong>City</strong><br />

and its employees and include the types <strong>of</strong> benefits provided at the time <strong>of</strong> each valuation. The actuarial<br />

methods and assumptions used techniques that are designed to reduce short-term volatility in actuarial<br />

accrued liabilities and the actuarial value <strong>of</strong> assets, consistent with the long-term perspective <strong>of</strong> the<br />

calculations. Actuarial valuations involve estimates <strong>of</strong> the value <strong>of</strong> reported amounts and assumptions<br />

about the probability <strong>of</strong> events far into the future, and that actuarially determined amounts are subject to<br />

continual revision as results are compared to past expectations and new estimates are made about the<br />

future.<br />

In the July 1, 2008 actuarial valuation, the entry age normal actuarial cost method was used. The<br />

actuarial assumptions included a 5.0% rate <strong>of</strong> return, which is a blended rate <strong>of</strong> expected long-term<br />

return on plan assets on the <strong>City</strong>’s own investments calculated based on the funded level <strong>of</strong> the plan at<br />

the valuation date, and an annual health care cost trend <strong>of</strong> 11.0% initially, reduced by decrements to an<br />

ultimate rate <strong>of</strong> 5.0% after 8 years. Both rates include a 3.25% inflation assumption. The remaining<br />

amortization period at July 1, 2008 was twenty nine years.<br />

86