Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

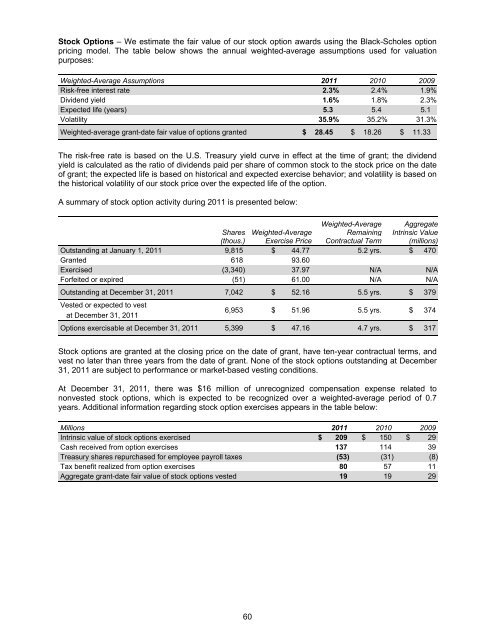

Stock Options – We estimate the fair value of our stock option awards using the Black-Scholes option<br />

pricing model. The table below shows the annual weighted-average assumptions used for valuation<br />

purposes:<br />

Weighted-Average Assumptions 2011 20<strong>10</strong> 2009<br />

Risk-free interest rate 2.3% 2.4% 1.9%<br />

Dividend yield 1.6% 1.8% 2.3%<br />

Expected life (years) 5.3 5.4 5.1<br />

Volatility 35.9% 35.2% 31.3%<br />

Weighted-average grant-date fair value of options granted $ 28.45 $ 18.26 $ 11.33<br />

The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of grant; the dividend<br />

yield is calculated as the ratio of dividends paid per share of common stock to the stock price on the date<br />

of grant; the expected life is based on historical and expected exercise behavior; and volatility is based on<br />

the historical volatility of our stock price over the expected life of the option.<br />

A summary of stock option activity during 2011 is presented below:<br />

Weighted-Average<br />

Remaining<br />

Contractual Term<br />

Aggregate<br />

Intrinsic Value<br />

(millions)<br />

Shares<br />

(thous.)<br />

Weighted-Average<br />

Exercise Price<br />

Outstanding at January 1, 2011 9,815 $ 44.77 5.2 yrs. $ 470<br />

Granted 618 93.60<br />

Exercised (3,340) 37.97 N/A N/A<br />

Forfeited or expired (51) 61.00 N/A N/A<br />

Outstanding at December 31, 2011 7,042 $ 52.16 5.5 yrs. $ 379<br />

Vested or expected to vest<br />

at December 31, 2011<br />

6,953 $ 51.96 5.5 yrs. $ 374<br />

Options exercisable at December 31, 2011 5,399 $ 47.16 4.7 yrs. $ 317<br />

Stock options are granted at the closing price on the date of grant, have ten-year contractual terms, and<br />

vest no later than three years from the date of grant. None of the stock options outstanding at December<br />

31, 2011 are subject to performance or market-based vesting conditions.<br />

At December 31, 2011, there was $16 million of unrecognized compensation expense related to<br />

nonvested stock options, which is expected to be recognized over a weighted-average period of 0.7<br />

years. Additional information regarding stock option exercises appears in the table below:<br />

Millions 2011 20<strong>10</strong> 2009<br />

Intrinsic value of stock options exercised $ 209 $ 150 $ 29<br />

Cash received from option exercises 137 114 39<br />

Treasury shares repurchased for employee payroll taxes (53) (31) (8)<br />

Tax benefit realized from option exercises 80 57 11<br />

Aggregate grant-date fair value of stock options vested 19 19 29<br />

60