TAV IT

TAV IT

TAV IT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

124<br />

<strong>TAV</strong> Airports Holding Annual Report 2008<br />

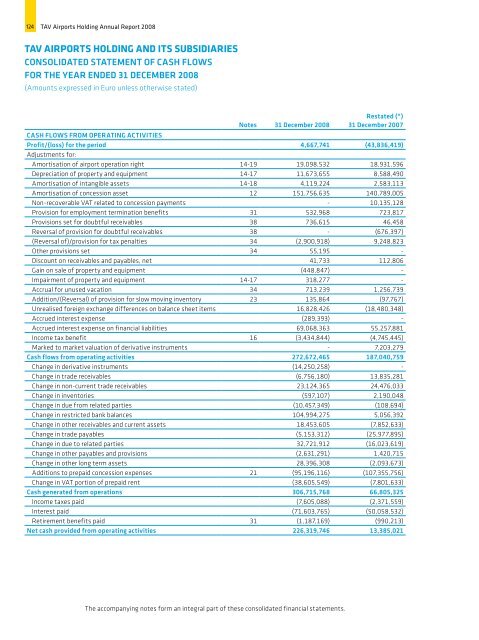

<strong>TAV</strong> AIRPORTS HOLDING AND <strong>IT</strong>S SUBSIDIARIES<br />

CONSOLIDATED STATEMENT OF CASH FLOWS<br />

FOR THE YEAR ENDED 31 DECEMBER 2008<br />

(Amounts expressed in Euro unless otherwise stated)<br />

Notes 31 December 2008<br />

Restated (*)<br />

31 December 2007<br />

CASH FLOWS FROM OPERATING ACTIV<strong>IT</strong>IES<br />

Profit/(loss) for the period 4,667,741 (43,836,419)<br />

Adjustments for:<br />

Amortisation of airport operation right 14-19 19,098,532 18,931,596<br />

Depreciation of property and equipment 14-17 11,673,655 8,588,490<br />

Amortisation of intangible assets 14-18 4,119,224 2,583,113<br />

Amortisation of concession asset 12 151,756,635 140,789,005<br />

Non-recoverable VAT related to concession payments - 10,135,128<br />

Provision for employment termination benefits 31 532,968 723,817<br />

Provisions set for doubtful receivables 38 736,615 46,458<br />

Reversal of provision for doubtful receivables 38 - (676,397)<br />

(Reversal of)/provision for tax penalties 34 (2,900,918) 9,248,823<br />

Other provisions set 34 55,195 -<br />

Discount on receivables and payables, net 41,733 112,806<br />

Gain on sale of property and equipment (448,847) -<br />

Impairment of property and equipment 14-17 318,277 -<br />

Accrual for unused vacation 34 713,239 1,256,739<br />

Addition/(Reversal) of provision for slow moving inventory 23 135,864 (97,767)<br />

Unrealised foreign exchange differences on balance sheet items 16,828,426 (18,480,348)<br />

Accrued interest expense (289,393) -<br />

Accrued interest expense on financial liabilities 69,068,363 55,257,881<br />

Income tax benefit 16 (3,434,844) (4,745,445)<br />

Marked to market valuation of derivative instruments - 7,203,279<br />

Cash flows from operating activities 272,672,465 187,040,759<br />

Change in derivative instruments (14,250,258) -<br />

Change in trade receivables (6,756,180) 13,835,281<br />

Change in non-current trade receivables 23,124,365 24,476,033<br />

Change in inventories (597,107) 2,190,048<br />

Change in due from related parties (10,457,349) (108,694)<br />

Change in restricted bank balances 104,994,275 5,056,392<br />

Change in other receivables and current assets 18,453,605 (7,852,633)<br />

Change in trade payables (5,153,312) (25,977,895)<br />

Change in due to related parties 32,721,912 (16,023,619)<br />

Change in other payables and provisions (2,631,291) 1,420,715<br />

Change in other long term assets 28,396,308 (2,093,673)<br />

Additions to prepaid concession expenses 21 (95,196,116) (107,355,756)<br />

Change in VAT portion of prepaid rent (38,605,549) (7,801,633)<br />

Cash generated from operations 306,715,768 66,805,325<br />

Income taxes paid (7,605,088) (2,371,559)<br />

Interest paid (71,603,765) (50,058,532)<br />

Retirement benefits paid 31 (1,187,169) (990,213)<br />

Net cash provided from operating activities 226,319,746 13,385,021<br />

The accompanying notes form an integral part of these consolidated financial statements.