Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

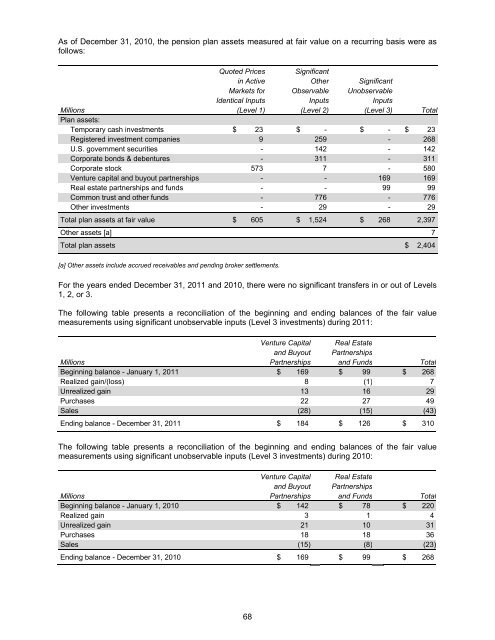

As of December 31, 20<strong>10</strong>, the pension plan assets measured at fair value on a recurring basis were as<br />

follows:<br />

Quoted Prices Significant<br />

in Active Other Significant<br />

Markets for Observable Unobservable<br />

Identical Inputs Inputs Inputs<br />

Millions (Level 1) (Level 2) (Level 3) Total<br />

Plan assets:<br />

Temporary cash investments $ 23 $ - $ - $ 23<br />

Registered investment companies 9 259 - 268<br />

U.S. government securities - 142 - 142<br />

Corporate bonds & debentures - 311 - 311<br />

Corporate stock 573 7 - 580<br />

Venture capital and buyout partnerships - - 169 169<br />

Real estate partnerships and funds - - 99 99<br />

Common trust and other funds - 776 - 776<br />

Other investments - 29 - 29<br />

Total plan assets at fair value $ 605 $ 1,524 $ 268 2,397<br />

Other assets [a] 7<br />

Total plan assets $ 2,404<br />

[a] Other assets include accrued receivables and pending broker settlements.<br />

For the years ended December 31, 2011 and 20<strong>10</strong>, there were no significant transfers in or out of Levels<br />

1, 2, or 3.<br />

The following table presents a reconciliation of the beginning and ending balances of the fair value<br />

measurements using significant unobservable inputs (Level 3 investments) during 2011:<br />

Venture Capital Real Estate<br />

and Buyout Partnerships<br />

Millions Partnerships and Funds Total<br />

Beginning balance - January 1, 2011 $ 169 $ 99 $ 268<br />

Realized gain/(loss) 8 (1) 7<br />

Unrealized gain 13 16 29<br />

Purchases 22 27 49<br />

Sales (28) (15) (43)<br />

Ending balance - December 31, 2011 $ 184 $ 126 $ 3<strong>10</strong><br />

The following table presents a reconciliation of the beginning and ending balances of the fair value<br />

measurements using significant unobservable inputs (Level 3 investments) during 20<strong>10</strong>:<br />

Venture Capital Real Estate<br />

and Buyout Partnerships<br />

Millions Partnerships and Funds Total<br />

Beginning balance - January 1, 20<strong>10</strong> $ 142 $ 78 $ 220<br />

Realized gain 3 1 4<br />

Unrealized gain 21 <strong>10</strong> 31<br />

Purchases 18 18 36<br />

Sales (15) (8) (23)<br />

Ending balance - December 31, 20<strong>10</strong> $ 169 $ 99 $ 268<br />

68