Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

estimated, we have recorded a liability. We do not expect that any known lawsuits, claims, environmental<br />

costs, commitments, contingent liabilities, or guarantees will have a material adverse effect on our<br />

consolidated results of operations, financial condition, or liquidity after taking into account liabilities and<br />

insurance recoveries previously recorded for these matters.<br />

Indemnities – Our maximum potential exposure under indemnification arrangements, including certain<br />

tax indemnifications, can range from a specified dollar amount to an unlimited amount, depending on the<br />

nature of the transactions and the agreements. Due to uncertainty as to whether claims will be made or<br />

how they will be resolved, we cannot reasonably determine the probability of an adverse claim or<br />

reasonably estimate any adverse liability or the total maximum exposure under these indemnification<br />

arrangements. We do not have any reason to believe that we will be required to make any material<br />

payments under these indemnity provisions.<br />

Climate Change – Although climate change could have an adverse impact on our operations and<br />

financial performance in the future (see Risk Factors under Item 1A of this report), we are currently<br />

unable to predict the manner or severity of such impact. However, we continue to take steps and explore<br />

opportunities to reduce the impact of our operations on the environment, including investments in new<br />

technologies, using training programs to reduce fuel consumption, and changing our operations to<br />

increase fuel efficiency.<br />

CRITICAL ACCOUNTING POLICIES<br />

Our Consolidated Financial Statements have been prepared in accordance with GAAP. The preparation<br />

of these financial statements requires estimation and judgment that affect the reported amounts of<br />

revenues, expenses, assets, and liabilities. We base our estimates on historical experience and on<br />

various other assumptions that we believe are reasonable under the circumstances, the results of which<br />

form the basis for making judgments about the carrying values of assets and liabilities that are not readily<br />

apparent from other sources. The following critical accounting policies are a subset of our significant<br />

accounting policies described in Note 2 to the Financial Statements and Supplementary Data, Item 8.<br />

These critical accounting policies affect significant areas of our financial statements and involve judgment<br />

and estimates. If these estimates differ significantly from actual results, the impact on our Consolidated<br />

Financial Statements may be material.<br />

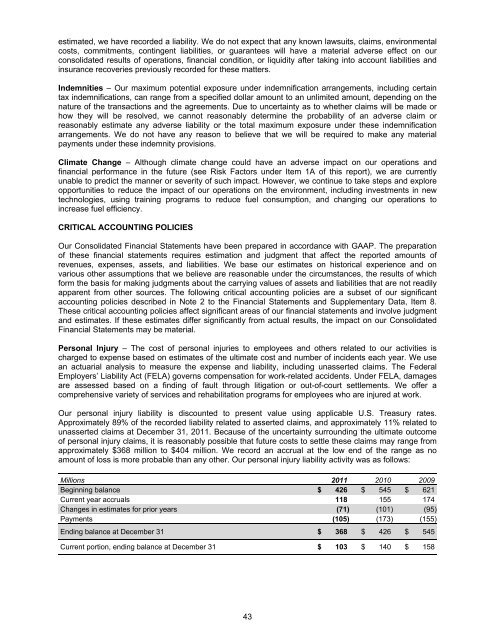

Personal Injury – The cost of personal injuries to employees and others related to our activities is<br />

charged to expense based on estimates of the ultimate cost and number of incidents each year. We use<br />

an actuarial analysis to measure the expense and liability, including unasserted claims. The Federal<br />

Employers’ Liability Act (FELA) governs compensation for work-related accidents. Under FELA, damages<br />

are assessed based on a finding of fault through litigation or out-of-court settlements. We offer a<br />

comprehensive variety of services and rehabilitation programs for employees who are injured at work.<br />

Our personal injury liability is discounted to present value using applicable U.S. Treasury rates.<br />

Approximately 89% of the recorded liability related to asserted claims, and approximately 11% related to<br />

unasserted claims at December 31, 2011. Because of the uncertainty surrounding the ultimate outcome<br />

of personal injury claims, it is reasonably possible that future costs to settle these claims may range from<br />

approximately $368 million to $404 million. We record an accrual at the low end of the range as no<br />

amount of loss is more probable than any other. Our personal injury liability activity was as follows:<br />

Millions 2011 20<strong>10</strong> 2009<br />

Beginning balance $ 426 $ 545 $ 621<br />

Current year accruals 118 155 174<br />

Changes in estimates for prior years (71) (<strong>10</strong>1) (95)<br />

Payments (<strong>10</strong>5) (173) (155)<br />

Ending balance at December 31 $ 368 $ 426 $ 545<br />

Current portion, ending balance at December 31 $ <strong>10</strong>3 $ 140 $ 158<br />

43