TAV IT

TAV IT

TAV IT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

156<br />

<strong>TAV</strong> Airports Holding Annual Report 2008<br />

<strong>TAV</strong> AIRPORTS HOLDING AND <strong>IT</strong>S SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2008<br />

(Amounts expressed in Euro unless otherwise stated)<br />

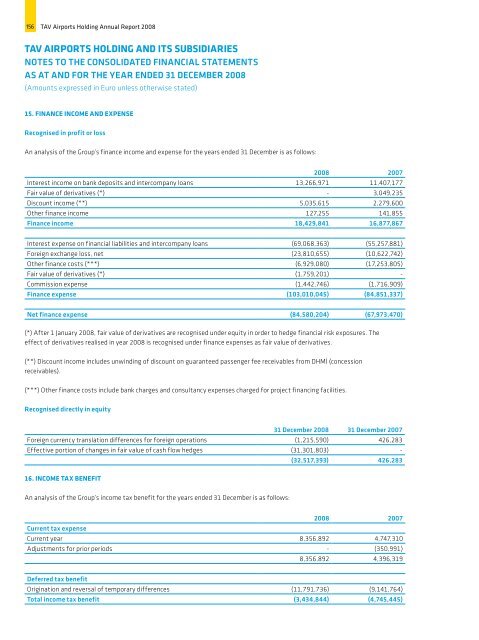

15. FINANCE INCOME AND EXPENSE<br />

Recognised in profit or loss<br />

An analysis of the Group’s finance income and expense for the years ended 31 December is as follows:<br />

2008 2007<br />

Interest income on bank deposits and intercompany loans 13,266,971 11,407,177<br />

Fair value of derivatives (*) - 3,049,235<br />

Discount income (**) 5,035,615 2,279,600<br />

Other finance income 127,255 141,855<br />

Finance income 18,429,841 16,877,867<br />

Interest expense on financial liabilities and intercompany loans (69,068,363) (55,257,881)<br />

Foreign exchange loss, net (23,810,655) (10,622,742)<br />

Other finance costs (***) (6,929,080) (17,253,805)<br />

Fair value of derivatives (*) (1,759,201) -<br />

Commission expense (1,442,746) (1,716,909)<br />

Finance expense (103,010,045) (84,851,337)<br />

Net finance expense (84,580,204) (67,973,470)<br />

(*) After 1 January 2008, fair value of derivatives are recognised under equity in order to hedge financial risk exposures. The<br />

effect of derivatives realised in year 2008 is recognised under finance expenses as fair value of derivatives.<br />

(**) Discount income includes unwinding of discount on guaranteed passenger fee receivables from DHMİ (concession<br />

receivables).<br />

(***) Other finance costs include bank charges and consultancy expenses charged for project financing facilities.<br />

Recognised directly in equity<br />

31 December 2008 31 December 2007<br />

Foreign currency translation differences for foreign operations (1,215,590) 426,283<br />

Effective portion of changes in fair value of cash flow hedges (31,301,803) -<br />

(32,517,393) 426,283<br />

16. INCOME TAX BENEF<strong>IT</strong><br />

An analysis of the Group’s income tax benefit for the years ended 31 December is as follows:<br />

2008 2007<br />

Current tax expense<br />

Current year 8,356,892 4,747,310<br />

Adjustments for prior periods - (350,991)<br />

8,356,892 4,396,319<br />

Deferred tax benefit<br />

Origination and reversal of temporary differences (11,791,736) (9,141,764)<br />

Total income tax benefit (3,434,844) (4,745,445)