Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

does not change the items which must be reported in other comprehensive income, how such items are<br />

measured or when they must be reclassified to net income. This standard is effective for interim and<br />

annual periods beginning after December 15, 2011. Because this ASU impacts presentation only, it will<br />

have no effect on our financial condition, results of operations or cash flows.<br />

4. Stock Options and Other Stock Plans<br />

There are 7,140 restricted shares outstanding under the 1992 Restricted Stock Plan for Non-Employee<br />

Directors of <strong>Union</strong> <strong>Pacific</strong> Corporation. We no longer grant awards of restricted shares under this plan.<br />

In April 2000, the shareholders approved the <strong>Union</strong> <strong>Pacific</strong> Corporation 2000 Directors Plan (Directors<br />

Plan) whereby 1,<strong>10</strong>0,000 shares of our common stock were reserved for issuance to our non-employee<br />

directors. Under the Directors Plan, each non-employee director, upon his or her initial election to the<br />

Board of Directors, receives a grant of 2,000 retention shares or retention stock units. Prior to December<br />

31, 2007, each non-employee director received annually an option to purchase at fair value a number of<br />

shares of our common stock, not to exceed <strong>10</strong>,000 shares during any calendar year, determined by<br />

dividing 60,000 by 1/3 of the fair market value of one share of our common stock on the date of such<br />

Board of Directors meeting, with the resulting quotient rounded up or down to the nearest 50 shares. In<br />

September 2007, the Board of Directors eliminated the annual payment of options for 2008 and all future<br />

years. As of December 31, 2011, 18,000 restricted shares and 219,900 options were outstanding under<br />

the Directors Plan.<br />

The <strong>Union</strong> <strong>Pacific</strong> Corporation 2001 Stock Incentive Plan (2001 Plan) was approved by the shareholders<br />

in April 2001. The 2001 Plan reserved 24,000,000 shares of our common stock for issuance to eligible<br />

employees of the Corporation and its subsidiaries in the form of non-qualified options, incentive stock<br />

options, retention shares, stock units, and incentive bonus awards. Non-employee directors were not<br />

eligible for awards under the 2001 Plan. As of December 31, 2011, 545,696 options were outstanding<br />

under the 2001 Plan. We no longer grant any stock options or other stock or unit awards under this plan.<br />

The <strong>Union</strong> <strong>Pacific</strong> Corporation 2004 Stock Incentive Plan (2004 Plan) was approved by shareholders in<br />

April 2004. The 2004 Plan reserved 42,000,000 shares of our common stock for issuance, plus any<br />

shares subject to awards made under the 2001 Plan and the 1993 Plan that were outstanding on April 16,<br />

2004, and became available for regrant pursuant to the terms of the 2004 Plan. Under the 2004 Plan,<br />

non-qualified options, stock appreciation rights, retention shares, stock units, and incentive bonus awards<br />

may be granted to eligible employees of the Corporation and its subsidiaries. Non-employee directors are<br />

not eligible for awards under the 2004 Plan. As of December 31, 2011, 6,276,021 options and 3,760,260<br />

retention shares and stock units were outstanding under the 2004 Plan.<br />

Pursuant to the above plans 32,374,343; 32,904,291; and 33,559,150 shares of our common stock were<br />

authorized and available for grant at December 31, 2011, 20<strong>10</strong>, and 2009, respectively.<br />

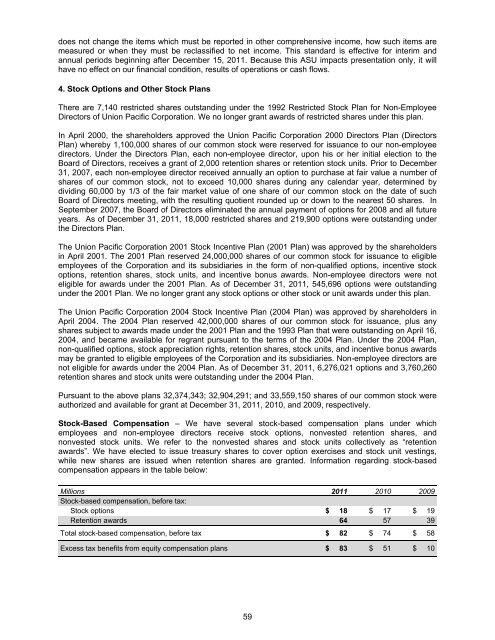

Stock-Based Compensation – We have several stock-based compensation plans under which<br />

employees and non-employee directors receive stock options, nonvested retention shares, and<br />

nonvested stock units. We refer to the nonvested shares and stock units collectively as “retention<br />

awards”. We have elected to issue treasury shares to cover option exercises and stock unit vestings,<br />

while new shares are issued when retention shares are granted. Information regarding stock-based<br />

compensation appears in the table below:<br />

Millions 2011 20<strong>10</strong> 2009<br />

Stock-based compensation, before tax:<br />

Stock options $ 18 $ 17 $ 19<br />

Retention awards 64 57 39<br />

Total stock-based compensation, before tax $ 82 $ 74 $ 58<br />

Excess tax benefits from equity compensation plans $ 83 $ 51 $ <strong>10</strong><br />

59