Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2009<br />

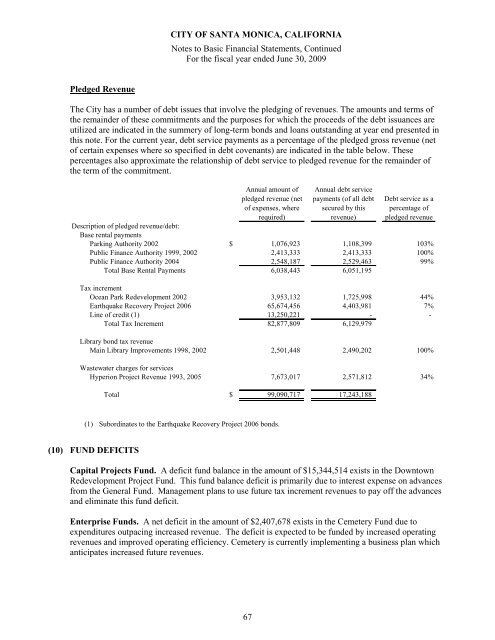

Pledged Revenue<br />

The <strong>City</strong> has a number <strong>of</strong> debt issues that involve the pledging <strong>of</strong> revenues. The amounts and terms <strong>of</strong><br />

the remainder <strong>of</strong> these commitments and the purposes for which the proceeds <strong>of</strong> the debt issuances are<br />

utilized are indicated in the summery <strong>of</strong> long-term bonds and loans outstanding at year end presented in<br />

this note. For the current year, debt service payments as a percentage <strong>of</strong> the pledged gross revenue (net<br />

<strong>of</strong> certain expenses where so specified in debt covenants) are indicated in the table below. These<br />

percentages also approximate the relationship <strong>of</strong> debt service to pledged revenue for the remainder <strong>of</strong><br />

the term <strong>of</strong> the commitment.<br />

<strong>Annual</strong> amount <strong>of</strong><br />

pledged revenue (net<br />

<strong>of</strong> expenses, where<br />

required)<br />

<strong>Annual</strong> debt service<br />

payments (<strong>of</strong> all debt<br />

secured by this<br />

revenue)<br />

Debt service as a<br />

percentage <strong>of</strong><br />

pledged revenue<br />

Description <strong>of</strong> pledged revenue/debt:<br />

Base rental payments<br />

Parking Authority 2002 $ 1,076,923 1,108,399 103%<br />

Public Finance Authority 1999, 2002 2,413,333 2,413,333 100%<br />

Public Finance Authority 2004 2,548,187 2,529,463 99%<br />

Total Base Rental Payments 6,038,443 6,051,195<br />

Tax increment<br />

Ocean Park Redevelopment 2002 3,953,132 1,725,998 44%<br />

Earthquake Recovery Project 2006 65,674,456 4,403,981 7%<br />

Line <strong>of</strong> credit (1) 13,250,221 - -<br />

Total Tax Increment 82,877,809 6,129,979<br />

Library bond tax revenue<br />

Main Library Improvements 1998, 2002 2,501,448 2,490,202 100%<br />

Wastewater charges for services<br />

Hyperion Project Revenue 1993, 2005 7,673,017 2,571,812 34%<br />

Total $ 99,090,717 17,243,188<br />

(1) Subordinates to the Earthquake Recovery Project 2006 bonds.<br />

(10) FUND DEFICITS<br />

Capital Projects Fund. A deficit fund balance in the amount <strong>of</strong> $15,344,514 exists in the Downtown<br />

Redevelopment Project Fund. This fund balance deficit is primarily due to interest expense on advances<br />

from the General Fund. Management plans to use future tax increment revenues to pay <strong>of</strong>f the advances<br />

and eliminate this fund deficit.<br />

Enterprise Funds. A net deficit in the amount <strong>of</strong> $2,407,678 exists in the Cemetery Fund due to<br />

expenditures outpacing increased revenue. The deficit is expected to be funded by increased operating<br />

revenues and improved operating efficiency. Cemetery is currently implementing a business plan which<br />

anticipates increased future revenues.<br />

67