Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

hedges using the short-cut method; therefore, we do not record any ineffectiveness within our<br />

Consolidated Financial Statements.<br />

On February 25, 20<strong>10</strong>, we elected to terminate an interest rate swap agreement with a notional amount of<br />

$250 million prior to the scheduled maturity and received cash of $20 million (which is comprised of $16<br />

million for the fair value of the swap that was terminated and $4 million of accrued but unpaid interest<br />

receivable). We designated the swap agreement as a fair value hedge, and as such the unamortized<br />

adjustment to debt for the change in fair value of the swap remains classified as debt due after one year<br />

in our Consolidated Statements of Financial Position and will be amortized as a reduction to interest<br />

expense through April 15, 2012. As of December 31, 2011 and 20<strong>10</strong>, we do not have any interest rate<br />

fair value hedges outstanding.<br />

Interest Rate Cash Flow Hedges – We report changes in the fair value of cash flow hedges in<br />

accumulated other comprehensive loss until the hedged item affects earnings. At December 31, 2011 and<br />

20<strong>10</strong>, we recorded reductions of $2 million and $3 million, respectively, as an accumulated other<br />

comprehensive loss that is being amortized on a straight-line basis through September 30, 2014. As of<br />

December 31, 2011 and 20<strong>10</strong>, we had no interest rate cash flow hedges outstanding.<br />

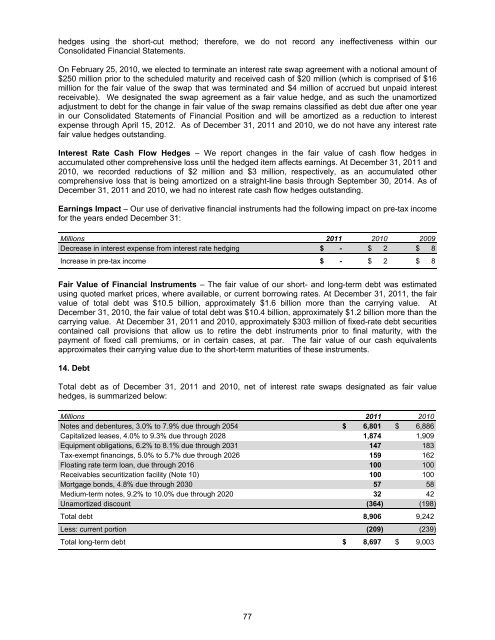

Earnings Impact – Our use of derivative financial instruments had the following impact on pre-tax income<br />

for the years ended December 31:<br />

Millions 2011 20<strong>10</strong> 2009<br />

Decrease in interest expense from interest rate hedging $ - $ 2 $ 8<br />

Increase in pre-tax income $ - $ 2 $ 8<br />

Fair Value of Financial Instruments – The fair value of our short- and long-term debt was estimated<br />

using quoted market prices, where available, or current borrowing rates. At December 31, 2011, the fair<br />

value of total debt was $<strong>10</strong>.5 billion, approximately $1.6 billion more than the carrying value. At<br />

December 31, 20<strong>10</strong>, the fair value of total debt was $<strong>10</strong>.4 billion, approximately $1.2 billion more than the<br />

carrying value. At December 31, 2011 and 20<strong>10</strong>, approximately $303 million of fixed-rate debt securities<br />

contained call provisions that allow us to retire the debt instruments prior to final maturity, with the<br />

payment of fixed call premiums, or in certain cases, at par. The fair value of our cash equivalents<br />

approximates their carrying value due to the short-term maturities of these instruments.<br />

14. Debt<br />

Total debt as of December 31, 2011 and 20<strong>10</strong>, net of interest rate swaps designated as fair value<br />

hedges, is summarized below:<br />

Millions 2011 20<strong>10</strong><br />

Notes and debentures, 3.0% to 7.9% due through 2054 $ 6,801 $ 6,886<br />

Capitalized leases, 4.0% to 9.3% due through 2028 1,874 1,909<br />

Equipment obligations, 6.2% to 8.1% due through 2031 147 183<br />

Tax-exempt financings, 5.0% to 5.7% due through 2026 159 162<br />

Floating rate term loan, due through 2016 <strong>10</strong>0 <strong>10</strong>0<br />

Receivables securitization facility (Note <strong>10</strong>) <strong>10</strong>0 <strong>10</strong>0<br />

Mortgage bonds, 4.8% due through 2030 57 58<br />

Medium-term notes, 9.2% to <strong>10</strong>.0% due through 2020 32 42<br />

Unamortized discount (364) (198)<br />

Total debt 8,906 9,242<br />

Less: current portion (209) (239)<br />

Total long-term debt $ 8,697 $ 9,003<br />

77