Form 10-K - Union Pacific

Form 10-K - Union Pacific

Form 10-K - Union Pacific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

dividends to our shareholders. The amount of retained earnings available for dividends was $13.8 billion<br />

and $12.9 billion at December 31, 2011 and 20<strong>10</strong>, respectively.<br />

Shelf Registration Statement and Significant New Borrowings – Under our current shelf registration,<br />

we may issue, from time to time, any combination of debt securities, preferred stock, common stock, or<br />

warrants for debt securities or preferred stock in one or more offerings. We have no immediate plans to<br />

issue equity securities; however, we will continue to explore opportunities to replace existing debt or<br />

access capital through issuances of debt securities under our shelf registration, and, therefore, we may<br />

issue additional debt securities at any time.<br />

During 2011, we issued the following unsecured, fixed-rate debt securities under our current shelf<br />

registration:<br />

Date<br />

Description of Securities<br />

August 9, 2011 $500 million of 4.75% Notes due September 15, 2041<br />

The net proceeds from the offering were used for general corporate purposes, including the repurchase of<br />

common stock pursuant to our share repurchase program. These debt securities include change-ofcontrol<br />

provisions. At December 31, 2011, we had remaining authority to issue up to $2.0 billion of debt<br />

securities under our shelf registration.<br />

During the third quarter of 2011, we renegotiated and extended for three years on substantially similar<br />

terms a $<strong>10</strong>0 million floating-rate term loan, which will mature on August 5, 2016.<br />

Debt Exchange – On June 23, 2011, we exchanged $857 million of various outstanding notes and<br />

debentures due between 2013 and 2019 (Existing Notes) for $750 million of 4.163% notes (New Notes)<br />

due July 15, 2022, plus cash consideration of approximately $267 million and $17 million for accrued and<br />

unpaid interest on the Existing Notes. The cash consideration was recorded as an adjustment to the<br />

carrying value of debt, and the balance of the unamortized discount and issue costs from the Existing<br />

Notes is being amortized as an adjustment of interest expense over the term of the New Notes. No gain<br />

or loss was recognized as a result of the exchange. Costs related to the debt exchange that were<br />

payable to parties other than the debt holders totaled approximately $6 million and were included in<br />

interest expense during 2011.<br />

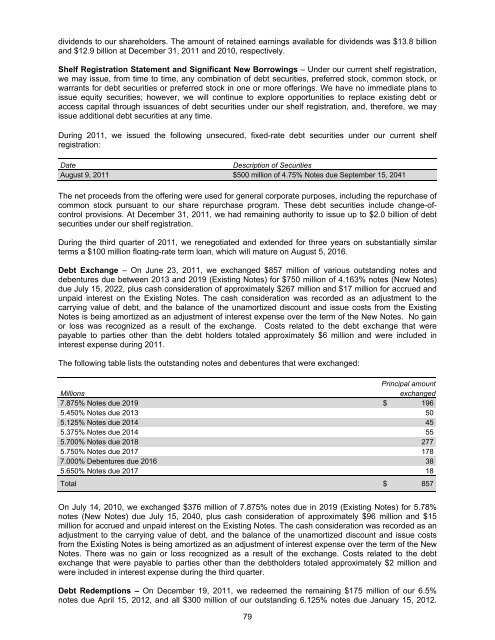

The following table lists the outstanding notes and debentures that were exchanged:<br />

Principal amount<br />

Millions<br />

exchanged<br />

7.875% Notes due 2019 $ 196<br />

5.450% Notes due 2013 50<br />

5.125% Notes due 2014 45<br />

5.375% Notes due 2014 55<br />

5.700% Notes due 2018 277<br />

5.750% Notes due 2017 178<br />

7.000% Debentures due 2016 38<br />

5.650% Notes due 2017 18<br />

Total $ 857<br />

On July 14, 20<strong>10</strong>, we exchanged $376 million of 7.875% notes due in 2019 (Existing Notes) for 5.78%<br />

notes (New Notes) due July 15, 2040, plus cash consideration of approximately $96 million and $15<br />

million for accrued and unpaid interest on the Existing Notes. The cash consideration was recorded as an<br />

adjustment to the carrying value of debt, and the balance of the unamortized discount and issue costs<br />

from the Existing Notes is being amortized as an adjustment of interest expense over the term of the New<br />

Notes. There was no gain or loss recognized as a result of the exchange. Costs related to the debt<br />

exchange that were payable to parties other than the debtholders totaled approximately $2 million and<br />

were included in interest expense during the third quarter.<br />

Debt Redemptions – On December 19, 2011, we redeemed the remaining $175 million of our 6.5%<br />

notes due April 15, 2012, and all $300 million of our outstanding 6.125% notes due January 15, 2012.<br />

79