Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2009<br />

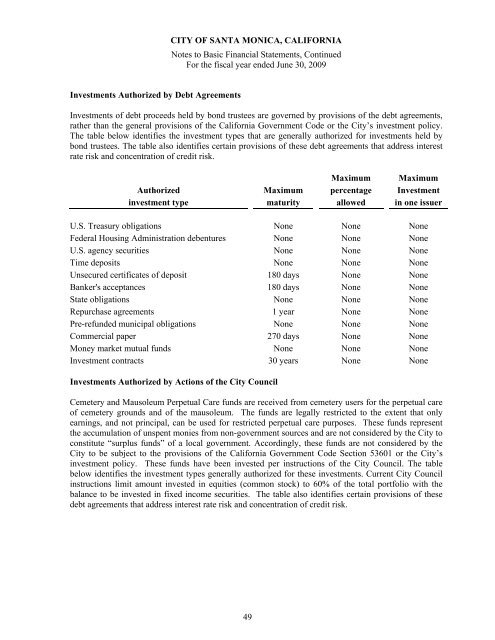

Investments Authorized by Debt Agreements<br />

Investments <strong>of</strong> debt proceeds held by bond trustees are governed by provisions <strong>of</strong> the debt agreements,<br />

rather than the general provisions <strong>of</strong> the California Government Code or the <strong>City</strong>’s investment policy.<br />

The table below identifies the investment types that are generally authorized for investments held by<br />

bond trustees. The table also identifies certain provisions <strong>of</strong> these debt agreements that address interest<br />

rate risk and concentration <strong>of</strong> credit risk.<br />

Maximum Maximum<br />

Authorized Maximum percentage Investment<br />

investment type maturity allowed in one issuer<br />

U.S. Treasury obligations None None None<br />

Federal Housing Administration debentures None None None<br />

U.S. agency securities None None None<br />

Time deposits None None None<br />

Unsecured certificates <strong>of</strong> deposit 180 days None None<br />

Banker's acceptances 180 days None None<br />

State obligations None None None<br />

Repurchase agreements 1 year None None<br />

Pre-refunded municipal obligations None None None<br />

Commercial paper 270 days None None<br />

Money market mutual funds None None None<br />

Investment contracts 30 years None None<br />

Investments Authorized by Actions <strong>of</strong> the <strong>City</strong> Council<br />

Cemetery and Mausoleum Perpetual Care funds are received from cemetery users for the perpetual care<br />

<strong>of</strong> cemetery grounds and <strong>of</strong> the mausoleum. The funds are legally restricted to the extent that only<br />

earnings, and not principal, can be used for restricted perpetual care purposes. These funds represent<br />

the accumulation <strong>of</strong> unspent monies from non-government sources and are not considered by the <strong>City</strong> to<br />

constitute “surplus funds” <strong>of</strong> a local government. Accordingly, these funds are not considered by the<br />

<strong>City</strong> to be subject to the provisions <strong>of</strong> the California Government Code Section 53601 or the <strong>City</strong>’s<br />

investment policy. These funds have been invested per instructions <strong>of</strong> the <strong>City</strong> Council. The table<br />

below identifies the investment types generally authorized for these investments. Current <strong>City</strong> Council<br />

instructions limit amount invested in equities (common stock) to 60% <strong>of</strong> the total portfolio with the<br />

balance to be invested in fixed income securities. The table also identifies certain provisions <strong>of</strong> these<br />

debt agreements that address interest rate risk and concentration <strong>of</strong> credit risk.<br />

49