ARTA Annual Report 2009 - Auckland Transport

ARTA Annual Report 2009 - Auckland Transport

ARTA Annual Report 2009 - Auckland Transport

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

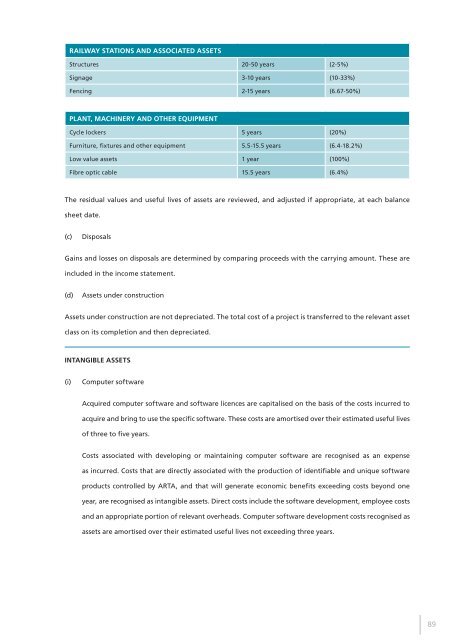

Railway Stations and Associated Assets<br />

Structures 20-50 years (2-5%)<br />

Signage 3-10 years (10-33%)<br />

Fencing 2-15 years (6.67-50%)<br />

Plant, Machinery and Other Equipment<br />

Cycle lockers 5 years (20%)<br />

Furniture, fixtures and other equipment 5.5-15.5 years (6.4-18.2%)<br />

Low value assets 1 year (100%)<br />

Fibre optic cable 15.5 years (6.4%)<br />

The residual values and useful lives of assets are reviewed, and adjusted if appropriate, at each balance<br />

sheet date.<br />

(c)<br />

Disposals<br />

Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These are<br />

included in the income statement.<br />

(d)<br />

Assets under construction<br />

Assets under construction are not depreciated. The total cost of a project is transferred to the relevant asset<br />

class on its completion and then depreciated.<br />

Intangible Assets<br />

(i)<br />

Computer software<br />

Acquired computer software and software licences are capitalised on the basis of the costs incurred to<br />

acquire and bring to use the specific software. These costs are amortised over their estimated useful lives<br />

of three to five years.<br />

Costs associated with developing or maintaining computer software are recognised as an expense<br />

as incurred. Costs that are directly associated with the production of identifiable and unique software<br />

products controlled by <strong>ARTA</strong>, and that will generate economic benefits exceeding costs beyond one<br />

year, are recognised as intangible assets. Direct costs include the software development, employee costs<br />

and an appropriate portion of relevant overheads. Computer software development costs recognised as<br />

assets are amortised over their estimated useful lives not exceeding three years.<br />

89